Yesterday's BoJ decision to widen the band around target 10-year yield was a hawkish one and has sent JPY spiking while equity markets plunged. However, those downbeat moods did not last long, at least not on US stock exchanges, with Wall Street indices recovering from early drop and finishing yesterday's session higher.

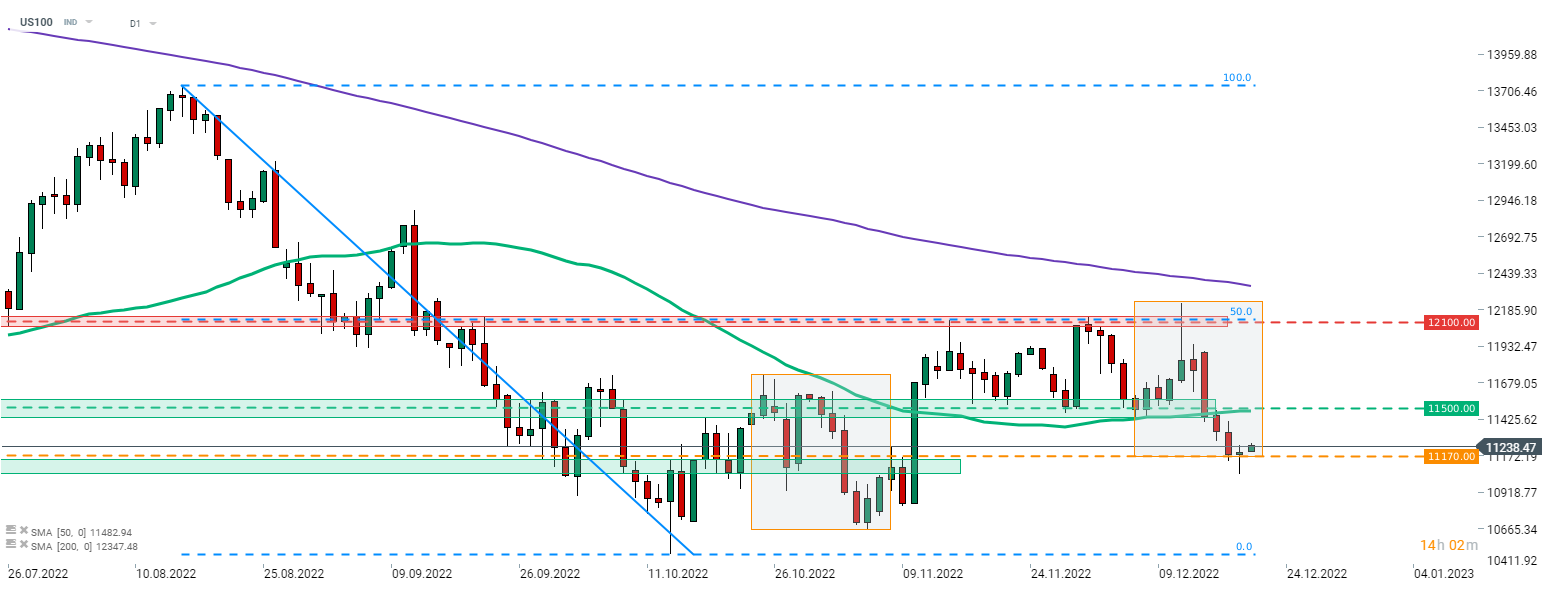

Taking a look at Nasdaq-100 (US100) at D1 interval we can see an interesting technical development. Index attempted to break below the lower limit of a local market geometry yesterday but bulls have ultimately managed to defend the 11,170 pts area. This means that the short-term uptrend is still in play and a long, lower wick of yesterday's daily candlestick boosts outlook for the bulls further. Should the ongoing recovery move extend, the first near-term resistance to watch is 11,500 pts area, which served as the lower limit of an earlier-broken trading range (11,500 - 12,100 pts).

Source: xStation5

Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.