James Bullard, President of St. Louis Fed, hit a hawkish tone during a speech today and triggered noticeable moves on gold and USD markets. Bullard confirmed that his dot on the latest dot plot pointed to rate lift-off in late 2022, earlier than median. He said that the Fed should be ready to make policy adjustments in order to push inflation back towards the goal and that he is worried that the US central bank is aiding the already hot housing market. Bullard also said that recent inflation has been "more intense than expected" and that there is upside risk to inflation forecasts. His comments on taper debate were somewhat puzzling as he said that debate will continue during the coming meetings but at the same time he said that organizing taper debate will take several meetings.

Gold dropped over $10 per ounce on the back of his comments while EURUSD dipped towards 1.1870. Bullard's comments spooked markets as he has been a rather dovish Fed member as of late. His hawkish U-turn signals that Fed officials are becoming increasingly aware of the negative impact of keeping loose policy for a prolonged period of time.

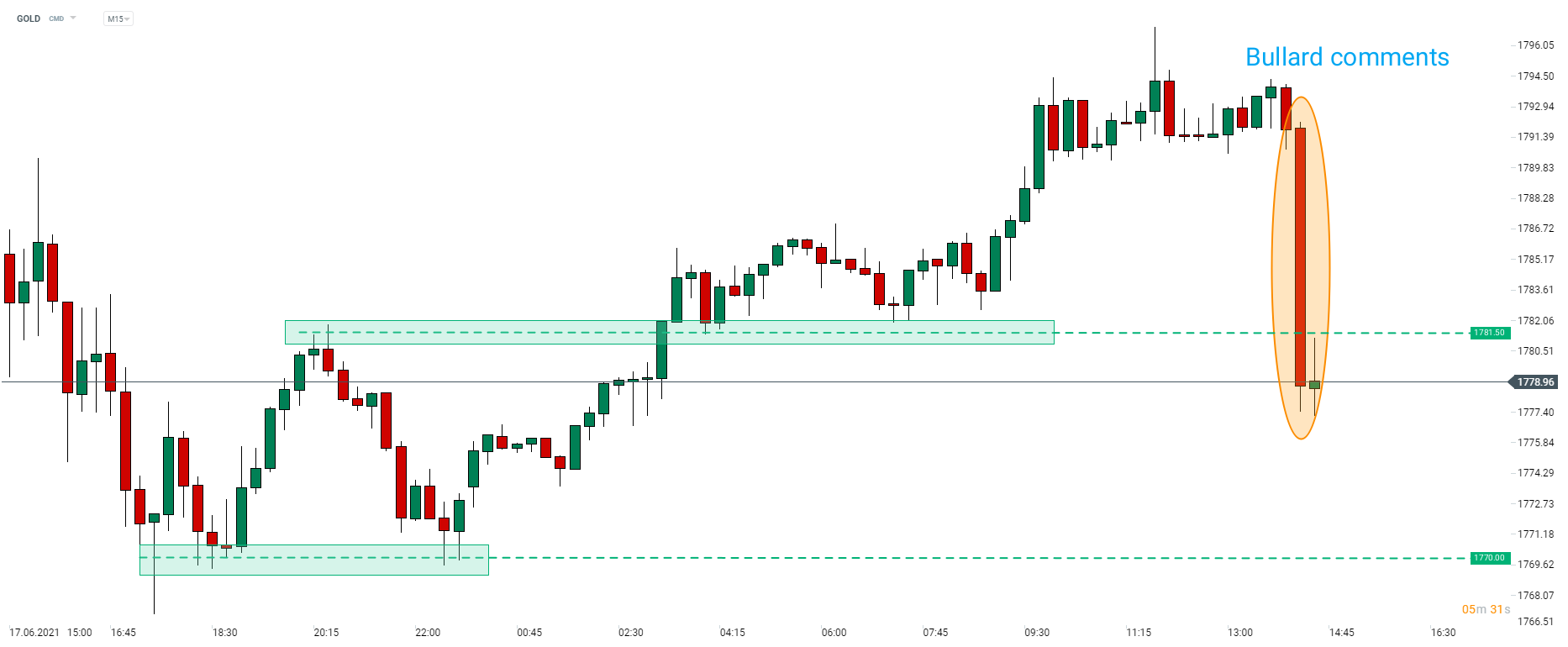

Gold dropped around $10 per ounce following a hawkish U-turn from Fed's Bullard. Precious metal erased the majority of today's gains. Source: xStation5

Gold dropped around $10 per ounce following a hawkish U-turn from Fed's Bullard. Precious metal erased the majority of today's gains. Source: xStation5

📈US100 bounces back above the 100-day EMA

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Economic Calendar: Quiet Tuesday Highlights Geopolitics and Weekly Oil Stocks (10.03.2026)

Morning wrap (10.03.2026)