- BoE decision on interest rates. Actual: 5.25%. Expectations: 5.25%. Previously: 5.25%.

- Distribution of bankers' votes (hike-hold-lower). Actual: 0-7-2. Expectations: 0-8-1; Previously: 0-8-1.

The decision was received dovishly by the market, which is related to the details of the decision and the statement:

- Ramsden voted in favor of the cuts, as well as Dhindra

- Risks from inflation persistence are receding

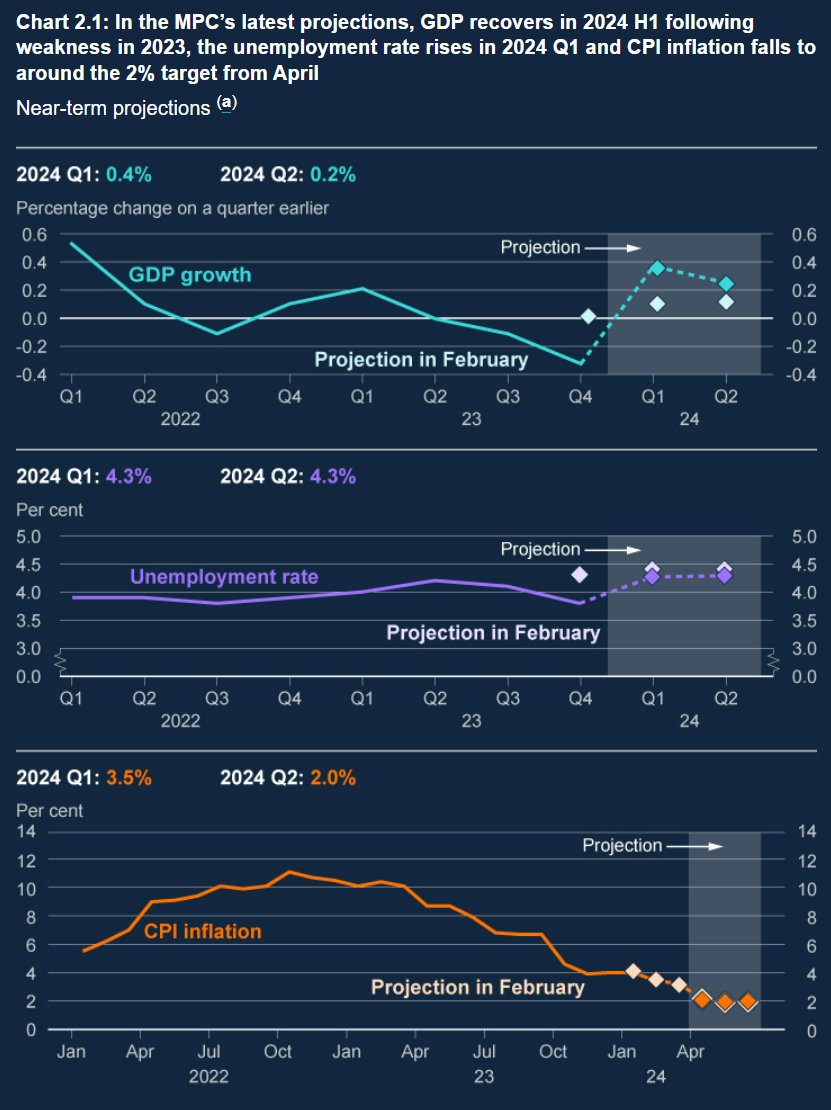

- Inflation projections are lowered by BoE

We have an open door to an interest rate cut in June. It is worth mentioning that April inflation is likely to be on target, due to energy price cuts. The market is now pricing that the first cut could take place in June.

However, Governor Bailey said that the bank is not yet at the point to cut the base rate!

Key changes in economic forecasts:

- BoE estimates GDP +0.4% qq for q1 2024 (march forecast: +0.1%), sees +0.2% qq in q2 2024

- BoE forecasts GDP in 2024 +0.5% (feb: 0.25%), 2025 1% (feb: +0.75%), 2026 1.25% (feb: 1%)

- BoE forecasts unemployment rate in q4 2024 4.4% (feb: 4.6%); q4 2025 4.7% (feb: 4.9%); q4 2026 4.8% (feb: 5.0%)

- BoE estimates wage growth +5.25% yy in q4 2024 (feb: +4%), q4 2025 +2.25% (feb: +2.75%); q4 2026 1.5% (feb: +1.75%)

- BoE forecasts real post-tax household income in 2024 +1.75% (feb: +0.5%), 2025 +1% (feb: +0.25%), 2026 0.5% (feb: 0%)

Source: BoE

Source: BoE

Source: xStation

Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)