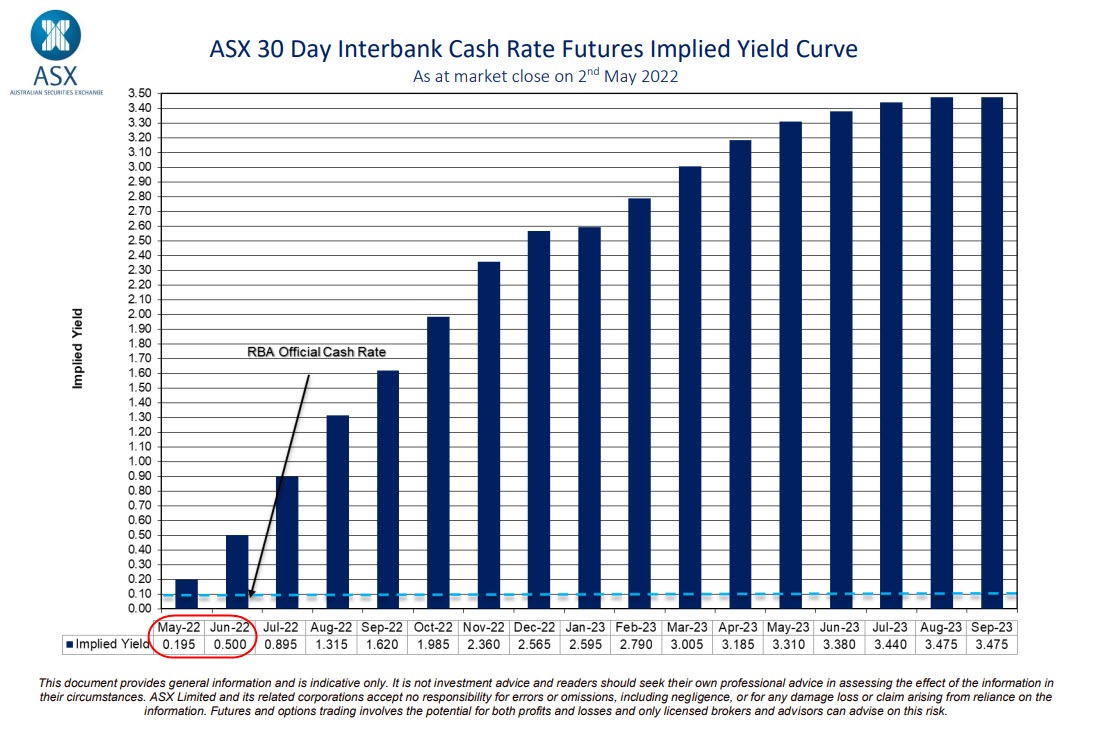

The weekly series of interest rate hike decisions will begin tomorrow at 05:30 BST by the Reserve Bank of Australia (RBA). Analyst consensus assumes that the Bank will raise rates 15 basis points, or to 0.25%. It is worth remembering that if this scenario materializes, it will be the first rate hike in Australia in over a decade.

Any additional signal of a possible hawkish turn by the Bank will have a positive impact on the valuation of the Australian dollar. The decision to raise rates by 15 points has already been priced in by the market, so the lack of surprises may bring a different effect. It is also worth remembering that Wednesday is the day of the FOMC decision in the USA, which if it materializes a hawkish turn in the macro policy, can erase any positive impact of the rate hike on the Australian dollar. Source: ASX

AUDUSD pair chart, D1 interval. The Aussie has been moving in a strong downtrend against the dollar for nearly a month. The currency was strongly influenced by the hawkish policy of FED and difficulties in China's economy. From a technical point of view, the pair is heading towards the psychological support at the level of 0.5. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️