-

Las criptomonedas registran notables beneficios en últimas sesiones

-

El DASH genera más del doble de su valor

-

La fluctuación del Bitcoin podría desencadenar otro arreón alcista

El mercado de criptomonedas encamina la recta final de una brillante semana. Desde un par de sesiones atrás, la capitalización de este mercado se ha incrementado en 30 billones de USD (alrededor de un 14%). El Bitcoin asciende un 11%, rompiendo al alza el extremo superior del canal bajista marcado en rojo en el gráfico posterior, marcando el camino a las principales criptos (algunas de las cuales han duplicado su valor). No obstante, no hay noticias que puedas justificar tal crecimiento a título fundamental.

DASH

Fuente: xStation5

Fuente: xStation5

DASH is a true leader of an ongoing upward impulse. The altcoin gained around 130% in just two days. Rally was halted near the resistance at 135. However, a pullback has occurred following this steep rise and the coin moved back to the 115 handle. A point to note is that this coin has been trading in a downward trend for almost two years. A break above the upper limit of the Overbalance structure (green box) could herald a bigger upward move. In such a scenario, one should focus on the previous peak at 186 USD.

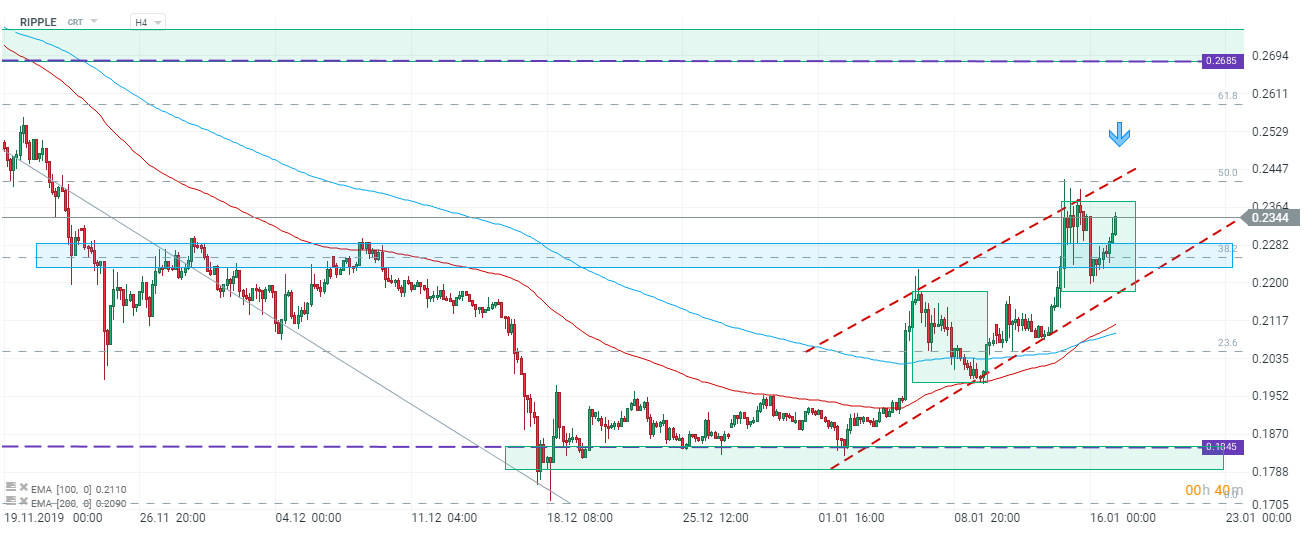

RIPPLE

Fuente: xStation5

Fuente: xStation5

Ripple is also making moves this week. The altcoin trades in an upward channel and has ended correction at 0.22 handle recently. The ongoing upward impulse has pushed the price 6% higher and a test of recent highs at 0.24 could be on the cards now. A point to note is that this level coincides with the upper limit of the channel therefore resistance there could be strong. Should the coin start to decline, one should focus on the aforementioned 0.22 level in the first place. In case it fails to stop the bears, attention will shift to the lower limit of the Overbalance structure at 0.2170.

Will cryptocurrencies rise after Bitcoin halving this time?

Another halving milestone for Bitcoin is approaching. Block no. 630000 is expected to be solved near mid-May and rewards to miners will be halved afterwards. The move is aimed at limiting inflation on the digital currency. A point to note is that the previous two halvings were succeeded by Bitcoin bull market. The first such bull market pushed Bitcoin 1700% higher while the second saw digital coin price increasing by 3600%. Having said that, cryptocurrencies may be ahead of another major rally should the history repeat itself. However, traders should keep in mind that those gains were realized over the long time frame as both aforementioned bull markets lasted around 1000 days.

Bitcoin lucha por recuperar los US$ 70.000 tras el desplome de confianza de inicios de febrero

Resumen diario: Datos débiles en EE.UU. arrastran a los mercados; nueva presión sobre los metales preciosos

El precio de bitcoin pierde un soporte clave: ¿se repite el patrón de caída de octubre?

Resumen del mercado: Novo Nordisk sube más del 7%

Este material ha sido elaborado por XTB. Su contenido tiene fines exclusivamente informativos y no constituye, en ningún caso, una asesoría personalizada ni una recomendación de inversión sobre instrumentos, mercados o estrategias específicas. La información aquí contenida no considera los objetivos, la situación financiera ni el perfil de riesgo de ningún inversionista en particular. Antes de invertir en cualquier instrumento financiero, le recomendamos informarse sobre los riesgos involucrados y verificar si el producto es adecuado para su perfil. El desempeño pasado no garantiza resultados futuros. Toda decisión de inversión basada en este material será responsabilidad exclusiva del inversionista. XTB Agente de Valores SpA no se hace responsable por pérdidas directas o indirectas, incluidos daños patrimoniales o pérdida de beneficios, derivados del uso o confianza depositada en esta información.