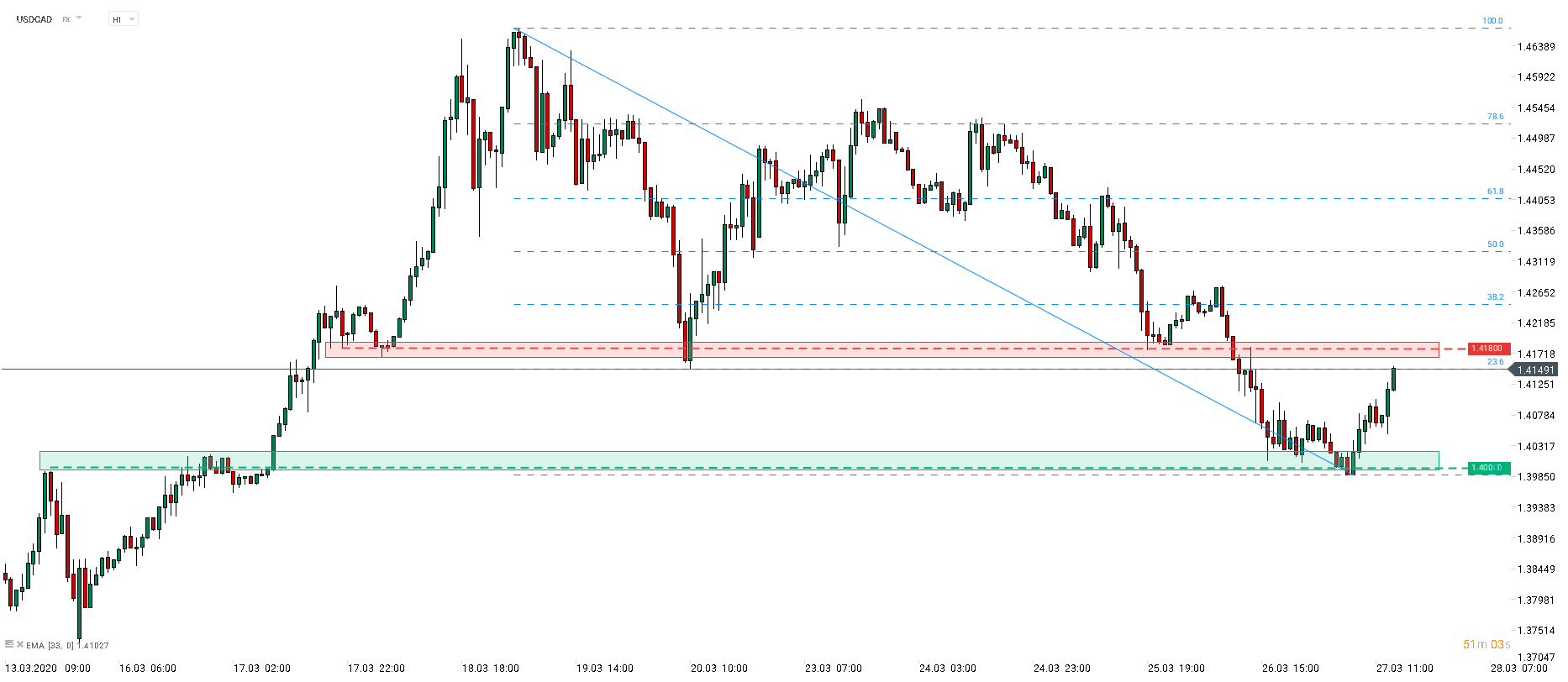

Bank of Canada decided to deliver a 50 basis points rate cut in an emergency move. Main rate was lowered from 0.75% to 0.25%. The move is aimed at supporting Canadian economy at times of the coronavirus outbreak. Before the cut, Bank of Canada held the highest interest rate among developed countries. USDCAD extended gain on the news and tested 23.6% Fibo level of the downward move started on March 19.

USDCAD tested 23.6% retracement after the Bank of Canada delivered a 50 basis point rate cut. Important resistance zone can be found near the 1.4180 handle. Source: xStation5

USDCAD tested 23.6% retracement after the Bank of Canada delivered a 50 basis point rate cut. Important resistance zone can be found near the 1.4180 handle. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)