01:30 PM GMT, United States - Employment Data for February:

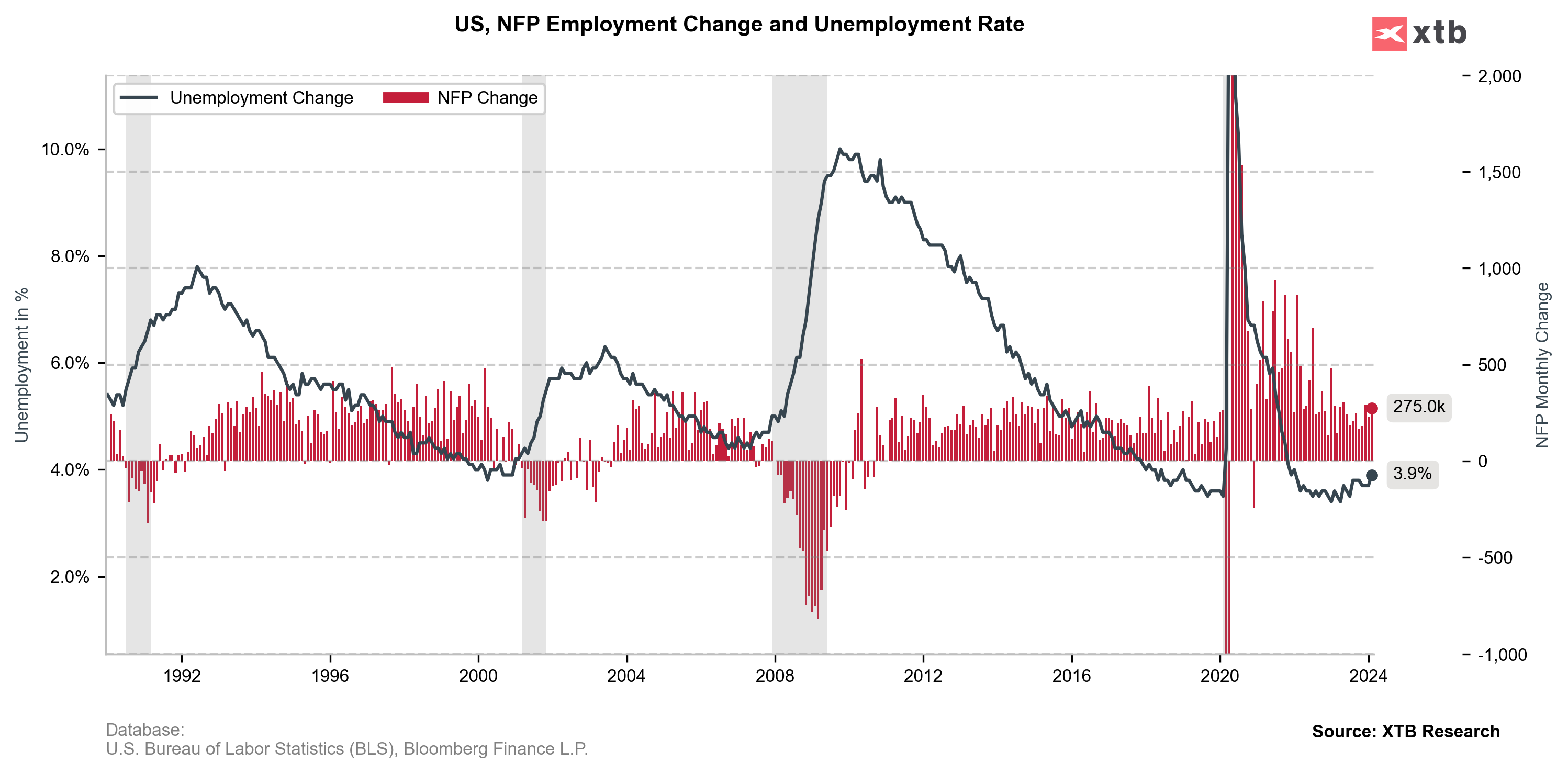

- Nonfarm Payrolls: actual 275K; forecast 198K; previous 229K;

- Private Nonfarm Payrolls: actual 223K; forecast 160K; previous 177K;

- Unemployment Rate: actual 3.9%; forecast 3.7%; previous 3.7%;

- Participation Rate: actual 62.5%; previous 62.5%;

- Average Hourly Earnings: actual 4.3% YoY; forecast 4.4% YoY; previous 4.4% YoY;

- US short-term interest-rate futures rise after jobs report.

- Traders still see a June start to fed rate cuts after job report, with about 30% chance of starting May 1st.

Good data, clearly above expectations, but a lot of revisions visible. Plus lower wage growth, which weakens the dollar. The unemployment rate up, although it is worth remembering that this comes from the household survey, which may reflect the current situation a little better. The sheer number of employed people is falling, but the number of full-time jobs is rising, as many people are working 2 or even more jobs.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)