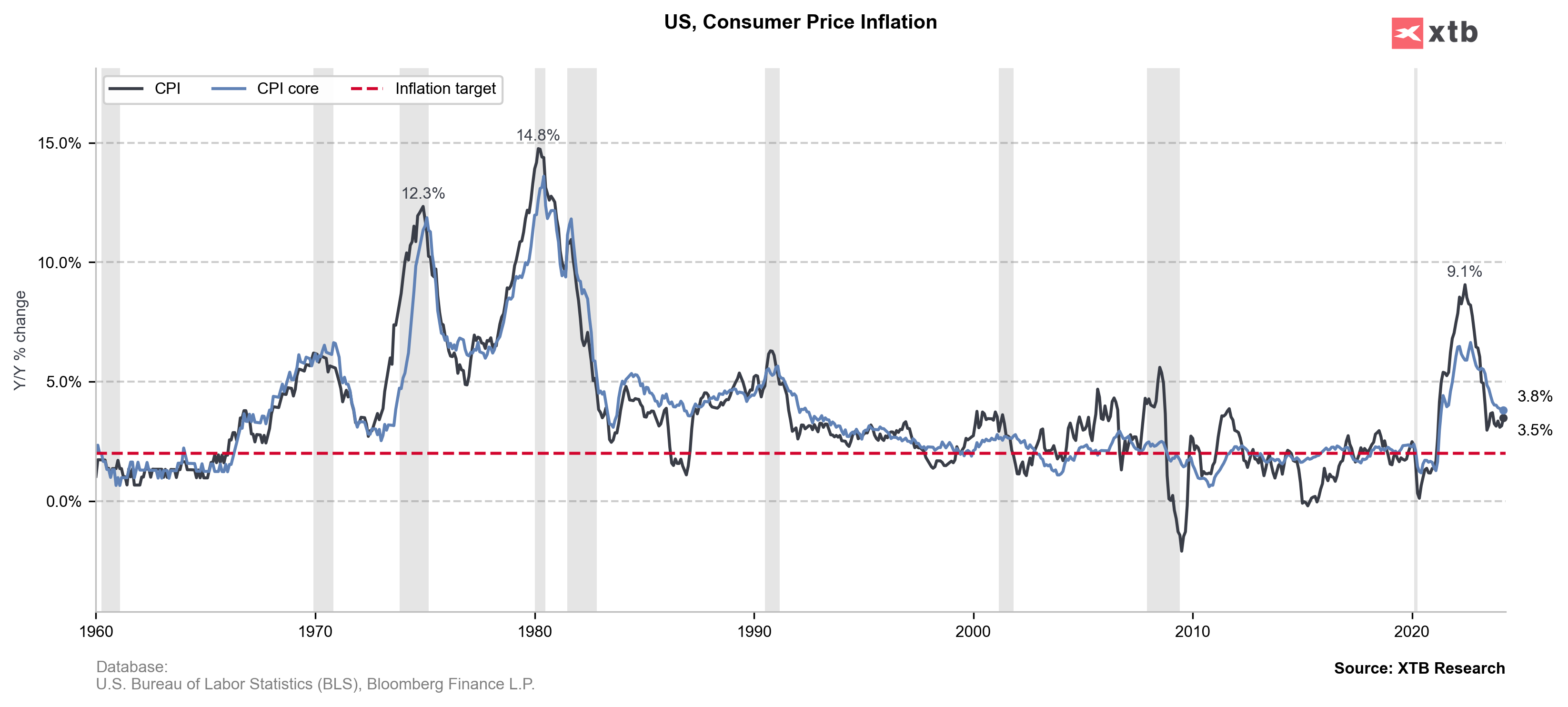

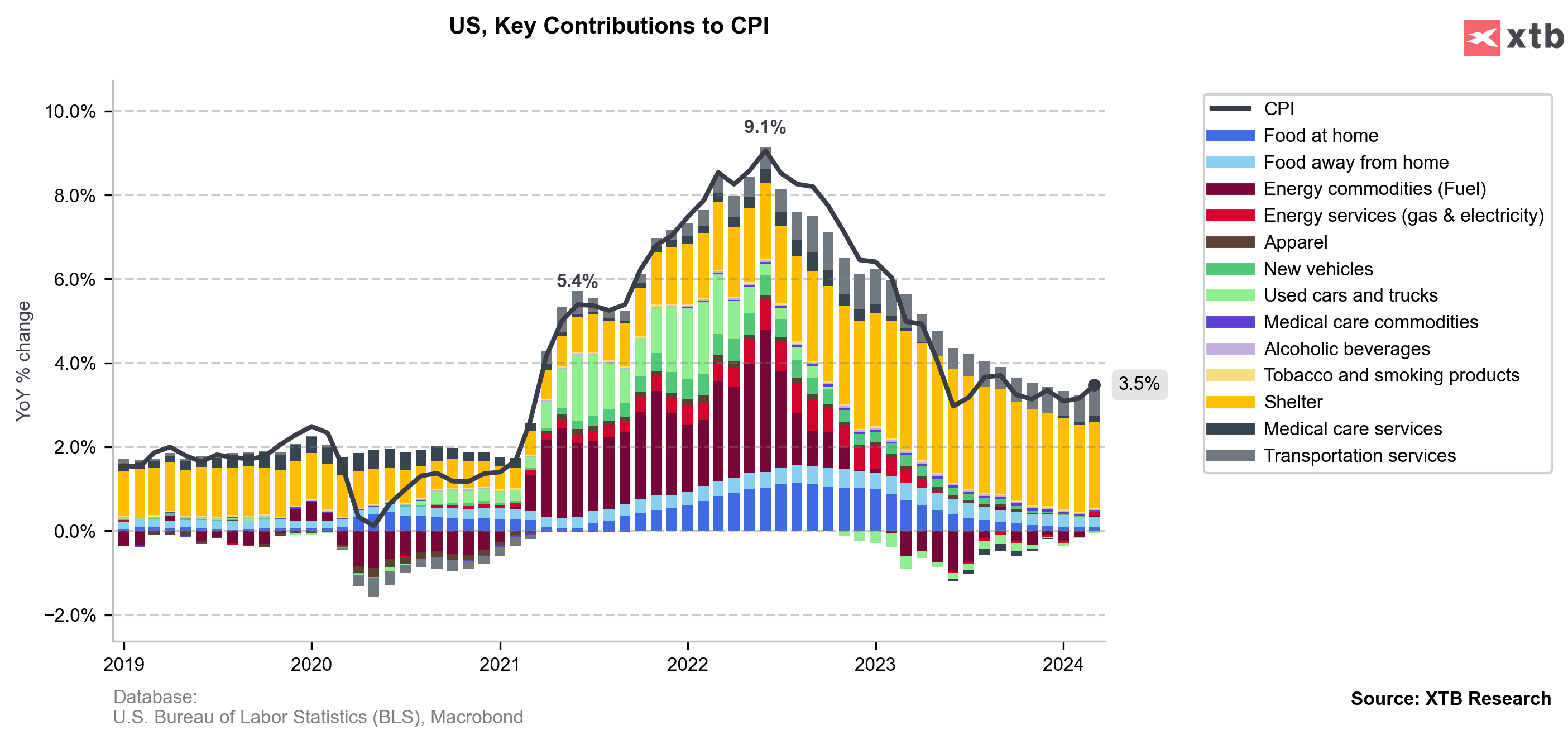

US CPI inflation report for March was released today at 1:30 pm BST. Report was expected to show an acceleration in headline measure as well as a slowdown in core CPI. Also, monthly inflation increase were expected to moderate after two months of 0.4% readings.

Actual report turned out to be a hawkish surprise. This is another hawkish surprise in a row, after data for January and February also surprised to the upside. Annual core CPI inflation unexpectedly stayed unchanged compared to a month ago, while headline inflation accelerated more than expected.

The reading was hawkish all across the board and is unlikely to give Fed more confidence to cut rates. Having said that a hawkish reaction in the markets should not come as a surprise - USD gains while gold and equity indices slumped.

US, CPI inflation for March

- Headline (annual): 3.5% YoY vs 3.4% YoY expected (3.2% YoY previously)

- Headline (monthly): 0.4% MoM vs 0.3% MoM expected (0.4% MoM previously)

- Core (annual): 3.8% YoY vs 3.7% YoY expected (3.8% YoY previously)

- Core (monthly): 0.4% MoM vs 0.3% MoM expected (0.4% MoM previously)

USD jumped following another hawkish surprise in US CPI data. EURUSD slumped below 1.08 mark following the release. Source: xStation5

USD jumped following another hawkish surprise in US CPI data. EURUSD slumped below 1.08 mark following the release. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)