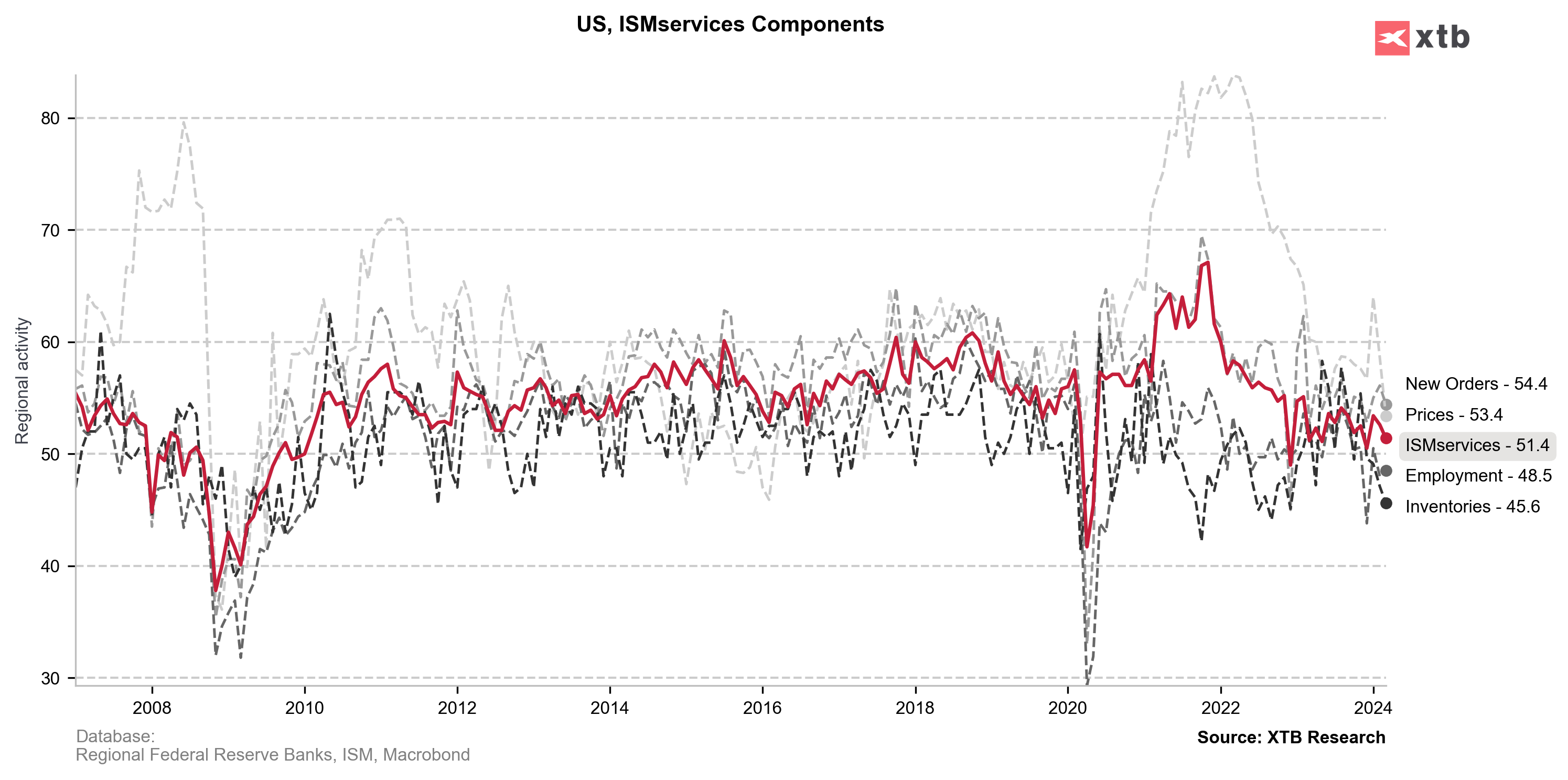

US services ISM data for March was released today at 3:00 pm BST. Report was expected to show the headline index staying virtually unchanged compared to February's data. However, an improvement was expected in New Orders subindex, as well as deterioration in Employment subindex.

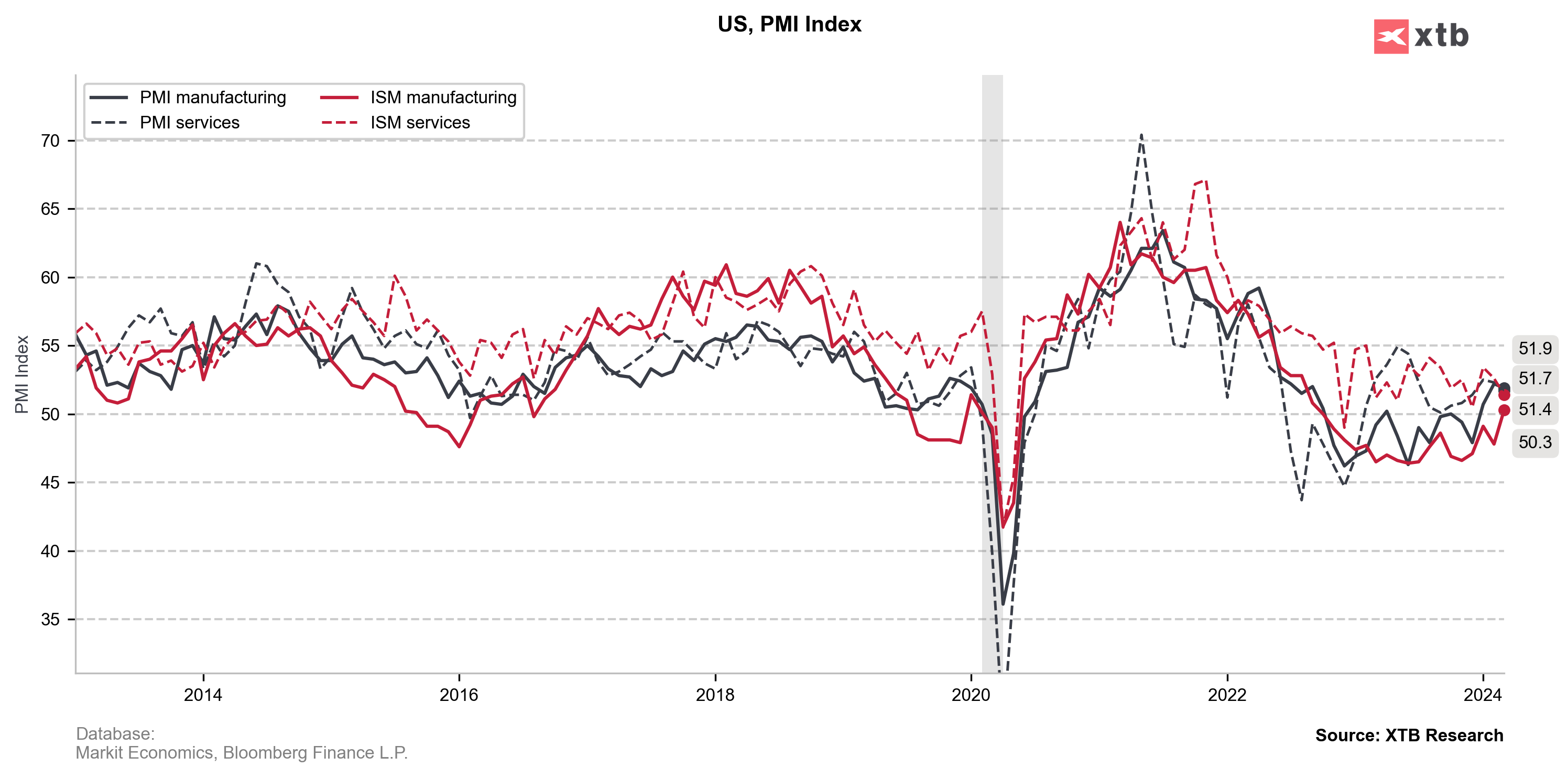

The actual report turned out to be a negative surprise, with headline index and subindices all coming in below expectations. The biggest plunge was recorded in Prices Paid subindex. Employment subindex climbed compared to a month ago reading, but less than expected by analysts.

This is a dovish reading as it hints at weakening outlook for the US services sector as well as at easing price pressures. Having said that, it should not come as a surprise that we have seen a dovish response in the markets - USD dropped while US equity indices jumped.

US services ISM index for March: 51.4 vs 52.7 expected (52.6 previously)

- Prices Paid: 53.4 vs 58.4 expected (58.6 previously)

- New Orders: 54.4 vs 55.5 expected (56.1 previously)

- Employment: 48.5 vs 49.0 expected (48.0 previously)

EURUSD spiked after services ISM data, breaking above the 1.08 mark and approaching 38.2% retracement of the last major downward impulse. Source: xStation5

EURUSD spiked after services ISM data, breaking above the 1.08 mark and approaching 38.2% retracement of the last major downward impulse. Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)