Norges Bank - the Bank of Norway unexpectedly raised interest rates by 25 basis points.

- Current interest rate level: 4.50%; expected 4.25%; previously 4.25%

Norges Bank decided to raise the policy rate from 4.25% to 4.5% to address persistently high inflation and balance economic risks. Despite observing a cooling economy, inflation remains significantly above the 2% target, driven by increased business costs, prospects of continued high wage growth, and further depreciation of the krone, which contributes to sustained inflation. The current high employment and low unemployment also factor into this decision. The policy rate is expected to stay at 4.5% until autumn 2024 before gradually decreasing, depending on future economic developments.

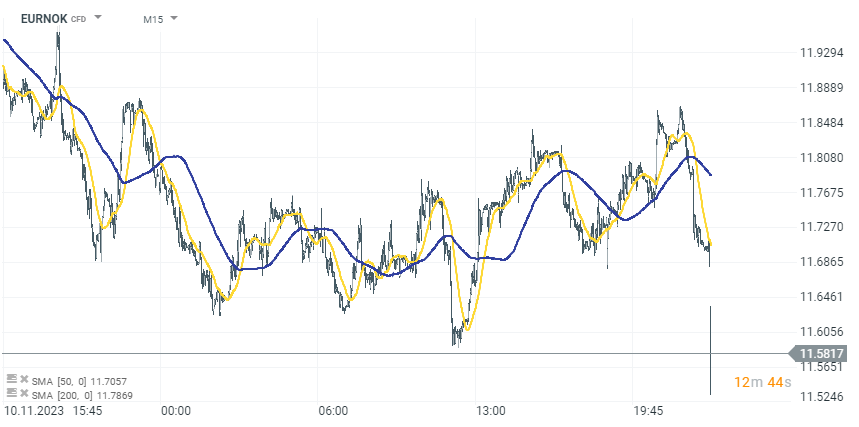

The unexpected interest rate hike caused a sharp strengthening of the Norwegian krone. EURNOK has already lost over 1.1% following the decision, and the exchange rate has not returned to levels before the announcement.

source: xStation 5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)