Fed's Federal Open Market Committee (FOMC) announced its latest monetary policy today at 6:00 pm GMT. FOMC delivered a 25 basis rate hike with Fed Funds target rate being now in 0.25-0.50% range, in-line with market expectations. Median interest rate forecast in dot-plot moved higher and now suggests that Fed members expect an interest rate of 1.9% at the end of 2022 and 2.8% at the end of 2023. December's dot-plot pointed to a median expectations of 0.9%. Fed therefore sees a total of 6 rate hikes this year - in-line with current market pricing.

Initial market reaction was negative for indices with S&P 500 (US500) dropping 0.5% in a knee-jerk move. EURUSD dropped from around 1.0985 to around 1.0950. However, those moves were quickly erased.

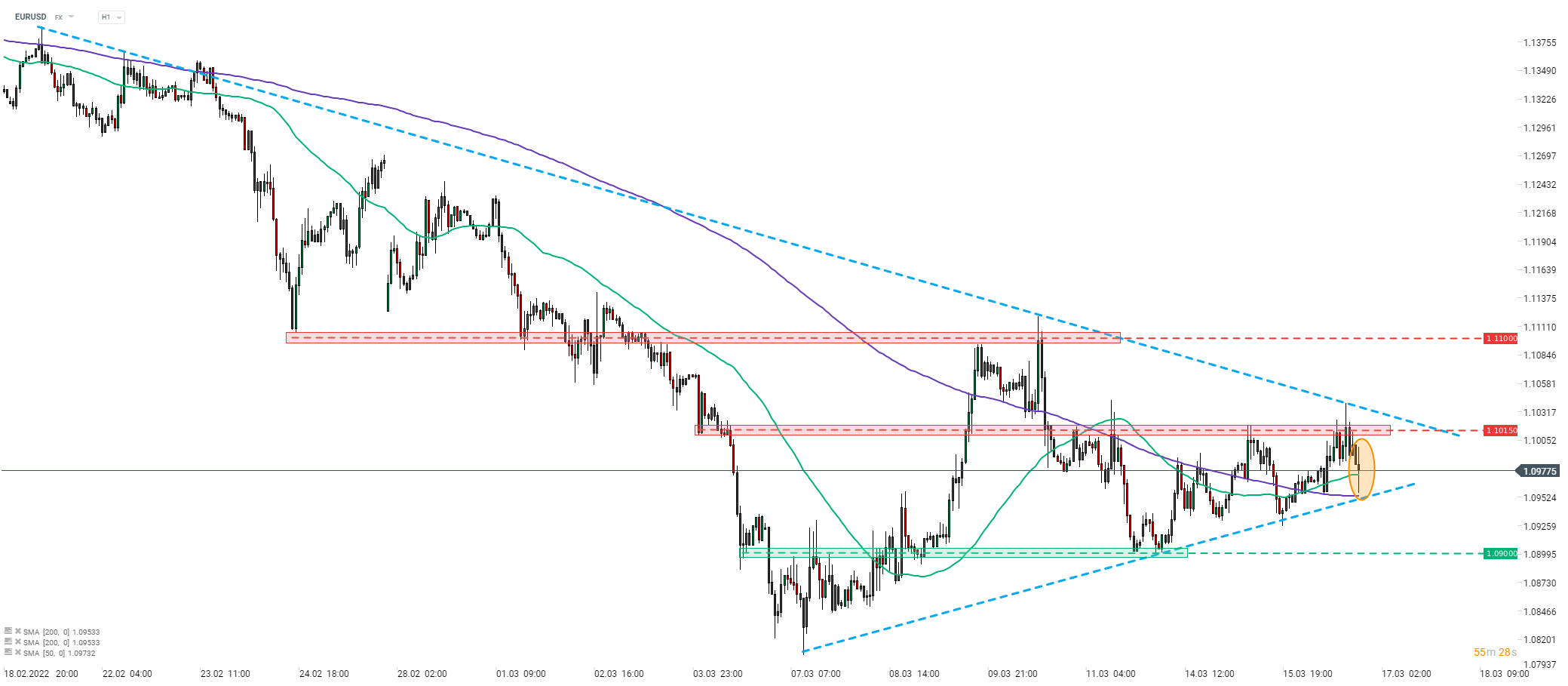

EURUSD dipped in knee-jerk move but has since recovered all of post-decision losses. Source: xStation5

EURUSD dipped in knee-jerk move but has since recovered all of post-decision losses. Source: xStation5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)