Shares of ZIM Integrated Shipping (ZIM.US), an Israeli commercial ship operator based in Haifa, a port backed by China, have risen more than 30% since last Friday and are trading higher today ahead of the opening of U.S. trading. The Suez Canal departure of shipping giants like Hapag-Lloyd (HLAG.DE) and Maersk (MAERSKA.DK) has meant that ZIM's shares need not be trading at a discount to European companies. Analysts at BDO Consulting Israel stressed that ZIM is no longer at a disadvantage vis-à-vis its competitors and does not face higher risks than the industry in having to circumnavigate Africa, leading the market to correct pessimistic sentiment. Given that about 24% of the company's free float is currently lent to short-selling, with a possible rebound in the shipping company sector, ZIM shares could face a short-squeeze scenario.

The market will reconsider opportunities and risks for ZIM

- The company's lower freight rates and high operating leverage have made it highly vulnerable to a slowdown in the maritime industry. After a prolonged discount, JP Morgan analysts upgraded the company to a 'Buy' rating just before the Gaza war broke out, while the company itself stressed in a statement that shipping to and from Israel accounts for only 10% of its business

- Shipping companies announce they will not transit the Bab el-Mandeb Strait, which is the gateway to the Red Sea, from the Indian Ocean. Until recently, it was thought that the threat from Houthi militias was only to Israeli ships or those carrying cargo to Israel, but the deepening of the crisis suggests that this is a more global problem that will face more than just ZIM.

- If ZIM's ships couldn't sail through the Suez Canal, but its competitors could, the company would be doomed to lose market share, as orders would go to cheaper operators. Now, if everyone goes around Africa, it is likely that all shipping companies will raise prices.

- Estimates indicate that about 30% of the world's container shipping and 12% of its crude oil is carried between the Bab el-Mandeb Strait and the Suez Canal. Once around Africa, cargoes on the route from Asia to Europe will be more expensive and delayed by at least two to three weeks.

ZIM shares (D1 interval)

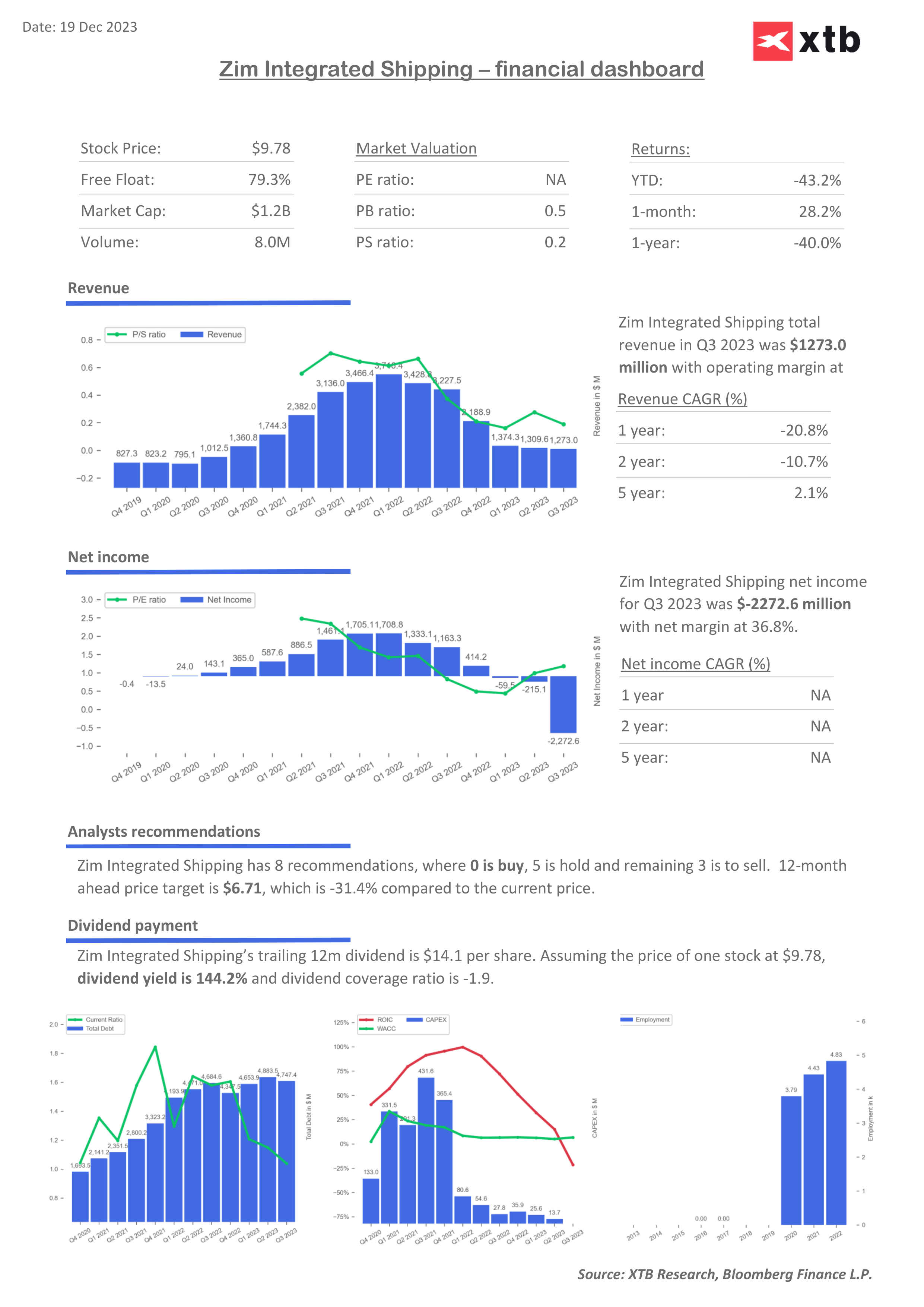

In the short term, ZIM is not in danger of bankruptcy, given its satisfactory liquid assets to pay off its short-term liabilities (current ratio at 1.04), but its debt to equity ratio has weakened significantly in recent months, rising to close to 2. This shows that the valued assets held by ZIM are worth less than its short- and long-term debt, and a possible worsening of problems in the freighter sector due to, for example, a recession could lead to a deeper depreciation of the stock. This makes us believe that, the company will be extremely vulnerable to further freight rates cycle.

Shares of Israel's ZIM (ZIM.US) rose after a long period of weakness, but are trading more than 20% lower since the beginning of 2023, and were unable to sustain the strong gains of the first quarter, when the market expected stronger momentum in the Chinese economy. Stronger supply became active yesterday, after reaching $11 per share, and the stock is currently at the SMA100 level (black line). In an upward scenario, the key for the bulls remains the test of $13.5 per share, where the SMA200 and the main trend line run. Source: xStation5

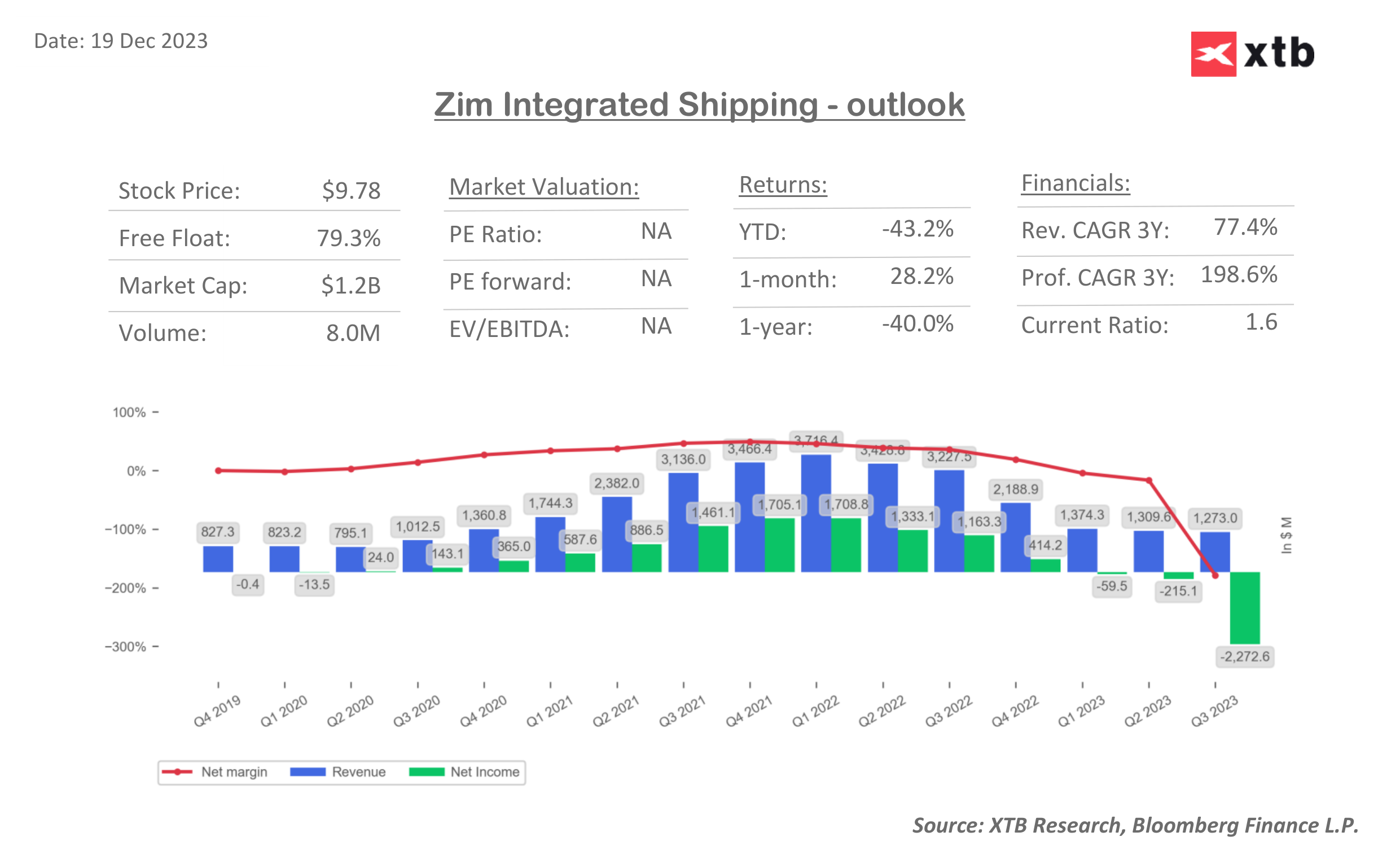

ZIM - financial dashboard and expectations

ZIM shares are trading at a near 50% discount to book value, with a very low price-to-sales ratio near 0.2. Source: XTB Research

ZIM shares are trading at a near 50% discount to book value, with a very low price-to-sales ratio near 0.2. Source: XTB Research

The company has begun to incur significant losses, with negative net margins in the face of recently very high profits, which depressed investors sentiments and ZIM valuation. However, that Q3 results were distorted by a non-cash impairment charge of $2,063 million. Without the write-down, the net result would have been slightly better q/q with a net loss of about $209 million, compared to a $215 million loss in Q2. Source: XTB Research

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈