OPEC+ left its oil production policy and quotas unchanged at a meeting today. Such a decision was in-line with market expectations. Group of oil producers seems cautious rather than optimistic when it comes to the reopening of the Chinese economy and its impact on oil demand. Given that price have held stable at relatively low levels recently, market hoped that OPEC+ may signal a production cut. No such decision was made and the next OPEC+ meeting will not be held until April. It looks highly likely that OPEC+ will keep policy unchanged throughout whole 2023 but a lot will depend on condition of global economy.

Oil is trading lower on the day with Brent and WTI dropping around 1.2% each. Oil has been trading lower since the beginning of the day and OPEC+ decision as well as higher-than-expected US oil inventories data added more fuel to the move.

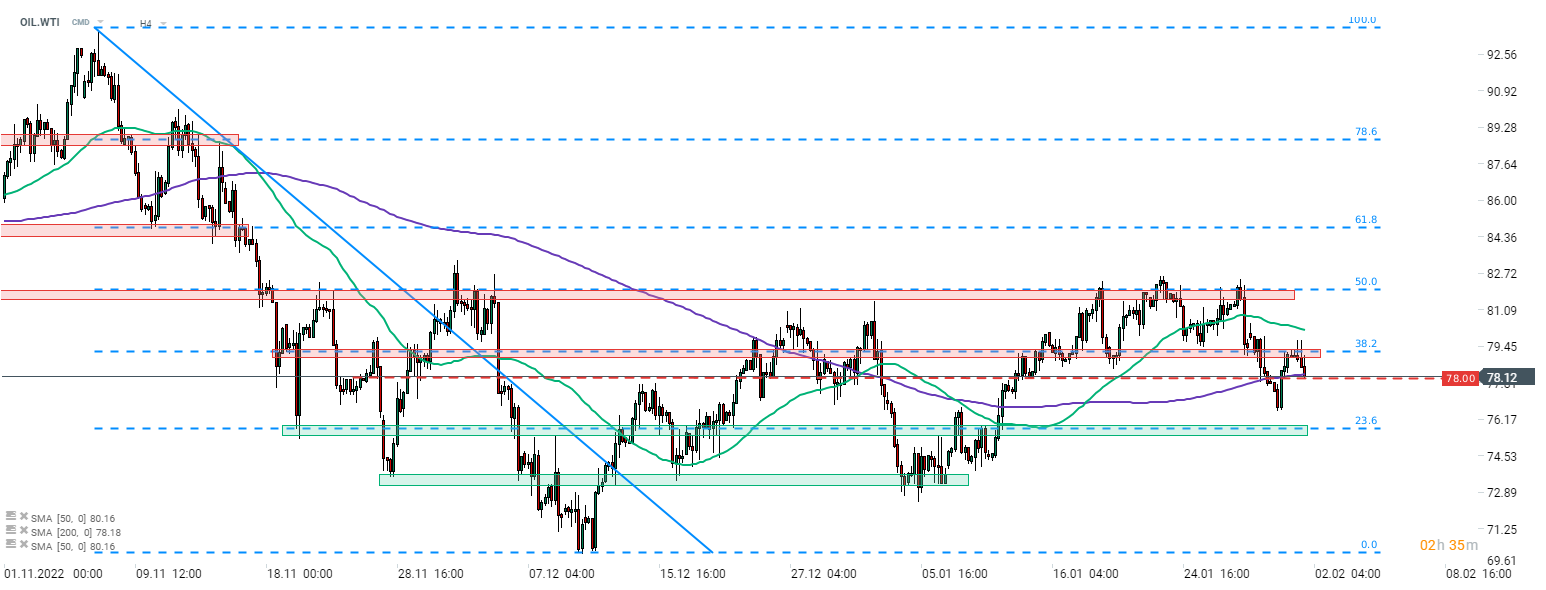

Taking a look at WTI chart (OIL.WTI) at the H4 interval, we can see that the price is testing $78 per barrel area, marked with a 200-period moving average (purple line). This comes after a failed attempt at breaking above resistance zone marked with 38.2% retracement of the downward move launched in early November 2022. If bears succeed at pushing price below $78 zone, the next support can be found at 23.6% retracement in the $76 area.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉