Releases of flash PMI indices for July are highlights in today's economic calendar. Two key releases from the euro area - French and German - were already released at 8:15 am BST and 8:30 am BST.

French release was expected to show a deterioration compared to June's reading but actual reading was even worse than market expected. Manufacturing gauge dropped below 50.0 threshold - into contraction territory. Services index dropped from 53.9 to 52.1 and remained in expansion territory. Release from Germany was not positive either. In this case, both manufacturing and services indices turned out to be worse-than-expected and dropped into contraction territory.

France

-

Manufacturing: 49.6 vs 50.9 expected (51.4 previously)

-

Services: 52.1 vs 52.8 expected (53.9 previously)

Germany

-

Manufacturing: 49.2 vs 50.6 expected (52.0 previously)

-

Services: 49.2 vs 51.2 expected (52.4 previously)

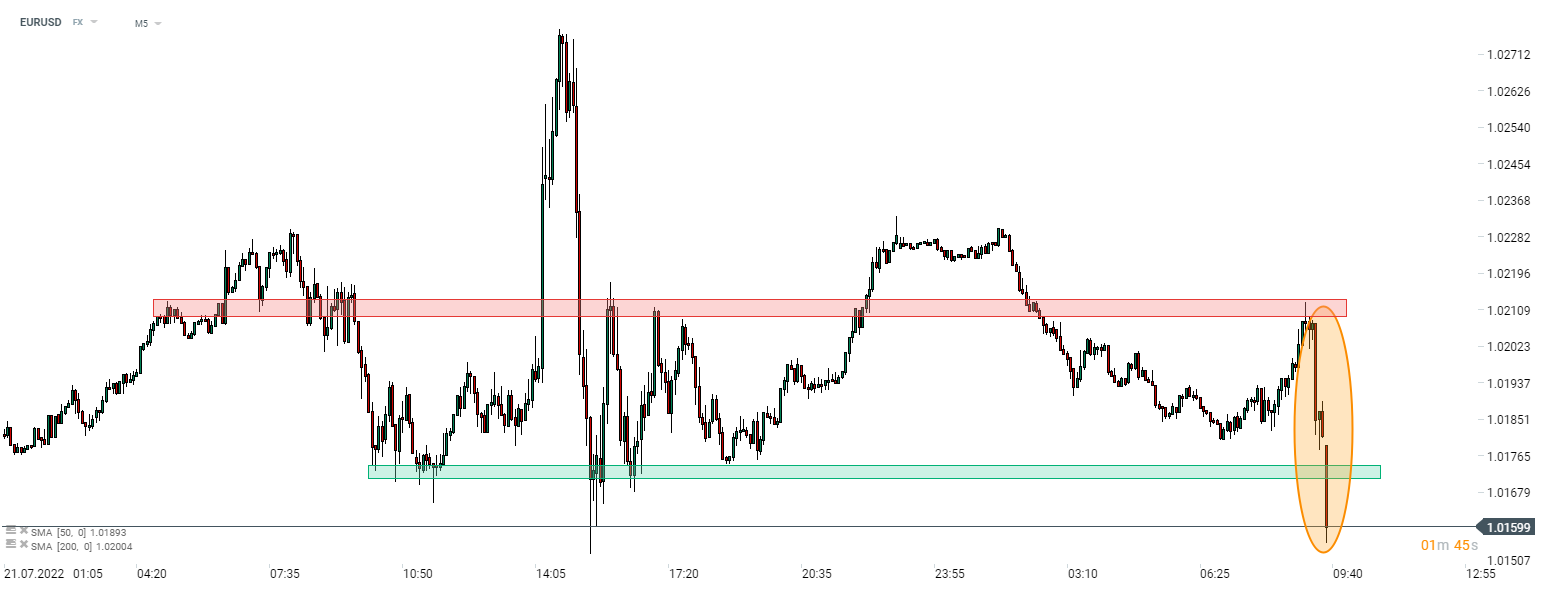

Euro and equity indices pulled back following releases of disappointing French PMIs. DE30 quickly recovered from the drop while the euro remained lower. However, another wave of selling arrived after release of disappointing German PMIs. EURUSD plunged below short-term support zone in the 1.0750 area and is looking towards yesterday's lows.

Source: xStation5

Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)