European stock market indices and US index futures trade lower on Friday ahead of the release of US retail sales data for December. The US dollar is trading mixed against major peers following strong declines earlier this week. Market expects headline retail sales growth to be flat month-over-month (0.0% MoM) while gauge excluding transport is expected to jump 0.2% MoM. The reading will be closely watched as investors will assess how big of an impact elevated inflation has on the US consumer. A disappointing reading could have a negative impact on equities moods as it would highlight that consumers are struggling amid high price growth. Meanwhile, it would also highlight the need for quicker tightening, what could be positive for the US dollar.

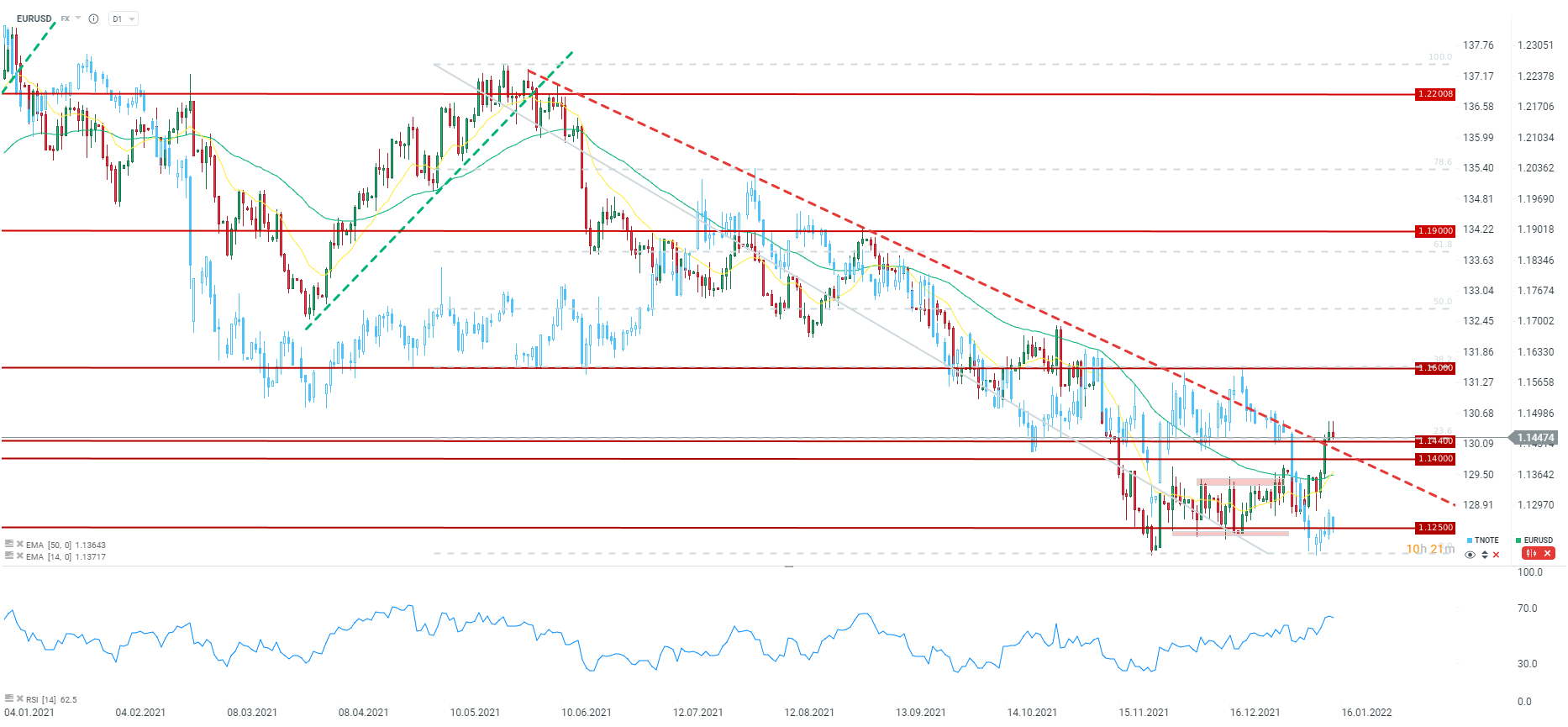

The US dollar has been trading lower this week in spite of hawkish comments from Fed members, allowing EURUSD to jump above the 1.14 mark. The pair is attempting to break above the mid-term downward trendline - a move that could pave the way for a bigger rally.

Source: xStation5

Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone