U.S. technology companies reported their Q4 2025 results after the Wall Street close today. Most companies (Tesla didn't) beat consensus estimates on both earnings and revenue, supporting the US100, which recovered losses following Powell’s remarks. After the releases, Meta Platforms and Tesla are up more than 4%, Microsoft is down nearly 3%, and IBM is up almost 7%.

Source: xStation5

Meta Platforms: Q4 2025 results (META.US; up 4% after-hours)

-

EPS: $8.88 vs $8.19 est. vs $8.02 a year ago

-

Revenue: $59.89B vs $58.42B est.

-

Advertising revenue: $58.14B vs $56.79B est.

-

Family of Apps revenue: $58.94B vs $57.47B est.

-

Family of Apps operating income: $30.77B vs $30.0B est.

-

Total operating income: $24.75B, +5.9% y/y

-

Reality Labs revenue: $955M vs $962.7M est.

-

Reality Labs operating loss: $6.02B vs $5.8B est. (loss)

-

Commercial remaining performance obligation (cRPO): $625B

-

Q1 revenue guidance: $53.5B–$56.5B vs $51.27B est.

-

2026 capex guidance: $115B–$135B vs $110.62B est.

Source: xStation5

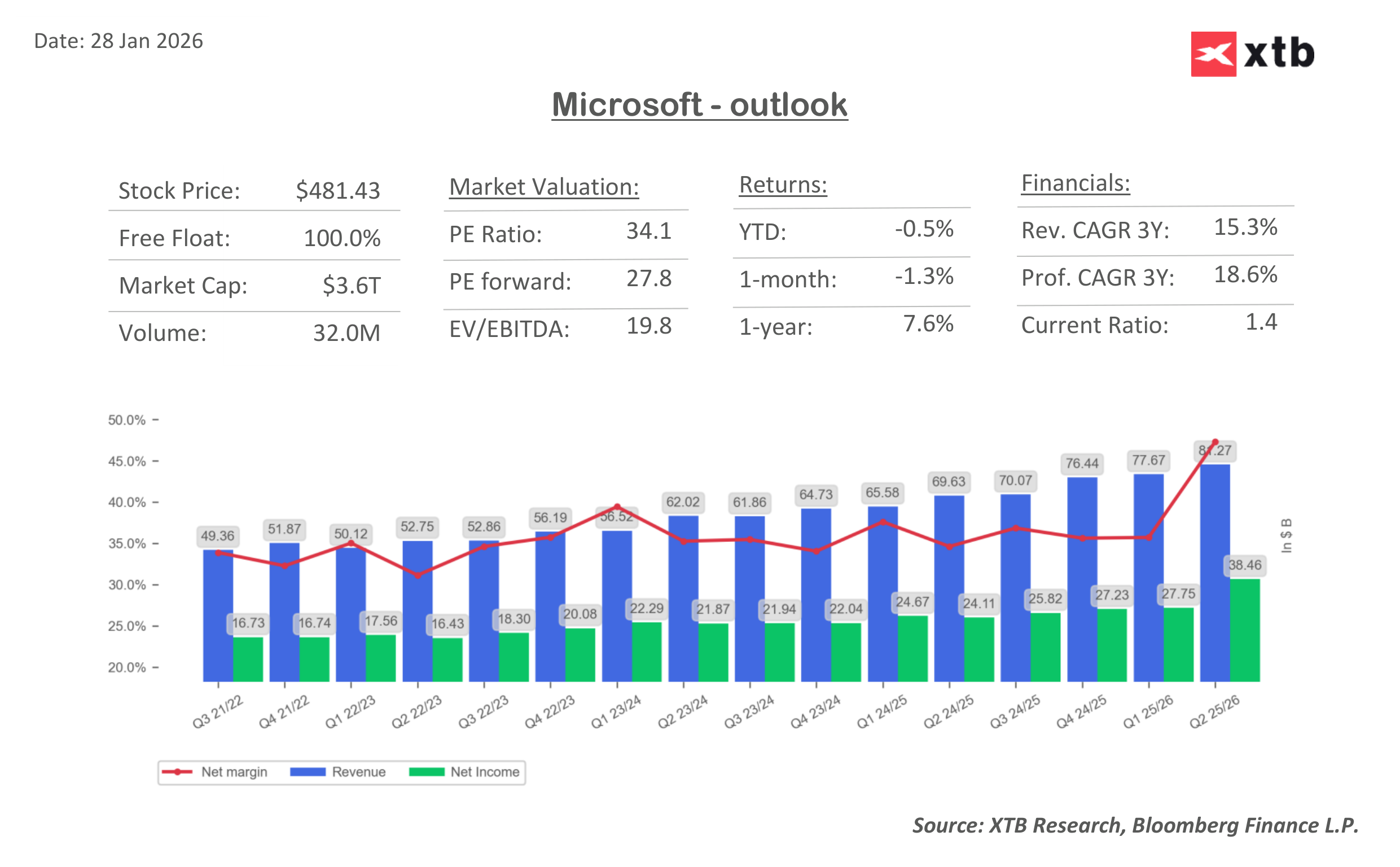

Microsoft: Q2 2026 results (MSFT.US; down 3% after-hours)

-

Adjusted EPS: $4.14 vs $3.92 est.

-

Revenue: $81.27B vs $80.31B est.

-

-

Intelligent Cloud revenue: $32.91B vs $32.39B est.

-

Azure & other cloud services (ex-FX): +38% vs +38% est.

-

Productivity and Business Processes revenue: $34.12B vs $33.45B est.

-

More Personal Computing revenue: $14.25B vs $14.33B est.

-

Commercial remaining performance obligation (cRPO): $625B

-

Microsoft 365 (commercial seats): +6%

-

Operating income: $38.28B vs $36.55B est.

-

Capital expenditures (CAPEX): $29.88B vs $23.78B est.

-

Revenue at constant currency: +15% vs +14.3% est.

-

Source: xStation5

Source: Bloomberg Finance L.P., XTB Research

Tesla: Q4 2025 results (TSLA.US; up 4% after-hours)

-

Adjusted EPS: $0.50 vs $0.45 est.

-

EPS: $0.24 vs $0.66 a year ago

-

Revenue: $24.90B vs $25.11B est.

-

Operating income: $1.41B vs $1.32B est.

-

Gross margin: 20.1% vs 17.1% est.

-

Free cash flow (FCF): $1.42B vs $1.59B est.

Source: xStation5

IBM: Q4 2025 results (IBM.US; up 7% after-hours)

-

Operating EPS: $4.52 vs $4.28 est.

-

Revenue: $19.69B vs $19.21B est.

-

Software revenue: $9.03B vs $8.82B est.

-

Consulting revenue: $5.35B vs $5.38B est.

-

Free cash flow (FCF): $7.55B vs $6.85B est.

-

FY revenue outlook (constant currency): above +5% vs +4.12% est.

-

FY FCF outlook: expected to increase by about $1B y/y

Source: xStation5

BREAKING: Oil falls after NYT report on talks between Iran and the CIA regarding a suspension of military action💡

Gold and silver rebound after the sell-off 📈

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Bitcoin jumps above $70k USD despite stronger dollar📈