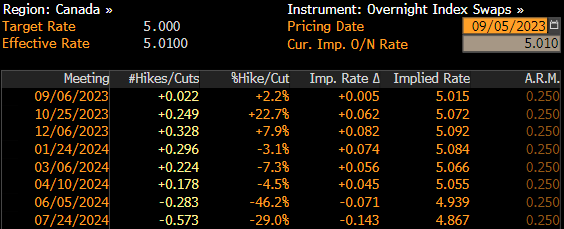

Bank of Canada is scheduled to announce its next monetary policy decision tomorrow at 3:00 pm BST (Wednesday, September 6). Market expects Canadian central bankers to keep rates unchanged at a meeting this week, with the main Canadian interest rate staying at 5.00% - the highest level since the first half of 2001.

- Markets price almost 100% chance for BoC to keep rates unchanged at tomorrow's meeting, after hiking rates by 25 bp in June and July

- Canadian GDP unexpectedly contracted by 0.2% annualized in the second quarter of 2023. Market was expecting a 1.2% annualized expansion

- Canadian CPI inflation accelerated more-than-expected in July, from 2.8% to 3.3% YoY. Markets was expecting an acceleration to 3.0% YoY

- Core retail sales for June dropped 0.8% MoM while market expected a 0.3% MoM increase

Marktes see virtually no chance for a rate hike at the Bank of Canada meeting tomorrow. Source: Bloomberg Finance LP

Weak Q2 GDP data has been crucial in shaping expectations for the upcoming BoC decision. While markets 25 bp rate hike was never a base case scenario for September meeting, markets saw an around 20-25% chance of such a move prior to release of the downbeat GDP report last Friday. Moreover, other data from the Canadian economy also does not support increasing rates with consumer spending remaining weakish. While CPI data came in above market expectations, rate hike would further deteriorate the situation in the Canadian housing market. Not to mention that drop in demand coming from weakish consumer spending would likely be enough to bring inflation down to the target without a need for more rate hikes.

A look at USDCAD chart

USDCAD enjoyed strong gains between June 2021 and October 2022, gaining over 15% over the period. However, the advance was halted in the final quarter of 2022 and the pair has traded largely sideways since. Recent USD strengthening allowed the pair to bounce off 10-month lows in the 1.3100 area and climb towards the upper limit of the trading range at 1.3650. An attempt to break above this zone was made today but so far, bulls failed to deliver a breakout. Decision from Bank of Canada tomorrow could be crucial for whether the pair breaks above this zone or pulls back from it. Should we see a strong hint that incoming data doesn't support rate hikes at future meetings, CAD may find itself under pressure with USDCAD potentially breaking above 1.3650 area.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)