UK retail sales data for May wsa released this morning at 7:00 am BST. Report was expected to show monthly increases in headline and core retail sales, as well as smaller year-over-year declines.

Actual data turned out to be a big positive surprise, with monthly headline and core retail sales rising much more than expected. Moreover, both headline and core measures showed unexpected increases on an annual basis.

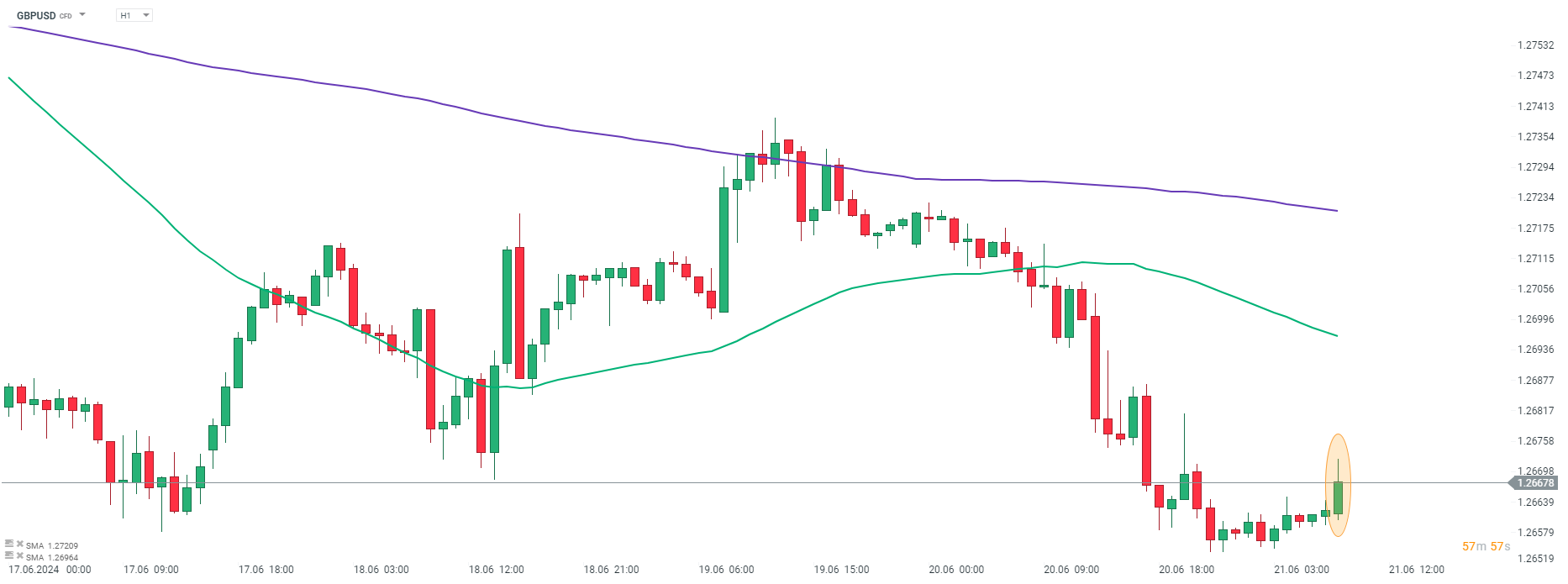

GBP jumped following the release, although part of a knee-jerk move has been erased already. GBPUSD jumped around 0.1% and reached a daily high near 1.2672.

UK, retail sales for May

- Headline (annual): +1.3% YoY vs -0.9% YoY expected (-2.7% YoY previously)

- Headline (monthly): +2.9% MoM vs +1.4% MoM expected (-2.3% MoM previously)

- Core (annual): +1.2% YoY vs -0.7% YoY expected (-3.0% YoY previously)

- Core (monthly): +2.9% MoM vs +1.8% MoM expected (-2.0% MoM previously)

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report