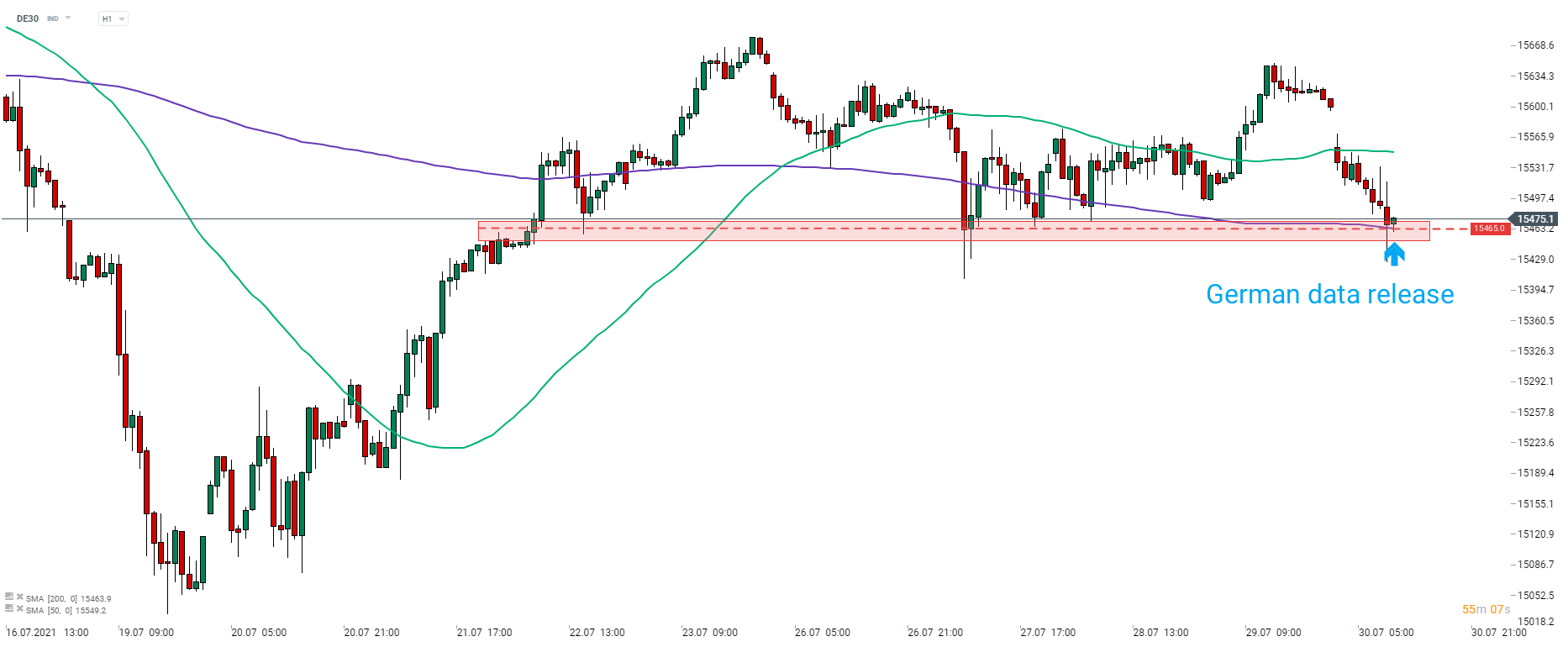

German Q2 GDP data release at 9:00 am BST was a key event of the European session. Report turned out to be a disappointment with growth reaching 1.5% QoQ while the market expected 2% QoQ. On annual terms GDP growth reached 9.6% YoY (not seasonally adjusted), in-line with expectations. This is interesting as readings from other EU member countries showed beats and significant ones in most cases. Nevertheless, the market does not seem to be too concerned by a big miss in German data as there was barely any reaction on EUR or stock markets.

Data from other EU member countries

-

France - 0.9% QoQ (exp. 0.8% QoQ)

-

Spain - 2.8% QoQ (exp. 2.1% QoQ)

-

Italy - 2.7% QoQ (exp. 1.3% QoQ)

DE30 barely saw any reaction to big miss in German GDP data. Index continues to trade near 200-hour moving average. Source: xStation5

DE30 barely saw any reaction to big miss in German GDP data. Index continues to trade near 200-hour moving average. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS