Flash PMI indices from France and Germany were released this morning at 8:15 am GMT and 8:30 am GMT, respectively. Market expected more or less flat manufacturing reading in both cases, slightly higher French services reading and a slightly lower German services reading. However, the French release turned out to be a big positive surprise with both gauges beating expectations significantly. Situation looked a bit different in Germany. While services gauge from the country also show major beat, manufacturing index dropped more than expected.

France

-

Manufacturing: 57.6 vs 55.5 expected

-

Services: 57.9 vs 53.6 expected

Germany

-

Manufacturing: 58.5 vs 59.5 expected

-

Services: 56.6 vs 53.0 expected

Market reaction was small. EUR jumped following French reading before giving back gain on German release. Stock markets completely ignored French releases but caught a bid following German print.

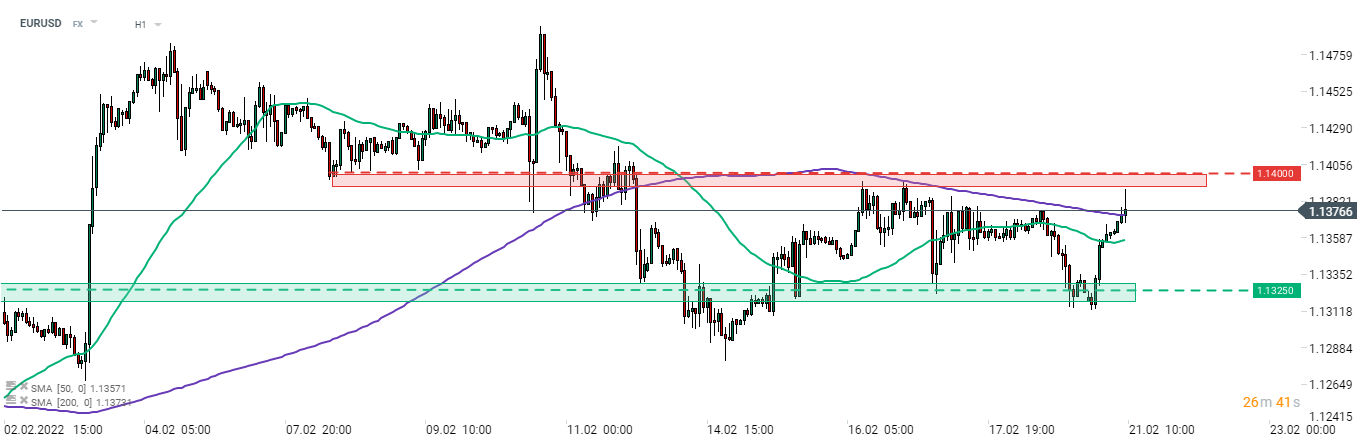

EURUSD jumped after the French PMI release and tested 1.14 resistance zone. However, gains were erased following the German release. The pair has pulled back to the 200-hour moving average (purple line). Source: xStation5

EURUSD jumped after the French PMI release and tested 1.14 resistance zone. However, gains were erased following the German release. The pair has pulled back to the 200-hour moving average (purple line). Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)