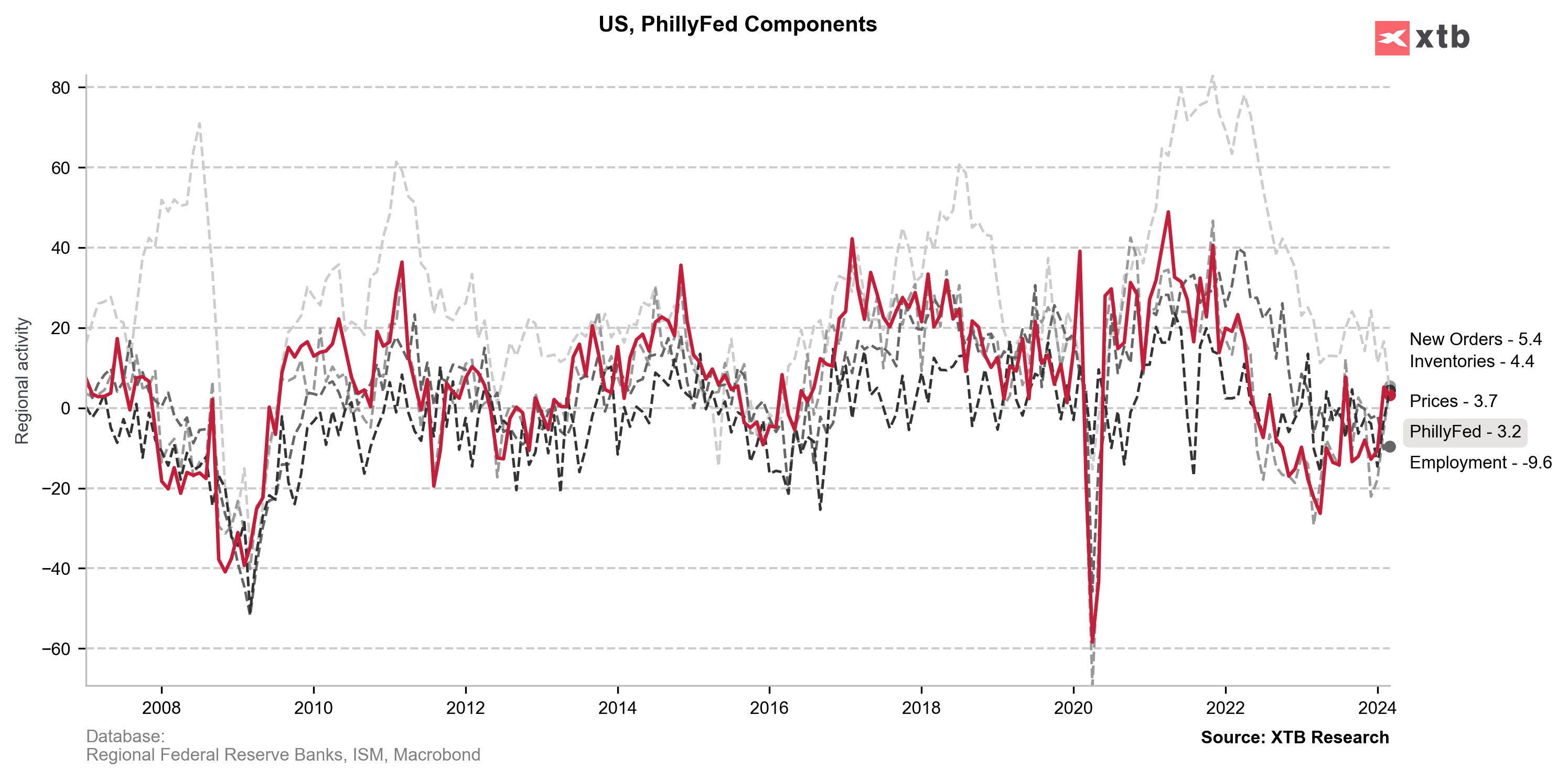

12:30 PM GMT, United States - Philadelphia Fed Manufacturing Index for March:

- actual 3.2; forecast -2.6; previous 5.2;

- Prices: actual 3.70; previous 16.60;

- New Orders: actual 5.4; previous -5.2;

- Employment: actual -9.6; previous -10.3;

12:30 PM GMT, United States - Employment Data:

- Continuing Jobless Claims: actual 1,807K; previous 1,803K;

- Jobless Claims 4-Week Avg.: actual 211.25K; previous 208.75K;

- Initial Jobless Claims: actual 210K; forecast 212K; previous 212K;

The March 2024 Manufacturing Business Outlook Survey, collected from March 11 to March 18, indicates that manufacturing activity in the region is continuing to expand, albeit at a somewhat muted pace compared to long-run averages. The survey revealed a slight decrease in the general activity index, but it remains positive, indicating ongoing growth. New orders have turned positive for the first time since October, and shipments are seeing a modest increase, reaching their highest level since August 2022. However, the employment index persists in negative territory, suggesting a continued decline in employment levels, with a larger proportion of firms reporting decreases in employment compared to those reporting increases. Additionally, both price indexes have declined and are sitting below their historical averages. The future activity indicators have risen, pointing to a more widespread expectation of growth over the next six months.

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)