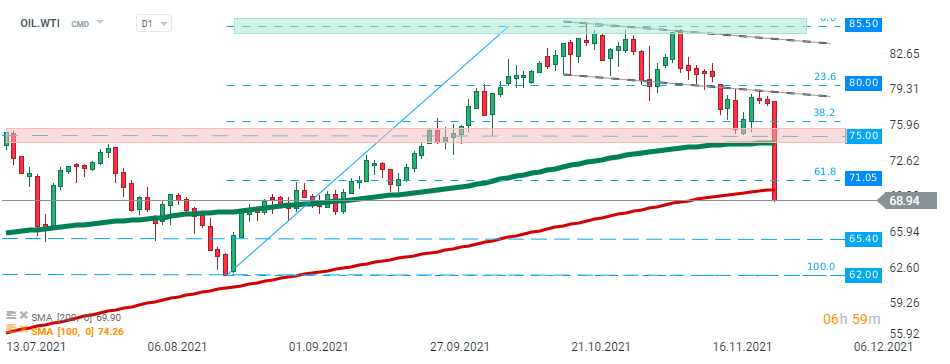

WTI crude tumbles more than 12% below $70 per barrel, the lowest level since September as new coronavirus strain triggered concerns regarding potential travel restrictions and lockdowns which would dampened demand. The UK already implemented a temporary ban on flights from several countries in southern Africa and other nations could take the same actions. Oil markets were already under pressure amid concerns about a wider global oil market surplus in the first quarter of 2022 following the announcement of a coordinated release of crude reserves among major consumers earlier in the week. OPEC predicts a 400k barrels per day excess in the oil markets in December and expects that the surplus will increase to 2.3 million bdp in January and 3.7 million bdp in February if consumer nations proceed with the release.

WTI crude (OIL.WTI) price broke below the psychological $70.00 level during today's session and is currently testing 200 SMA (red line). If current sentiment prevails downward move may accelerate towards support at $65.40 which is marked with previous price reactions. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

US Raises Tariffs to 15%