UK GDP report for Q3 2023 as well as UK retail sales data for November was released today at 7:00 am GMT. Attention was mostly on retail sales, as GDP data was a revision.

Actual data turned out to be mixed - retail sales data turned out to be much better than expected, snapping a losing streak, while UK GDP report was revised lower. GBP reacted positively showing that traders saw retail sales as a more important reading.

UK GDP report for Q3 2023 (revision)

- Quarterly: -0.1% QoQ vs 0.0% QoQ in first release

- Annual: 0.3% YoY vs 0.6% YoY in first release

UK retail sales for November

- Headline (annual): +0.1% YoY vs -1.4% YoY expected (-2.7% YoY previously)

- Headline (monthly): 1.3% MoM vs 0.4% MoM expected (-0.3% MoM previously)

- Core (annual): 0.3% YoY vs -1.4% YoY expected (-2.4% YoY previously)

- Core (monthly): 1.3% MoM vs 0.3% MoM expected (-0.1% MoM previously)

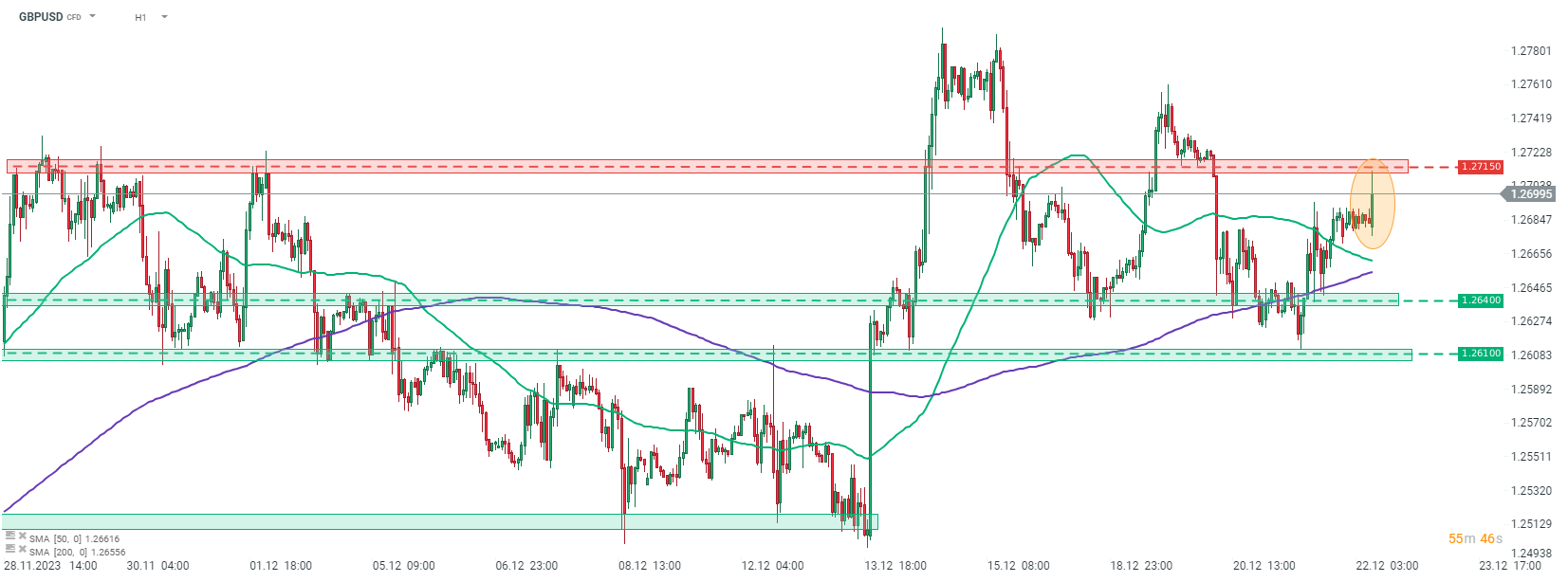

GBPUSD gained following release of mixed UK data and tested 1.2715 resistance zone. Source: xStation5

GBPUSD gained following release of mixed UK data and tested 1.2715 resistance zone. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)