Canadian jobs data for February was released today at 1:30 pm GMT. Report was expected to show an over-20k increase in total employment, as well as an uptick in the unemployment rate from 5.7 to 5.8%.

Actual report turned out to be much stronger than expected. While unemployment rate ticked higher in-line with market expectations, total employment change was almost twice as high as expected. Moreover, employment change was entirely driven by full-time jobs.

Canada, jobs report for February

- Employment change: +40.7k vs +20.5k expected (+37.3k previously)

- Full-time employment: +70.6k vs -11.6k previously

- Part-time employment: -29.9k vs +48.9k previously

- Unemployment rate: 5.8% vs 5.8% expected (5.7% previously)

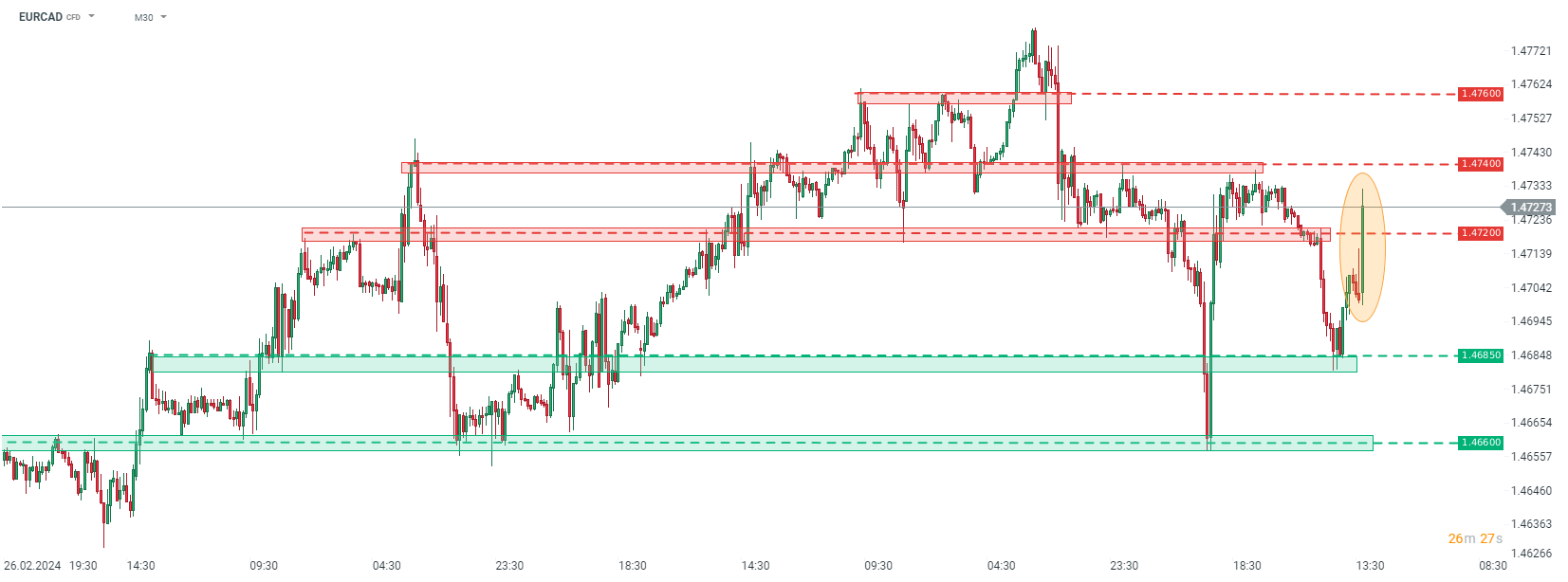

However, Canadian dollar weakened following the release. USDCAD swung up and down, follwoing the release but reaction on this pair was distorted by release of the NFP report. Taking a look at EURCAD we can see that the pair spiked following the release and jumped above 1.4720 resistance.

Source: xStation5

Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)