- US, data pack for April.

-

Core PCE. Actual: 4,7% YoY. Expected: 4.6% YoY. Previous: 4.6% YoY

-

Personal income.Actual: 0,4% MoM. Expected: 0.4% MoM. Previous: 0.3% MoM

-

Personal spending.Actual: 0,8% MoM. Expected: 0.3% MoM. Previous: 0.0% MoM

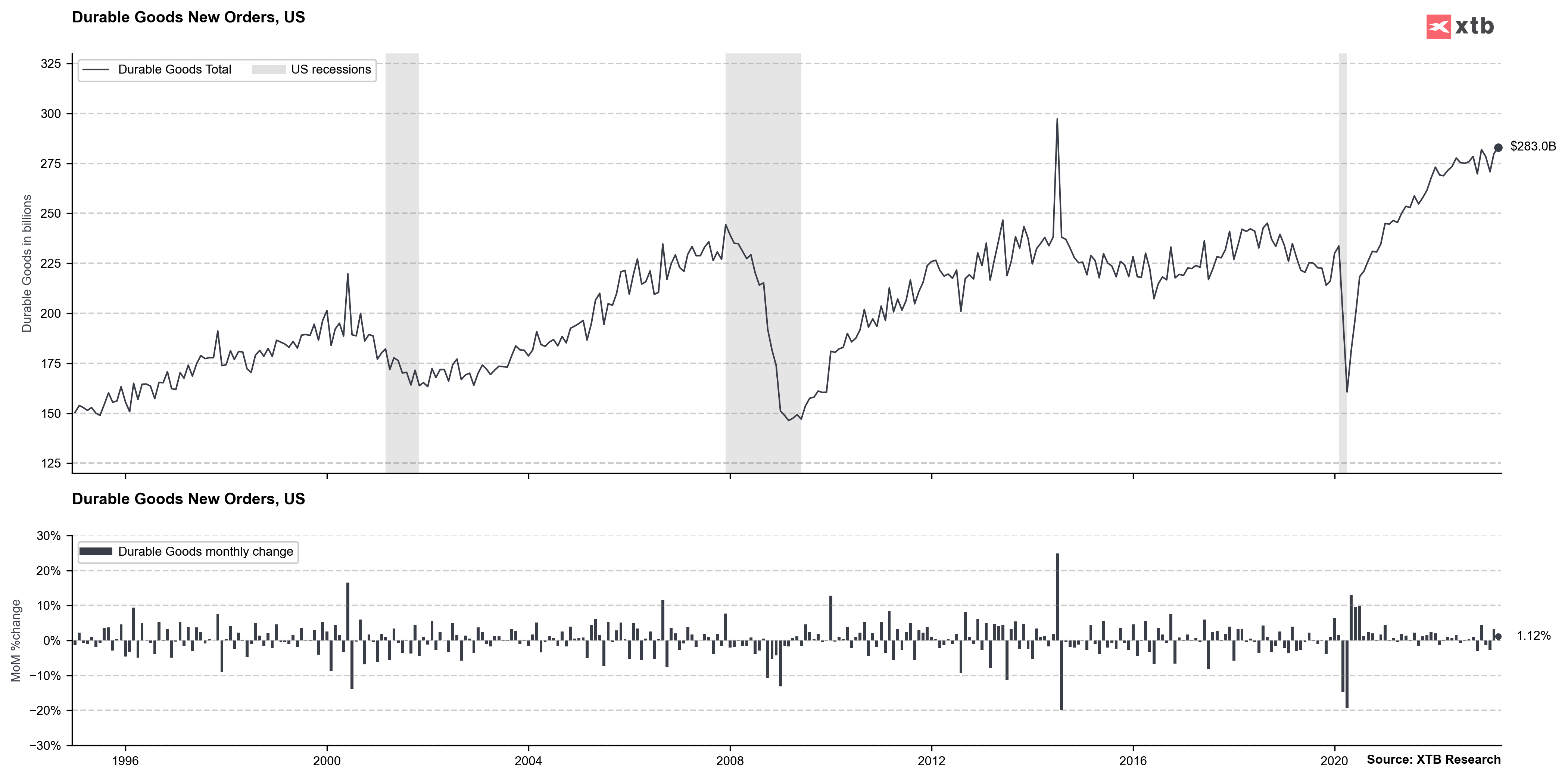

- US, durable goods orders for April

-

Headline. Actual: 1,1% MoM. Expected: -1.0% MoM. Previous: +2.8% MoM

-

Ex-transportation. Actual: -0,2% MoM. Expected: 0.0% MoM. Previous: 0.2% MoM

The US dollar strengthened after the release of the data, putting pressure on EURUSD. The upward surprise in PCE inflation strongly supports further interest rate hikes. Personal income met expectations, while personal spending by Americans surprised with an increase, indicating that there is still strong demand in the economy, which may make it challenging for the Federal Reserve to bring inflation down to its 2% target. Source: xStation 5

The US dollar strengthened after the release of the data, putting pressure on EURUSD. The upward surprise in PCE inflation strongly supports further interest rate hikes. Personal income met expectations, while personal spending by Americans surprised with an increase, indicating that there is still strong demand in the economy, which may make it challenging for the Federal Reserve to bring inflation down to its 2% target. Source: xStation 5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀