- USA, PMI index for the manufacturing sector in May (final). Currently: 48.4. Initial publication: 48.5.

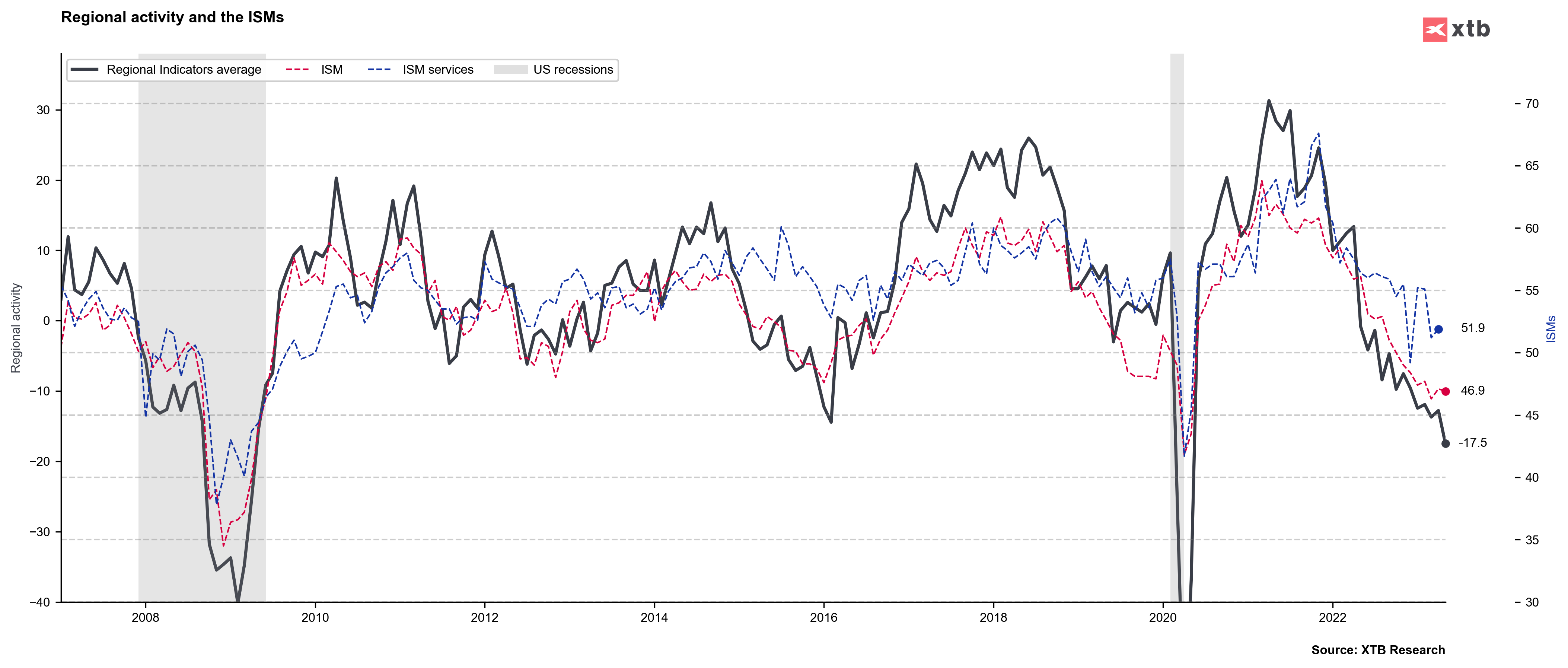

- USA, ISM index for the manufacturing sector in May. Currently: 46.9. Expected: 47.0. Previous: 47.1.

- Price Paid Index. Currently: 44.2. Forecast: 52.0.

- USA, Construction Spending for April. Currently: 1.2% m/m. Expectations: 0.1% m/m. Previous: 0.3% m/m.

The PMI data performed slightly worse than expected, with a decline in manufacturing sector conditions due to weakening demand, according to S&P Global. New orders are decreasing, but production is supported by a further decline in backlogs. Additionally, raw material costs have decreased for the first time in three years.

The report also provides valuable insights for future FOMC decisions. Manufacturers have experienced a rapid shift in buyer power, transitioning from sellers to buyers over the past year, resulting in significant easing of price pressures in the industrial sector. This information reduces inflationary pressure, which may increase the likelihood of keeping interest rates unchanged at the next Federal Reserve meeting.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report