The ISM Manufacturing PMI for the US fell to 48.4 in December from 49.0 in the previous month remaining in contraction zone, slightly bellow analysts’ expectations of 48.5. Further contractions were recorded for new orders (45.2 vs 47.2), and new export orders (46.2 vs 48.4) while production also declined (48.5 vs 51.5). On the other hand, employment rebounded (51.4 vs 48.4), with many companies confirming that they are continuing to manage head counts through a combination of hiring freezes, employee attrition and layoffs. Also, inventories grew faster (51.8 vs 50.9) and price pressures eased (39.4, the lowest reading since April 2020 vs 43). The month-over-month performance of supplier deliveries (45.1 vs 47.2) was the best since March 2009. Only two manufacturing industries reported growth in December: Primary Metals; and Petroleum & Coal Products.

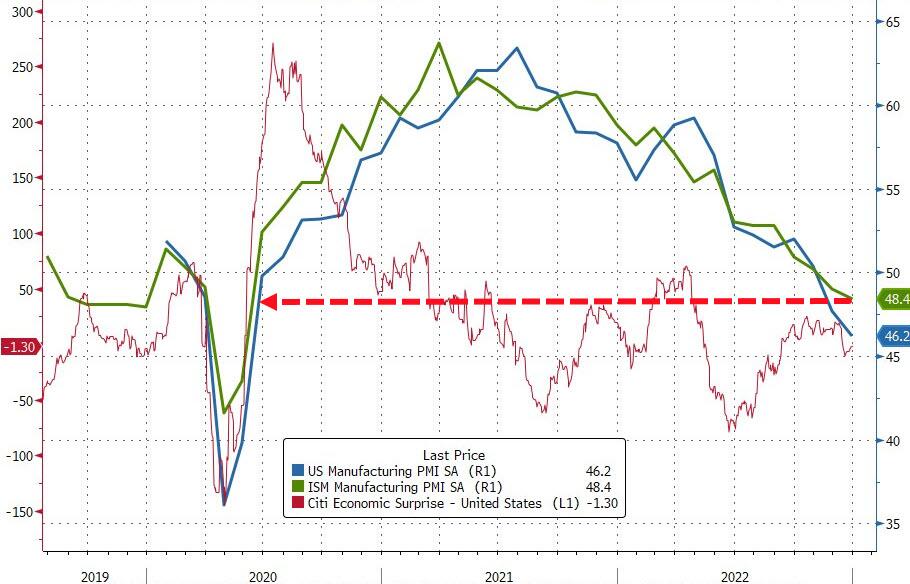

Today's data pointed to the second month of contraction in factory activity and the biggest decline since May of 2020 at the height of the covid pandemic. Source: Bloomberg via ZeroHedge

Today's data pointed to the second month of contraction in factory activity and the biggest decline since May of 2020 at the height of the covid pandemic. Source: Bloomberg via ZeroHedge

Details of the ISM report are rather mixed. Employment subindex moved higher while prices paid and new orders dropped to pandemic lows.Source: Bloomberg via ZeroHedge

Details of the ISM report are rather mixed. Employment subindex moved higher while prices paid and new orders dropped to pandemic lows.Source: Bloomberg via ZeroHedge

JOLTS job openings data for November which was released simultaneously also showed weaker-than-expected reading. The number of job openings in the United States decreased to 10.45 million in November from an upwardly revised 10.51 million in the previous month, still above market expectations of 10.0 million.

Fresh figures were perceived by market as hawkish as EURUSD pair dropped below 1.060 level, while US futures erased majority of premarket gains.

EURUSD pair fell after ISM release and tested support at 1.0600. Source: xStation5

EURUSD pair fell after ISM release and tested support at 1.0600. Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)