-

Microsoft announced $68.7 billion all-cash deal for Activision-Blizzard

-

Biggest gaming M&A in history

-

Microsoft to become third largest gaming company in the world

-

Activision surged on the news, other video game developers benefitted as well

-

Shares of Sony plunge as Xbox is getting edge over PlayStation

-

Expectations of more deals in the gaming sector

-

Ubisoft and Electronic Arts on the radar

Beginning of 2022 is marked with increased M&A activity in the gaming sector. Take-Two Interactive announced acquisition of Zynga last week and now Microsoft has announced its plans to acquire Activision-Blizzard in the biggest gaming M&A deal in history! News triggered big stock prices moves across the industry as expectations for more gaming M&A grew. Let's take a look at potential winners and losers of the Activision bid.

Microsoft acquires Activision Blizzard

Microsoft announced plans to acquire Activision Blizzard in an all-cash deal for almost $69 billion! This is not only the biggest all-cash M&A deal since the beginning of the pandemic but also the biggest gaming M&A in history! It's another step in Microsoft's expansion into gaming after the $7.5 billion acquisition of Bethesda, another video game company. The company will now be able to add Acitivision's franchises to its subscription service, boosting interest in its Xbox brand. The takeover of Activision may also begin a new trend in a gaming industry where gaming console companies may start buying whole publishers instead of exclusive rights on just selected titles.

Winners: Video Game Companies

Microsoft offered an almost 50% premium over Activision's market share price. In spite of Microsoft proposing an all-cash deal and having enough money on hand to finance it, Activision's stock jumped from $65 to $87, still short of the proposed $95 per share offer. As this was the second major gaming M&A deal announced recently, shares of other video game developers jumped in anticipation of more consolidation within the industry. Ubisoft jumped 12%, CD Projekt gained 3% while Electronic Arts moved 6% higher. Shares in Japanese video game companies Capcom, Square Enix and Konami jumped over 2%.

Stock of Activision (ATVI.US) launched Tuesday's trading with a massive bullish price gap. However, the share price failed to reach a $95 per share offer proposed by Microsoft (MSFT.US). Rally was halted at the $86.35 resistance zone, marked with 61.8% retracement of the 2021 downward move. However, given Microsoft's strong financial position and significant premium, the deal is likely to go through. Source: xStation5

Stock of Activision (ATVI.US) launched Tuesday's trading with a massive bullish price gap. However, the share price failed to reach a $95 per share offer proposed by Microsoft (MSFT.US). Rally was halted at the $86.35 resistance zone, marked with 61.8% retracement of the 2021 downward move. However, given Microsoft's strong financial position and significant premium, the deal is likely to go through. Source: xStation5

Losers: Sony

Activision Blizzard is a well-known video game publisher that has some blockbuster titles in its portfolio. Microsoft will become the world's third largest gaming company in terms of revenue following Activision takeover, trailing only Tencent and Sony. Sony (SONY.US) can be seen as one of the top losers of the Activision-Microsoft merger. Acquisition of Activision may encourage Microsoft to make Activision's franchises part of its subscription services - available only on its Xbox gaming consoles, and not on Sony's PlayStation, in order to boost cross-selling of its products. Sony does not have the same exposure to PC and mobile games markets as Microsoft and having such a big competitor expand in the gaming console market may encourage management to consider expansion as well. However, Sony does not have as strong a financial position as Microsoft and as much cash to spend.

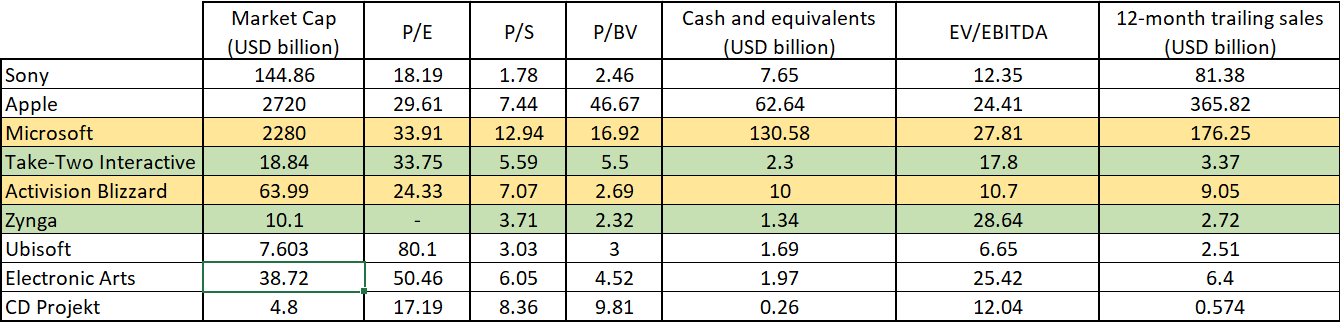

Sony has much less cash to spend than behemoths like Apple or Microsoft. However, it also should be noted that Activision-Blizzard was one of the largest third-party publishers and Sony could still look towards acquiring some smaller companies. Source: Bloomberg, XTB Research

Sony has much less cash to spend than behemoths like Apple or Microsoft. However, it also should be noted that Activision-Blizzard was one of the largest third-party publishers and Sony could still look towards acquiring some smaller companies. Source: Bloomberg, XTB Research

Potential M&A targets in gaming sector

Acquisition of Activision Blizzard by Microsoft was not the only big M&A deal in the gaming sector announced recently. Take-Two Interactive, US video game publisher, announced merger with Zynga, a mobile game developer, earlier this year. Increased M&A activity in the gaming sector at the beginning of 2022 sparked hopes that more deals will be announced soon, especially as takeover offers from both Take-Two and Microsoft offered significant premiums over market price. While we have already mentioned some stocks that jumped following Acitivison takeover news, some of them seem to be more vulnerable to becoming a takeover target. Ubisoft, French video game studio known for "Assassin's Creed" franchise, or Polish CD Projekt, known for "The Witcher" series, are seen as potential candidates.

Ubisoft

Speculation about possible takeover of Ubisoft (UBI.FR) began in 2018 when Chinese giant Tencent acquired a 5% stake in the studio. Investment helped Ubisoft defend against a takeover attempt from Vivendi and sparked debate whether the French company may be acquired by Tencent. Fact that Ubisoft trades at discount compared to US peers, when considering price-to-sales ratio, fuels the speculation further. Company has some well-known franchises in its portfolio, focusing mostly on PC and console games.

News of Activision takeover helped Ubisoft (UBI.FR) break above the upper limit of the downward channel. Stock continued to gained in the following days and is often brought up as a potential next M&A target due to low valuation. Retracements of the 2021 downward move should be considered resistance levels to watch. Source: xStation5

News of Activision takeover helped Ubisoft (UBI.FR) break above the upper limit of the downward channel. Stock continued to gained in the following days and is often brought up as a potential next M&A target due to low valuation. Retracements of the 2021 downward move should be considered resistance levels to watch. Source: xStation5

CD Projekt

CD Projekt (CDR.PL) has also been brought up as a potential candidate for the next gaming M&A. The Polish company continues to trade 60% below record highs following a failed launch of "Cyberpunk 2077". However, while CD Projekt has two big names in its portfolio - Cyberpunk and the Witcher - it has barely anything else of notice. This limited portfolio makes it a somewhat less probable target of Big Tech companies like Microsoft or Apple.

CD Projekt (CDR.PL) jumped following Activision takeover news and tested the upper limit of the triangle pattern. However, part of gains was erased after bulls were unable to break above the 205.00 PLN resistance. The nearest support can be found at the lower limit of the triangle pattern in the 182.00 PLN area. Source: xStation5

CD Projekt (CDR.PL) jumped following Activision takeover news and tested the upper limit of the triangle pattern. However, part of gains was erased after bulls were unable to break above the 205.00 PLN resistance. The nearest support can be found at the lower limit of the triangle pattern in the 182.00 PLN area. Source: xStation5

Electronic Arts

Electronic Arts (EA.US) is also suggested as a potential M&A target. EA is much larger than Ubisoft or CD Projekt and has a rich portfolio of franchises that are often chosen by gaming console players, like Fifa or Battlefield, which makes it a good target for acquisition by companies like Microsoft or Sony. However, as EA is a big company with a large portfolio, it may become a target of acquisition by a relatively new but big player in the gaming sector, potentially Apple or Amazon, that would give the acquirer immediate, strong presence within this booming industry.

Electronic Arts (EA.US) jumped on the Activision-Microsoft news but pared most of the gains later on. In the broad picture, EA is rebounding from a recent drop to $121.00 with the first major resistance zone being marked with multi-year highs in the $150.00 area. Source: xStation5

Electronic Arts (EA.US) jumped on the Activision-Microsoft news but pared most of the gains later on. In the broad picture, EA is rebounding from a recent drop to $121.00 with the first major resistance zone being marked with multi-year highs in the $150.00 area. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎