The Bank of England announced its monetary policy decision at 12:00 pm GMT. Market expected a 75 basis point rate hike and BoE delivered onto those expectations. Rates increased by 75 bp with main rate climbing to 3.00%. The decision was unanimous with all 9 members voting in favor of a hike (1 voted for 25 bp rate hike and 1 voted for a 50 bp rate hike). However, BoE warned that a 2-year recession may occur if rates follow path set by the market curve. According to BoE, GDP may fall by 2.9% over the next 8 quarters if the market curve is followed. BoE also said that peak policy rate is likely to be lower than predicted by the market (currently at 5.25%). Inflation is expected to peak at around 11% in Q4 2022. GBP moved lower on the news with GBPUSD testing 1.1200 mark.

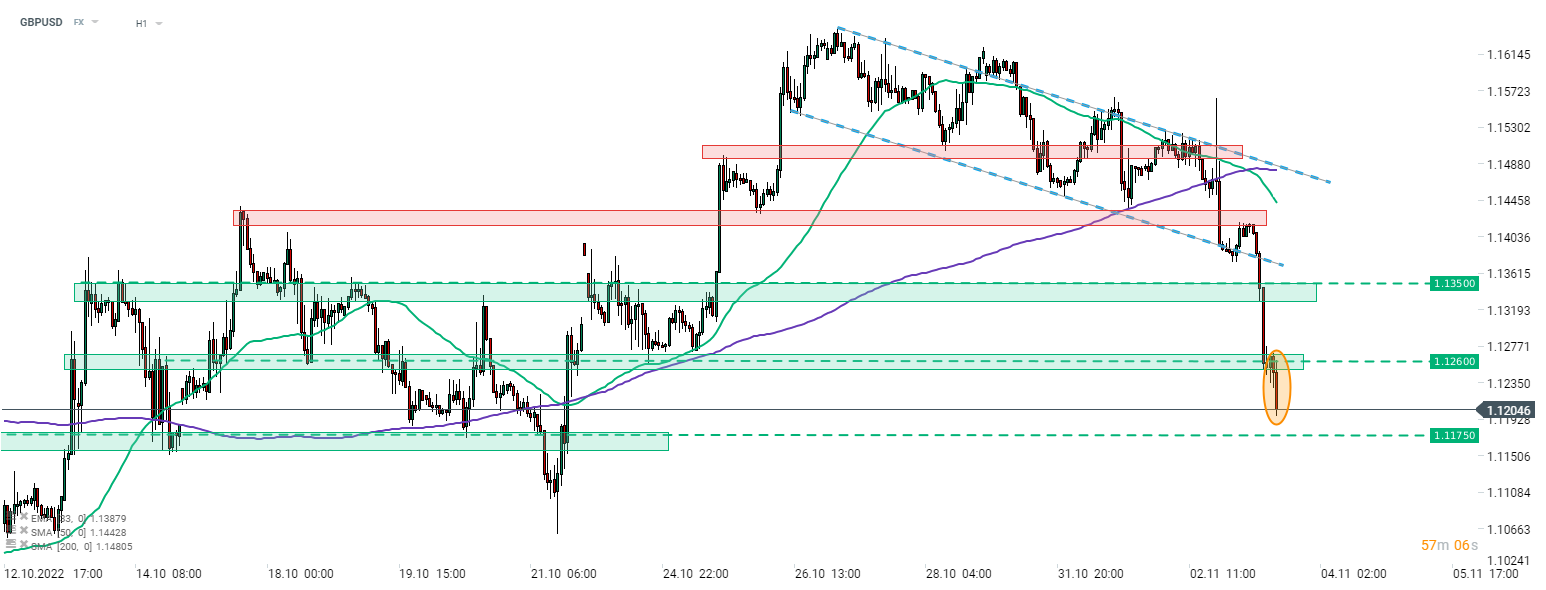

GBPUSD painted another leg lower in today's downward move following an in-line rate hike from BoE. Bank of England warned that should policy rates follow market path, a 2-year recession may occur. Source: xStation5

GBPUSD painted another leg lower in today's downward move following an in-line rate hike from BoE. Bank of England warned that should policy rates follow market path, a 2-year recession may occur. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)