The Bank of England announced a monetary policy decision at 12:00 pm GMT. Decision was closely watched as economists were split on whether the bank will deliver a 15 basis point rate hike or leave rates unchanged. Derivative markets were pricing in higher rates at today's meeting. Actual decision showed that the market was wrong - Bank of England left main rate unchanged at 0.1%. Decision was not unanimous and came with a 7-2 split among Monetary Policy Committee members. Votes were split 6-3 when it came to leaving QE purchases unchanged at 875 billion GBP. However, the Bank said in a statement that rates will need to rise in the coming months in order to meet targets.

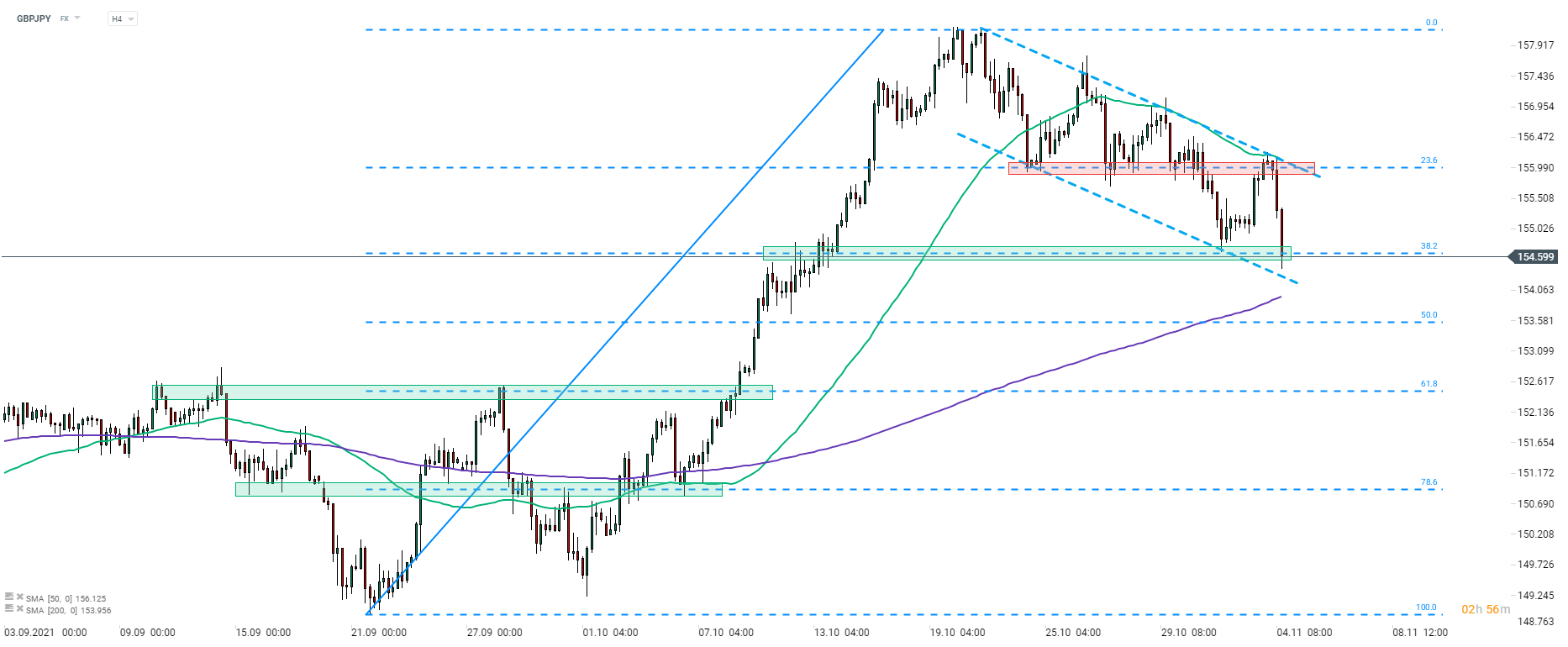

British pound plunged on the announcement with GBPUSD dropping below 1.3600 mark. GBPJPY deepened today's drop and reached the lower level in almost a month. The pair managed to bounce off the lows and is now trying to climb back above the support marked with 38.2% retracement of the upward impulse launched in late-September.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)