Flash PMI indices for January from France and Germany were released today at 8:15 am GMT and 8:30 am GMT. While the French release turned out to be more or less as expected by the markets, a big surprise was reported in German data with both manufacturing and services indices beating expectations.

France

-

Manufacturing: 55.5 vs 55.5 expected (55.6 prior)

-

Services: 53.1 vs 55.3 expected (57.0 prior)

Germany

-

Manufacturing: 60.5 vs 57 expected (57.4 prior)

-

Services: 52.2 vs 48.0 expected (48.7 prior)

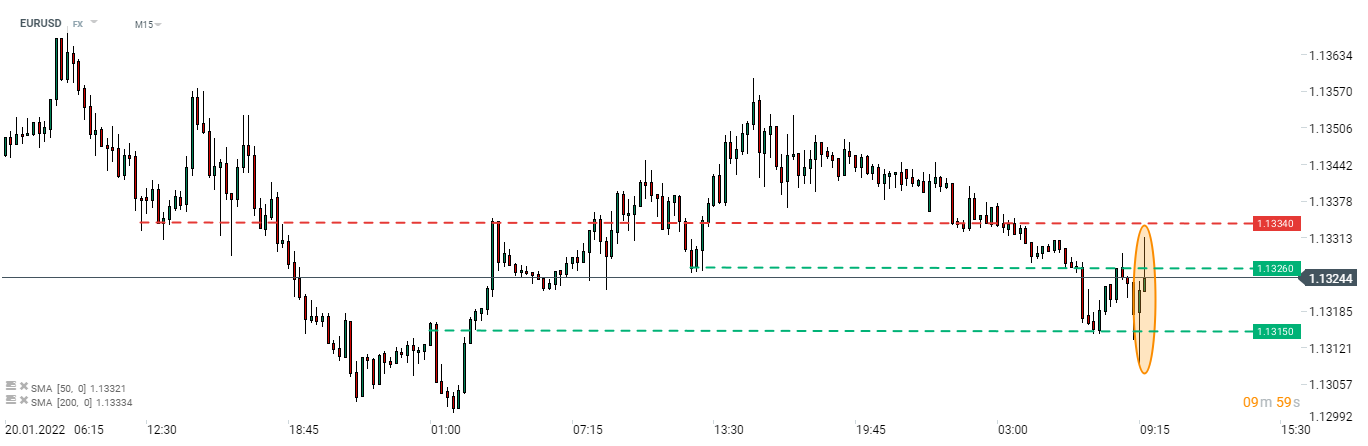

Reaction of the markets to flash PMIs for January has been rather small. Indices were recovering from a lower opening when French data was released and a print triggered a small pullback. Meanwhile, much better-than-expected German data lead to a barely noticeable bounce on the DE30 market. Euro can be seen as the winner of the situation with EURUSD moving higher after both releases. The main currency pair is trading a touch below 1.1330 handle.

EURUSD gained after flash PMI releases but scale of moves was rather small. Source: xStation5

EURUSD gained after flash PMI releases but scale of moves was rather small. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉