Initial jobless claims in the US ticked up to 207k in the final full week of December from 200k before which remain a great result indeed and if anything only proves that the unemployment situation has improved a lot. Continuing claims rose from 1718k to 1754k, much above expectations of 1688k so this is a stain on the report although continuing claims data is quite volatile and often sees significant revisions.

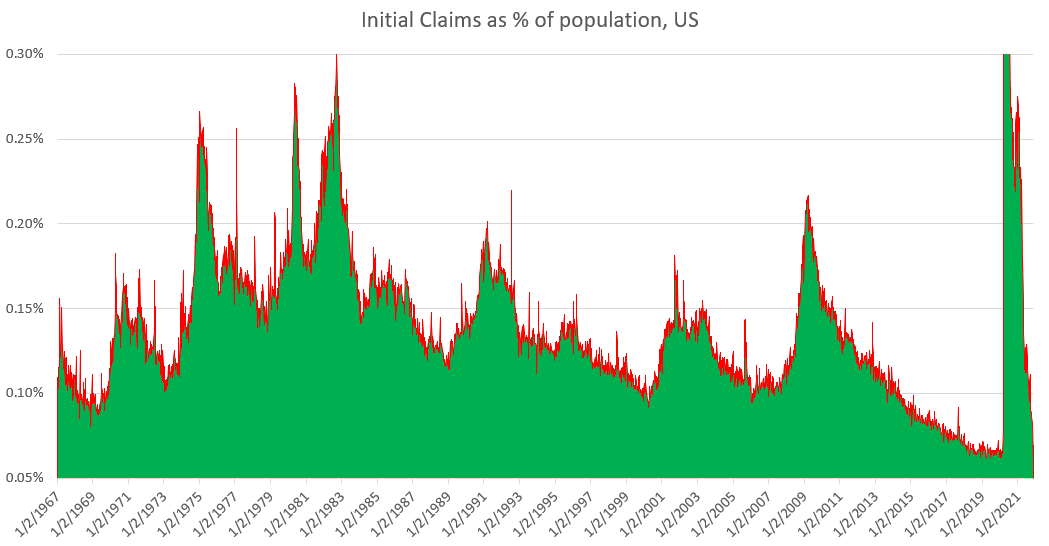

Claims to population ratio of 0.06% has never been lower! Source: Macrobond, XTB Research

Claims to population ratio of 0.06% has never been lower! Source: Macrobond, XTB Research

November trade balance is one of few reports that isn’t backing the greenback really. The deficit ballooned to above $80 billion from $67 billion in October.

Earlier we had flash inflation data from Germany that painted a mixed picture. CPI (domestic basket) increased from 5.2 to 5.3% y/y while HICP (EU basket) declined from 6 to 5.7%. In both cases the print was above expectations (of 5.1 and 5.6% respectively) which underlines that price pressures remain significant.

EURUSD is steady today having recovered from a dip below 1.13 but while the pair has managed to stay within the range it still looks like a flag pattern. This pattern usually leads to trend continuation.

EURUSD is steady today having recovered from a dip below 1.13 but while the pair has managed to stay within the range it still looks like a flag pattern. This pattern usually leads to trend continuation.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)