Flash PMI indices for May from France and Germany were released at 8:15 am BST and 8:30 am BST, respectively, this morning. Data release came after PMIs from Australia and Japan showed a deteriorating situation in the manufacturing sector in May. The same was expected from European releases. While this was the case for French release, German manufacturing reading not only beat expectations but also managed to improve compared to previous month. Nevertheless, both French and German data missed services expectations. This reflects current state of the global economy quite well - while services are no longer constrained by the pandemic restrictions, supply chain issues continue to negatively impact manufacturing. However, we should remember that both French and German PMIs remain in expansion territory.

France

-

Manufacturing: 54.5 vs 55.1 expected (55.7 previously)

-

Services: 58.4 vs 58.7 expected (58.9 previously)

Germany

-

Manufacturing: 54.7 vs 54.0 expected (54.6 previously)

-

Services: 56.3 vs 57.2 expected (57.6 previously)

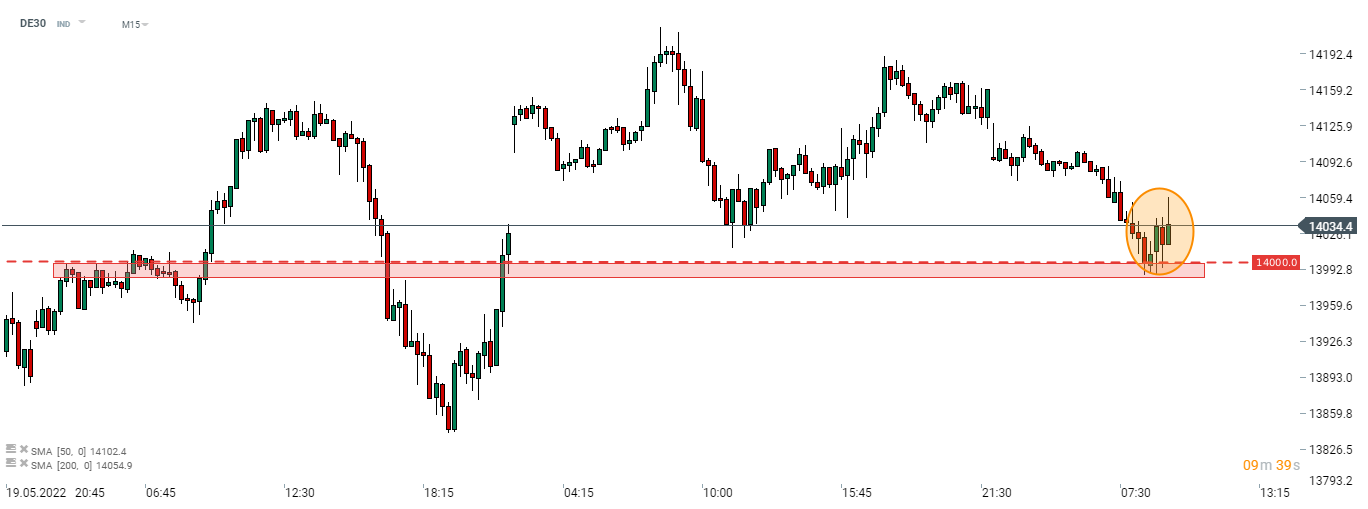

While French PMIs missed expectations, the scale of this miss was small and therefore no major market reaction could be spotted in the aftermath. Indices and EUR moved just slightly lower but common currency quickly resumed upward move. DE30 recovered some ground following German data release that showed a manufacturing beat.

DE30 tries to hold above 14,000 pts this morning. Source: xStation5

DE30 tries to hold above 14,000 pts this morning. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)