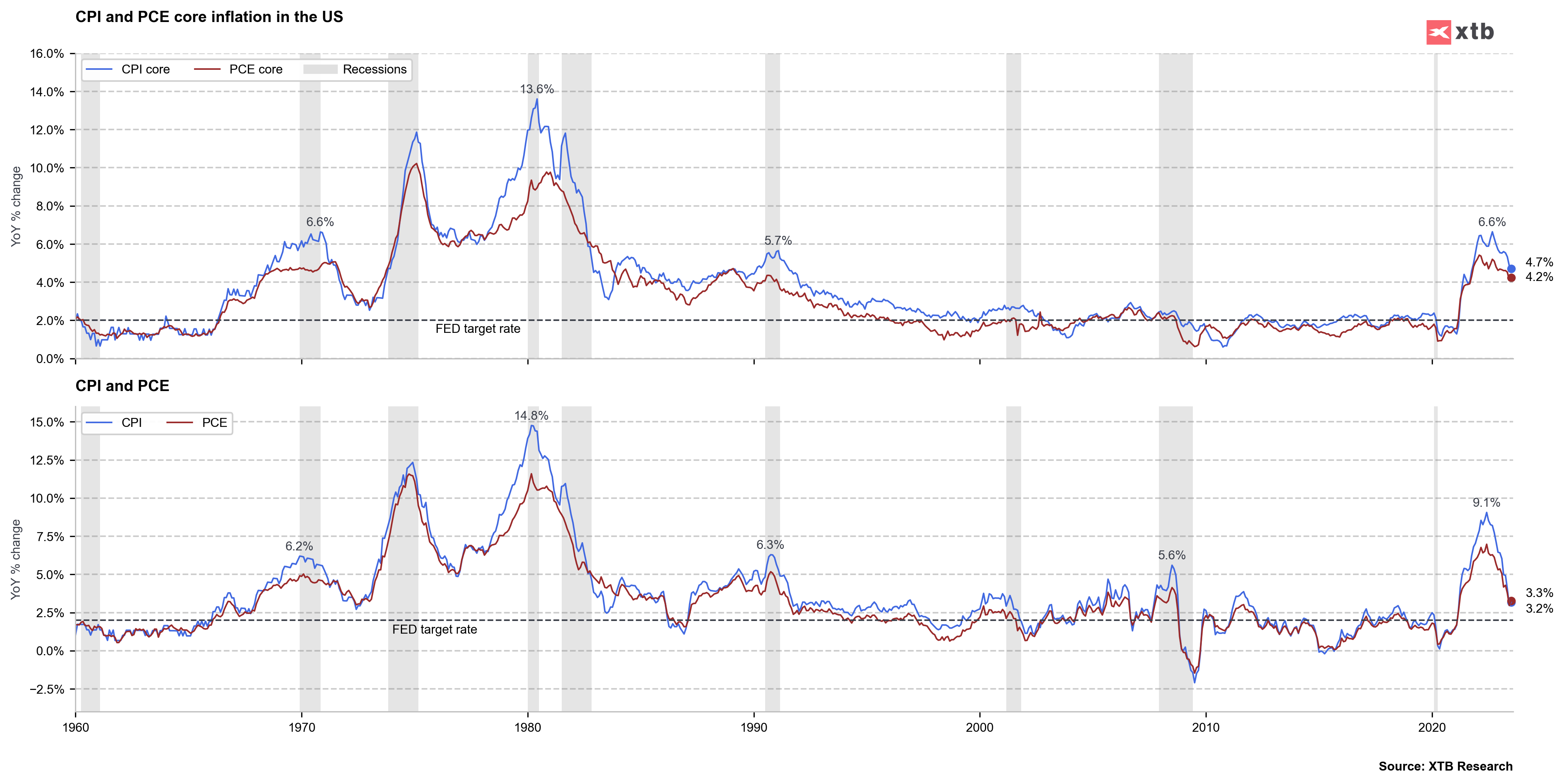

US Core PCE Price index y/y: 4,2% exp. 4,2% vs 4,1% previously

US PCE Price index: 3,3% exp. 3,3% vs 3% previously

US PCE Price index m/m: 0,2% exp. 0,2% vs 0,2 previously

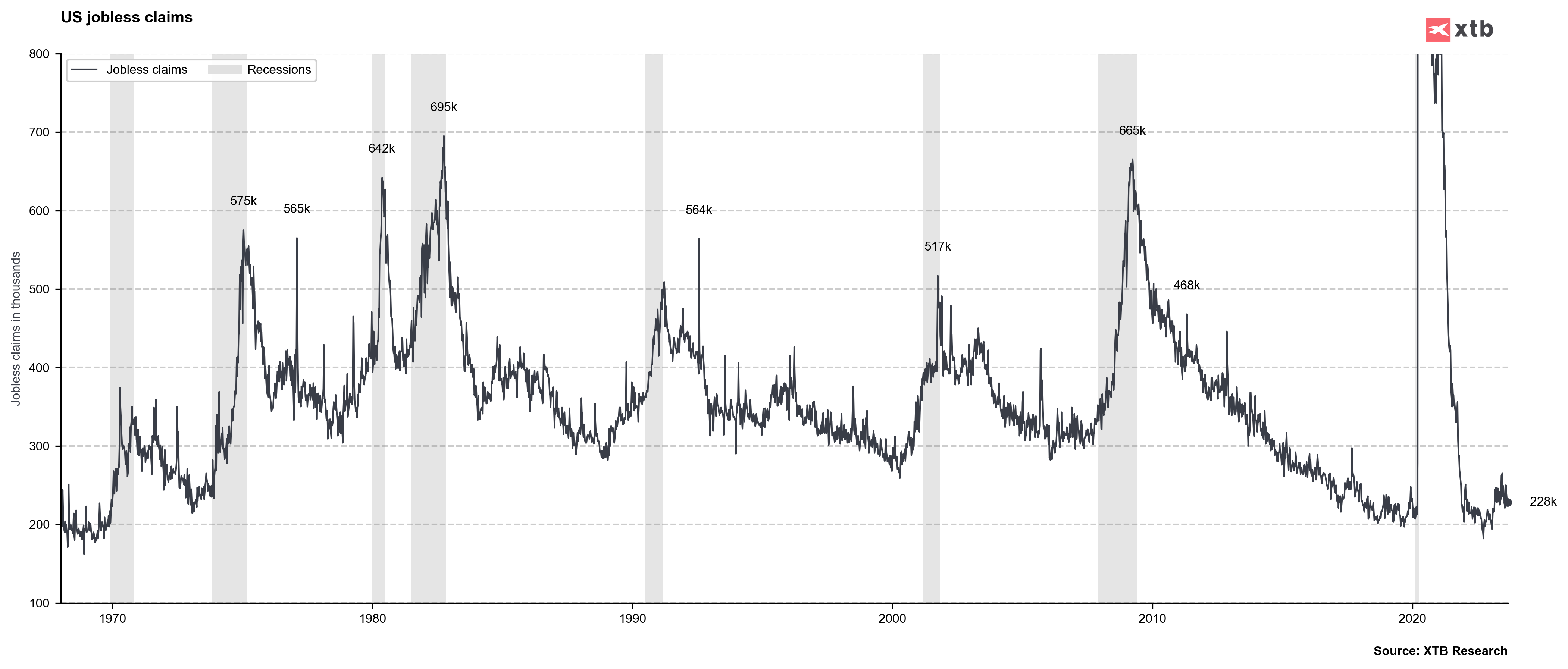

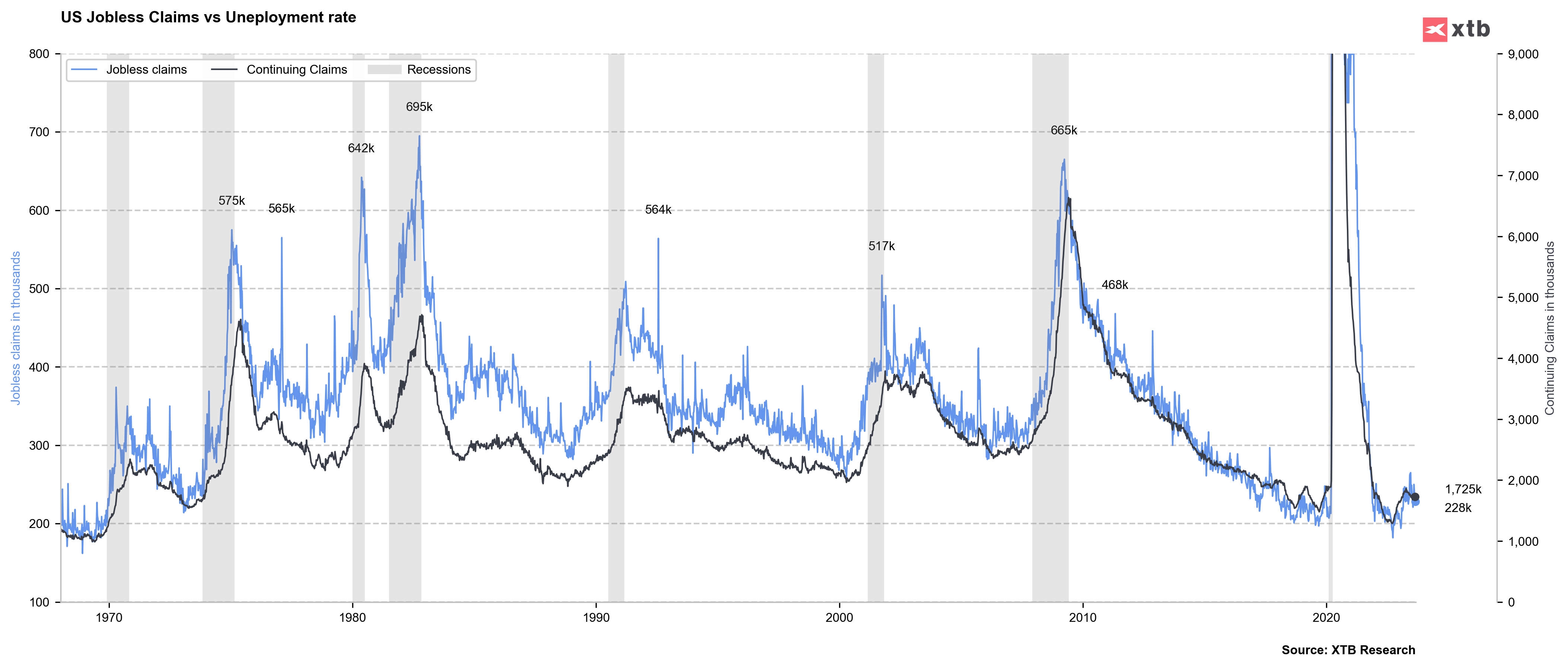

US Initial jobless claims: 228k exp. 235 k vs 230 k previously

US Continued jobless claims: 1,725 mln exp. 1,706 mln vs 1,702 mln previously

US Personal income m/m: 0,2% exp. 0,3% vs 0,3% previously

US Personal consumer spending m/m: 0,8% exp. 0,7% vs 0,5% previously

US Real Personal Consumption m/m: 0,6% exp. 0,5% vs 0,4% previously

In first reaction after new US data US500 falls down slightly but reading was quite good for the stock market. Lower claims signalize that job market is still strong and important for Fed PCE data came in line with Wall Street expectations (July PCE inflation was higher than in June due to underlying y/y factors). At the same time real US personal consumption is slighlty higer than expected and faster than before (0,6% vs 0,4% previously). It's worth noting that Challenger report (layoffs) today came in 75,151 reading vs 23,697 expected. Tomorrow's US Non-farm payrolls (NFP) report will be the most important reading this week.

Source: xStation5

Source: xStation5

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Source: XTB Research

Economic calendar: Key U.S. data to shift focus from geopolitics (22.01.2026)

Market Wrap: Wall Street and Europe lose ground; markets await Trump in Davos🛣️

What next for interest rates in the UK❓ Tobacco and airfare drive up prices in the economy 📈

Economic calendar: Trump’s speech in Davos and Wall Street earnings 🔎