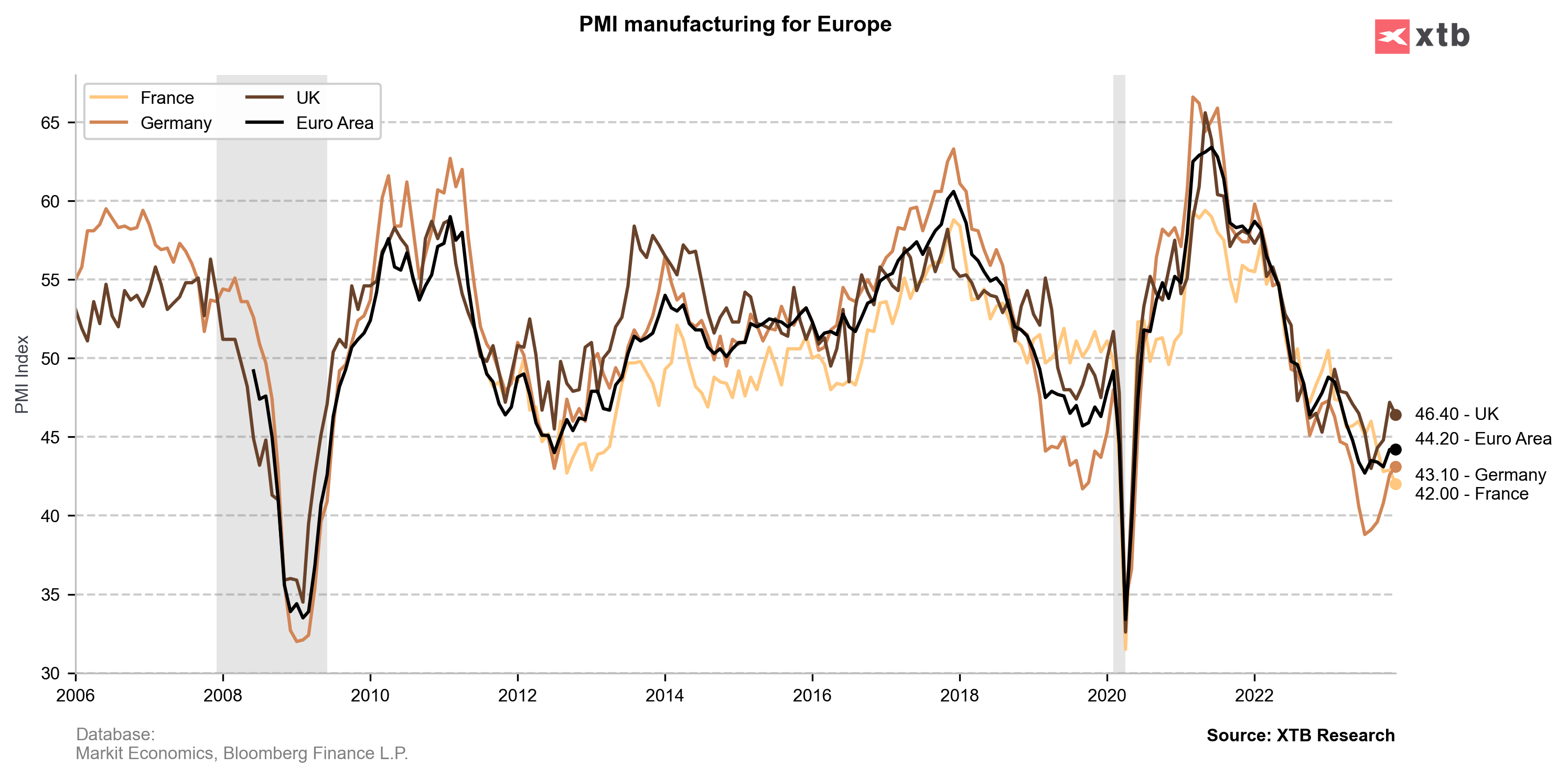

- Eurozone Mfg PMI Flash Actual 44.2 (Forecast 44.6, Previous 44.2)

- Eurozone Services Flash PMI Actual 48.1 (Forecast 49, Previous 48.7)

- Eurozone Composite PMI Flash Actual 47 (Forecast 48, Previous 47.6)

- UK Mfg PMI Flash Actual 46.4 (Forecast 47.5, Previous 47.2)

- UK Services PMI Flash Actual 52.7 (Forecast 51, Previous 50.9)

- German Service PMI Flash Actual 48.4 (Forecast 49.8, Previous 49.6)

- German Mfg PMI Flash Actual 43.1 (Forecast 43.2, Previous 42.6)

- French Services PMI Flash Actual 44.3 (Forecast 46, Previous 45.4)

- French Mfg PMI Flash Actual 42 (Forecast 43.3, Previous 42.9)

In December, business activity in the Eurozone declined more steeply, marking the fastest quarterly decrease in output in 11 years, excluding the initial pandemic months of early 2020. The Flash Eurozone Composite PMI Output Index fell to a two-month low of 47.0, with both the services and manufacturing sectors experiencing downturns. New business inflows decreased sharply, leading to further depletion of backlogs of work and resulting in job cuts for the second consecutive month. Manufacturing continued to lead the downturn, with output falling for the ninth month in a row, and service sector output also declined significantly. Inflation signals were mixed, with input cost inflation cooling but selling price inflation remaining elevated. The overall reduction in business activity reflected deteriorating order books, with new orders for goods and services continuing to decline sharply. This led to the seventeenth decline in backlogs of work in the past 18 months, indicating a persistent contraction in the Eurozone's economic activity.

BREAKING: UK GDP and manufacturing lower than expected 📉Final German CPI in line with expectations

Morning wrap (12.12.2025)

BREAKING: US wholesale sales lower than expected

BREAKING: US jobless claims above expectations🗽