The German GDP report for Q4 2022 was released today at 9:00 am GMT. Report turned out to be a disappointment with GDP growth coming in at 0.5% YoY, compared to 0.8% YoY expected. On a quarter-over-quarter basis, German growth dropped 0.2% QoQ (exp. 0.0% QoQ). EUR pulled back following the release while DE30 ticked higher.

EURUSD has been on the rise following the release of the Spanish CPI report for January. Spanish data showed CPI accelerating from 5.7 to 5.8% YoY. While this is a small acceleration, the market expected a slowdown to 4.8% YoY. This may put under question any dovish shift from ECB, especially if CPI data from Germany confirms it tomorrow. Keep in mind that ECB is set to announce its next monetary policy decision this Thursday at 1:15 pm GMT.

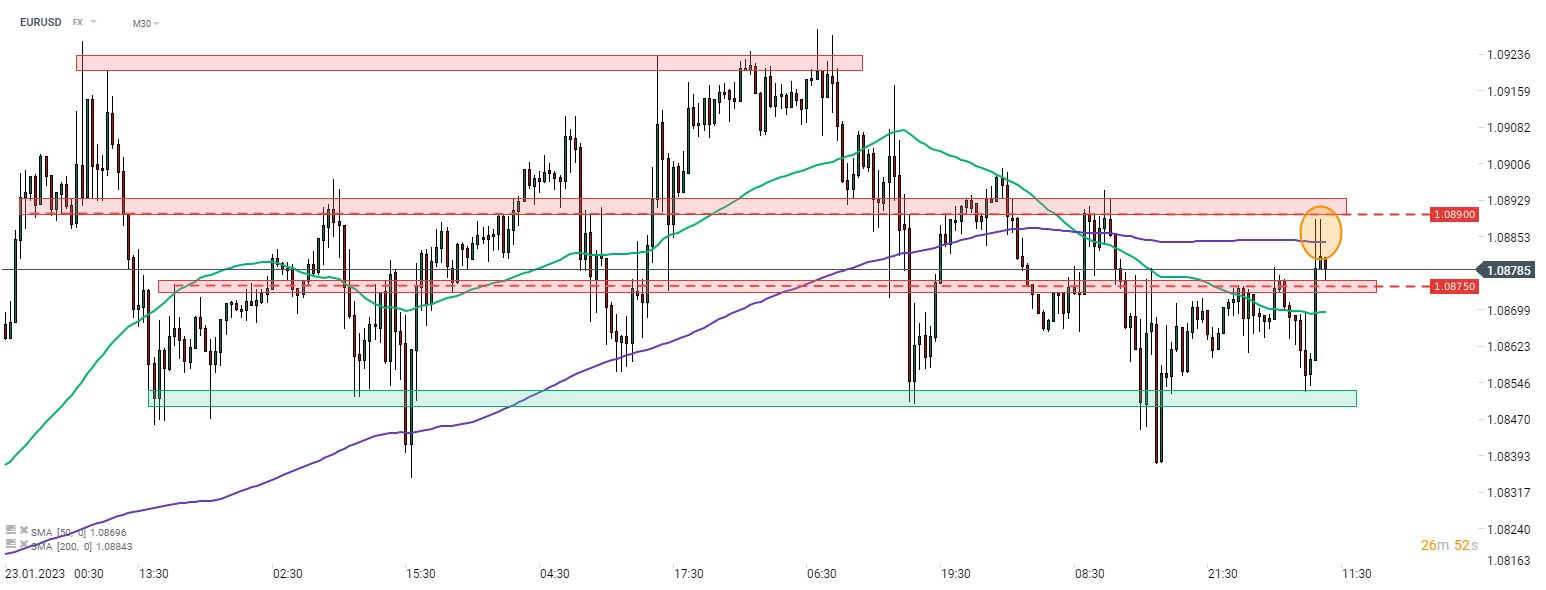

Taking a look at EURUSD chart at 30-minute interval, we can see that the pair has broken above 1.0875 resistance zone following Spanish CPI release and tested 200-period moving average later on (purple line). However, the attempt to break above was a failed one and now EURUSD is looking back towards the aforementioned 1.0875 but this time as a support.

EURUSD at a 30-minute interval. Source: xStation5

EURUSD at a 30-minute interval. Source: xStation5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)