Eidos Therapeutics (EIDX.US), the US biotech company, is surging today. Stock is trading around 40% above Friday's closing price after BridgeBio Pharma, the US company focused on genetics diseases, announced that it will acquire Eidos. BridgeBio will buy around 36.3% of Eidos (all outstanding shares it does not own yet). Eidos shareholders will get to choose whether they want to receive BridgeBio shares as a payment or prefer cash. They may choose to receive 1.85 BridgeBio shares per each Eidos share they own or to receive $73.26 per share. Deal is expected to close in the first quarter of 2021. The deal values Eidos at $2.8 billion.

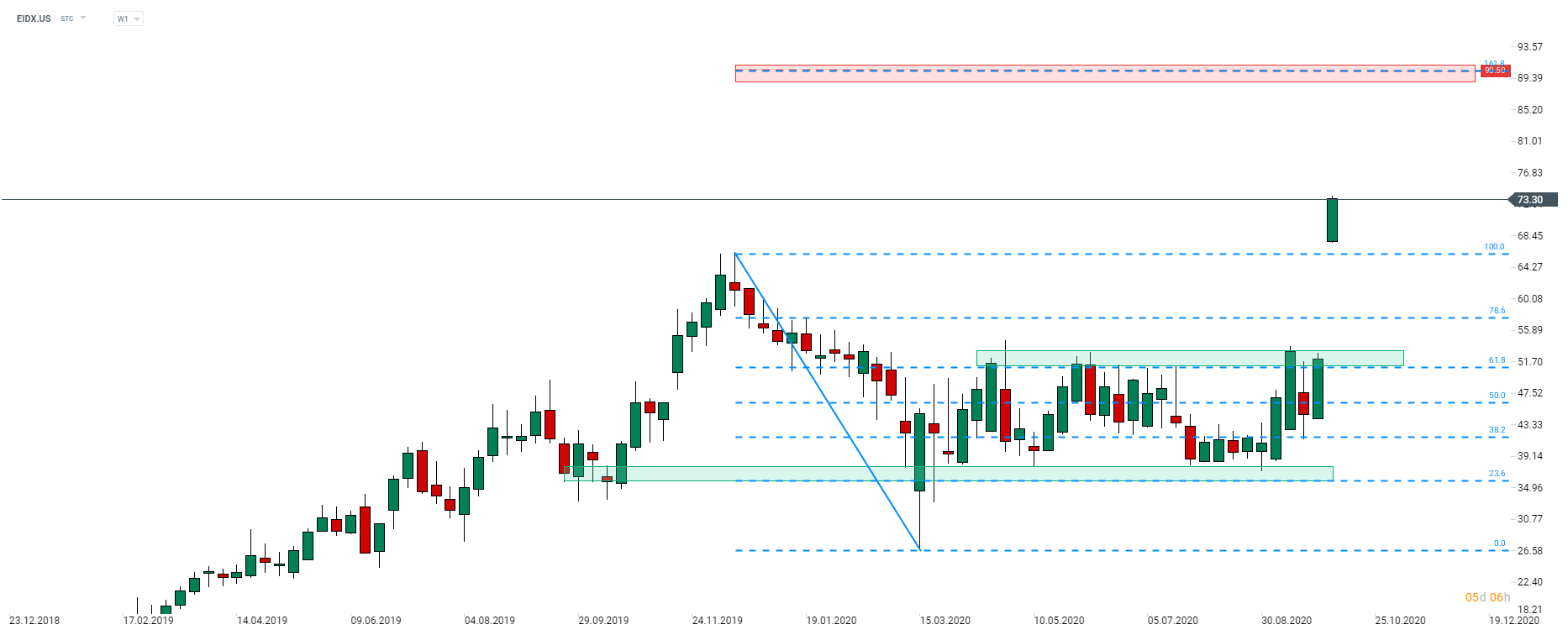

Following today's huge gap at the open, share price of Eidos Therapeutics (EIDX.US) not only jumped above a resistance at 61.8% retracement of early-year drop but also painted a fresh all-time high. Stock is trading around 10% above an all-time high reached in mid-December 2019 and the closest resistance can be found at 161.8% exterior retracement ($90.50 area). Source: xStation5

Following today's huge gap at the open, share price of Eidos Therapeutics (EIDX.US) not only jumped above a resistance at 61.8% retracement of early-year drop but also painted a fresh all-time high. Stock is trading around 10% above an all-time high reached in mid-December 2019 and the closest resistance can be found at 161.8% exterior retracement ($90.50 area). Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.