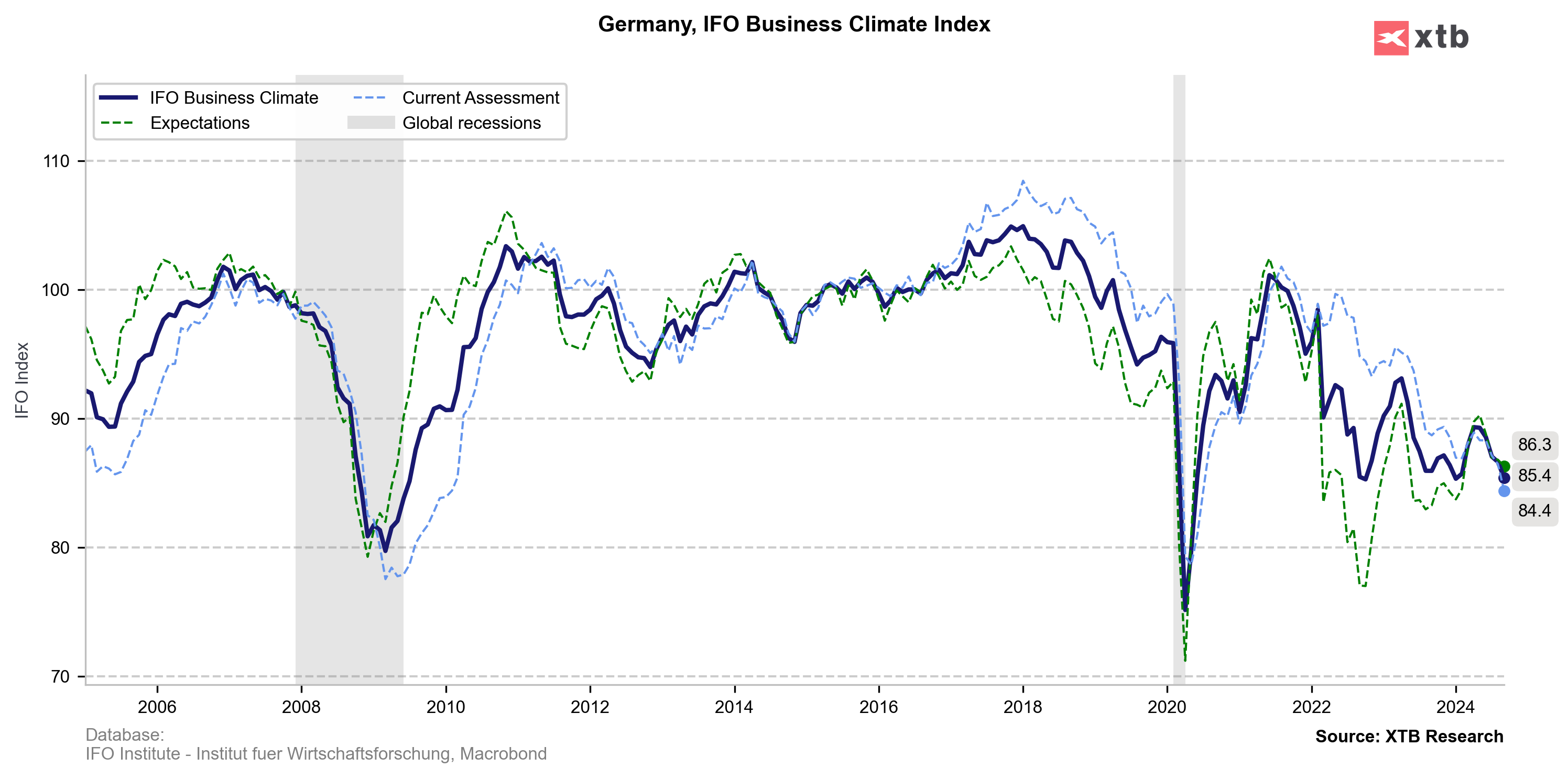

The German IFO Institute released its latest set of sentiment indices today at 9:00 AM BST. Data for August was expected to show a drop in the headline Business Climate index from 86.6 to 86, with both subindices – Current Conditions and Expectations – expected to decline.

However, the actual report came in below expectations, with the headline Business Climate index at 85.4, a larger drop than anticipated. The Expectations subindex also came in lower than expected, while the Current Conditions index showed a significant drop from 86.5 to 84.4.

The market reaction was initially muted, with positive price action in EUR/USD and the euro showing strength. The DE40 also ticked higher and is now approaching an all-time high.

Germany, IFO indices for September

- Business Climate: 85.4 vs 86.0 expected (86.6 previously)

- Current Conditions: 84.4 vs 86 expected (86.5 previously)

- Expectations: 86.3 vs 86.4 expected (86.8 previously)

The price action led to the RSI breaking its upward trendline and entering oversold territory. This could indicate short-term strength for the euro and an opportunity to recover part of yesterday's losses. Source: xStation

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)