The Bank of England announced a monetary policy decision today at 12:00 pm BST. Bank delivered a 50 basis point rate hike - in-line with market and economists' expectations. This was the biggest BoE rate hike in 27 years! Decision was not unanimous with 1 out of 9 BoE members dissenting. That member opted for a 25 basis point rate move. BoE said that it plans to wind down its massive balance sheet at the pace of 10 billion GBP per quarter starting after September meeting (vote will be held on bond reductions in September). However, one seems to be the biggest takeaway from the statement is that Bank of England expects UK economy to enter recession in the fourth quarter of 2022 and forecasts that it will last 5 quarters.

GBPUSD jumped in a knee-jerk move following decision announcement but erased gains later on under pressure from recession remarks.

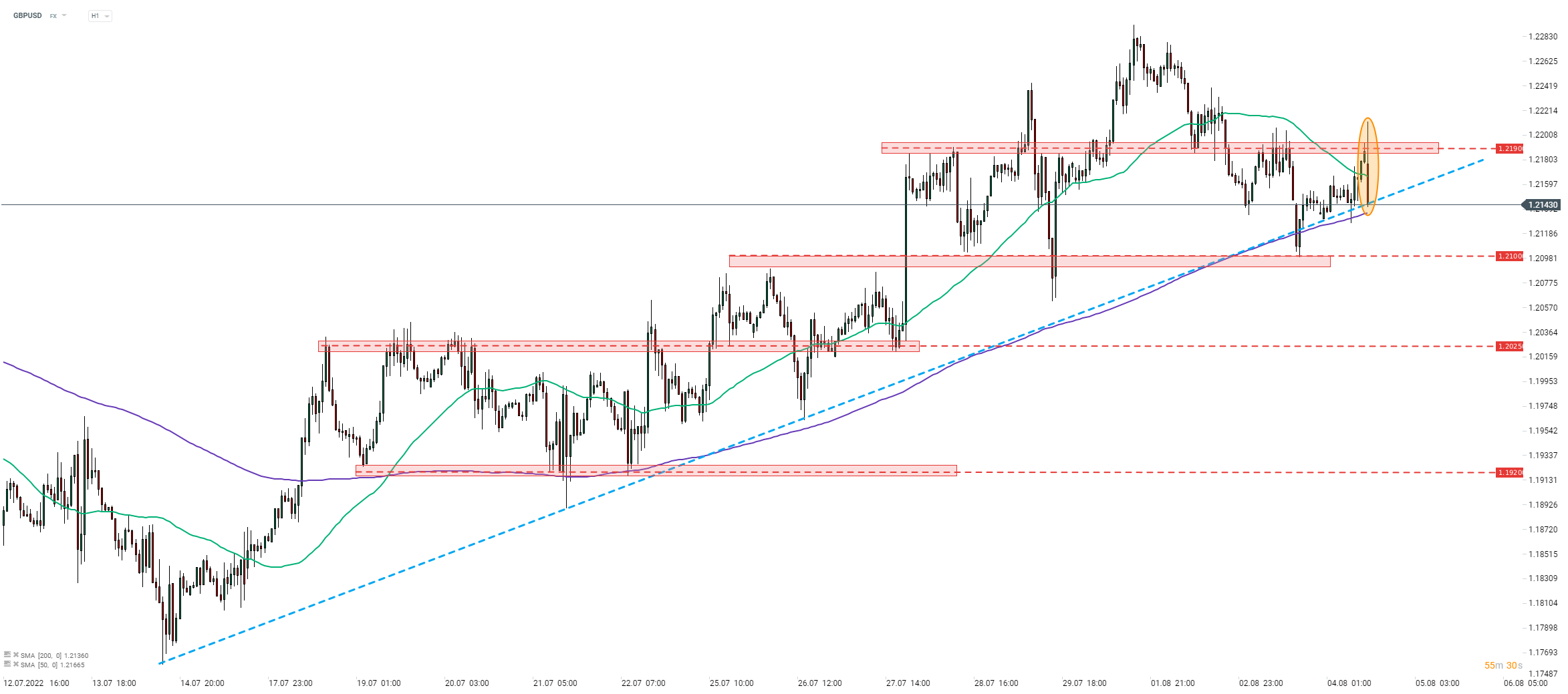

GBPUSD jumped in knee-jerk move but erased gains later on and is now testing short-term upward trendline. Source: xStation5

GBPUSD jumped in knee-jerk move but erased gains later on and is now testing short-term upward trendline. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts