-

Revision of Eurozone inflation data unchanged

-

Federal government wants to cut VAT rate for gas

Market sentiment improved on European trading floors during today's trading session. The German DE30 is up 0.74%, the French FRA40 is up 0.27%, and the Polish W20 is up 0.67%.

Today's session brings a slight slowdown after yesterday's tension over the release of the Fed's Minutes. Today's economic calendar includes the U.S. jobless claims report, U.S. home sales and the Fed's Philly index. A review of Eurozone inflation data showed no change from the preliminary reading. Speeches by two FED members George and Kashkari are also awaited today.

Economic data (13:30 BST):

Jobless claims fall to 250,000 with an expectation of 264,000 and a previous reading of 262,000. Continuing claims rise less than expected to 1.437 million from 1.428 million with an expectation of 1.455 million The Philly Fed Index at 6.2 points, with a previous reading of -12.3 and an expectation of 5 points.

DE30 index chart, H4 interval. The benchmark of German blue chips is seeing gains today and is trying to return above the 13,750-point barrier. Currently, the retracement of the 50% FIbo in the area of 13,540 points can serve as local support. Source: xStation 5

News:

-

Shop Pharmacy's (SAE.DE) main rival, Swiss company To the rose released weak first-half results, which supported SAE.DE valuations.

-

With gas prices soaring, the German government wants to relieve consumers of the burden of VAT. In the future, the gas tax will be 7% instead of the previous 19%, Chancellor Olaf Scholz said in Berlin on Thursday.

-

Deutsche Bank (DBK.DE) will raise starting salaries for junior bankers to $110,000 from $100,000, Financial News reports

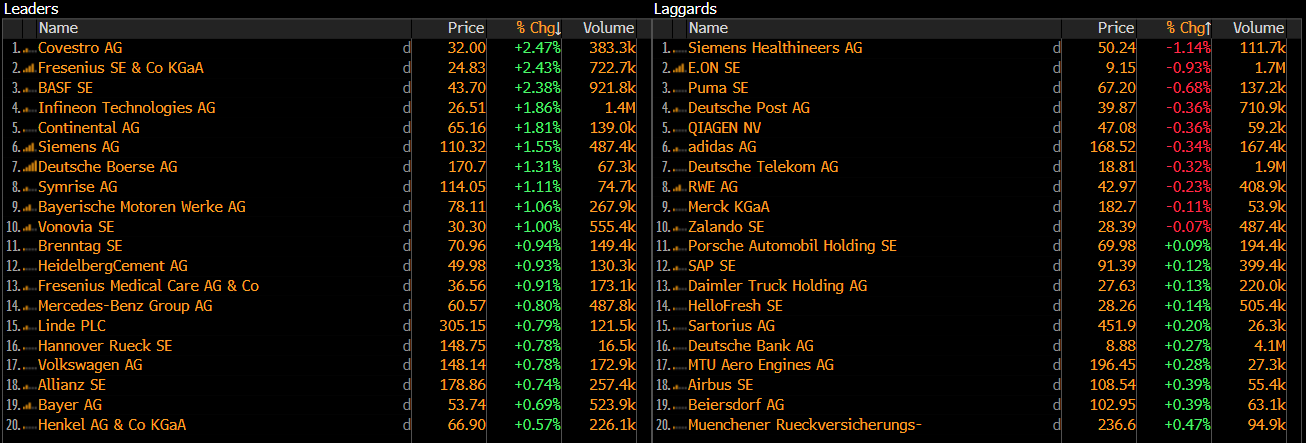

Largest percentage changes of companies entering the DAX index. Source: Bloomberg

Largest percentage changes of companies entering the DAX index. Source: BloombergThe most active stocks in the DAX index (DE30). Source: Bloomberg