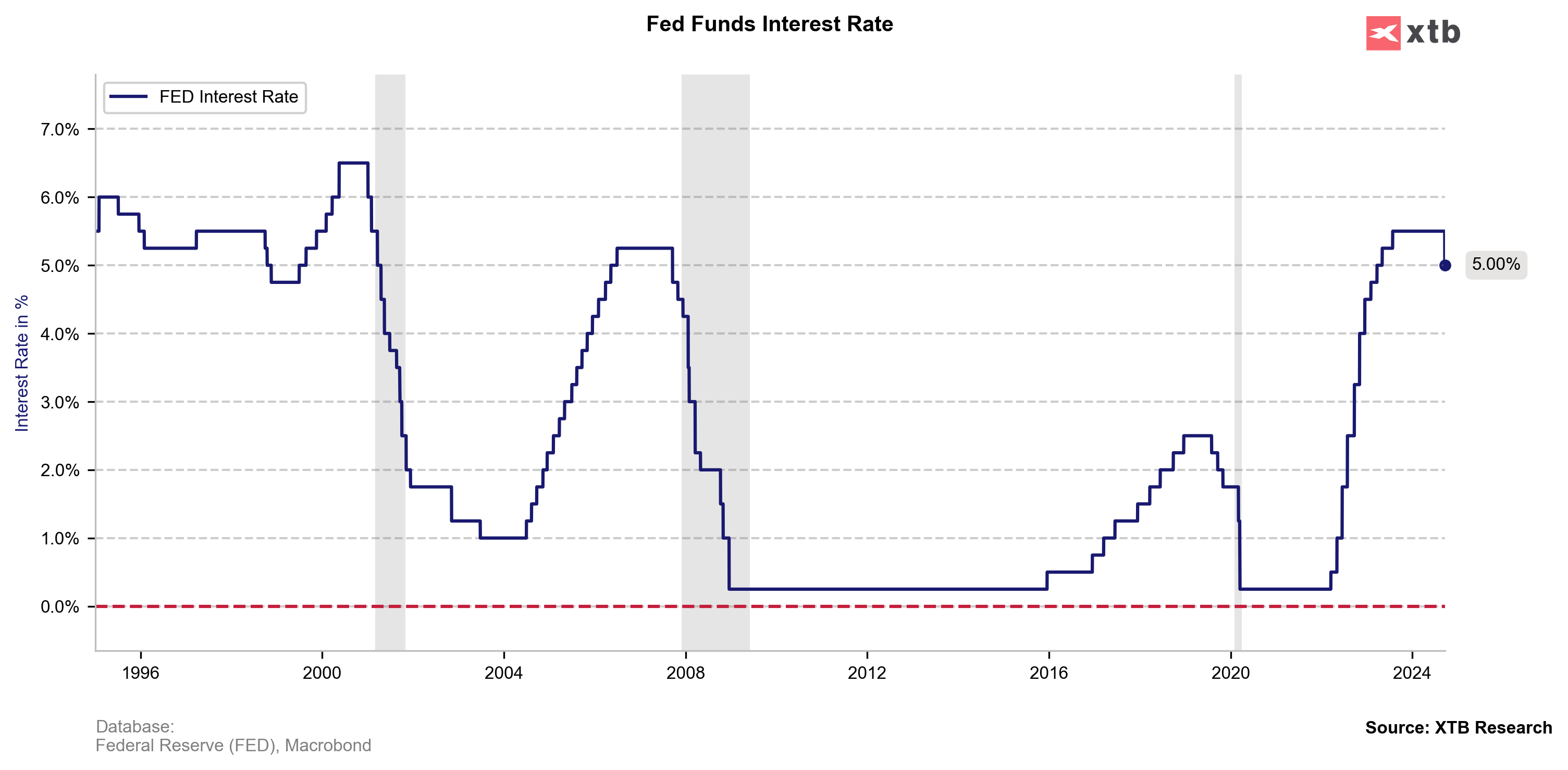

US Federal Reserve decided to cut rates by 50 bps in line with 50 bps highly anticipated on Wall Street; to 5% from 5.5% in August. It's a first rate cut in the US, since 2020, when the Federal Reserve was forced to ease monetary policy, due to Covid-19 recession concerns. Now markets are focusing on Fed dot-plot, economic commentary and Jerome Powell press conference scheduled at 7:30 PM BST.

- Fed sees median interest rates at 4.4% (previously expected 5.1%) at the end of the current year and 3.4% in 2025 (previously exp. 4.1%).

- US central bank sees also 2.9% rates in 2026, and the same in 2027; cuts inflation outlook quite a bit for this year with PCE at 2.3% and core PCE at 2.6%

- The Fed also sees the unemployment rate higher to 4.4% in 2024, while it sees 4.2% thereafter. The Fed sees no collapse in the labor market. GDP projection points to above 2% in 2024, indicating a soft landing scenario.

Futures on Wall Street gains in the first reaction to Fed decision (US100); US-dollar loses, with EURUSD rising almost 0.5% escaping consolidation zone, above 1.117. Markets see today decision as dovish, especially given the last quite solid readings from the US economy. Fed GDP NOW model signals almost 3% GDP rise for US economy in 2024, while inflation is falling driven by lower gasoline prices; markets may see higher odds for a soft landing scenario. In the effect, markets may bet also on quite aggressive Fed rates cycle and 'success story' with beating inflation and rates dropping quickly to neutral levels.

Source: xStation5

Source: xStation5

24 projections now effectively sees 2 more cuts with 5 more in 2025 to just above 3% at the end of 2025 which is almost in line with market expectations. Source: Fed, Macrobond, XTB Research

24 projections now effectively sees 2 more cuts with 5 more in 2025 to just above 3% at the end of 2025 which is almost in line with market expectations. Source: Fed, Macrobond, XTB Research

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes