US, data package for November.

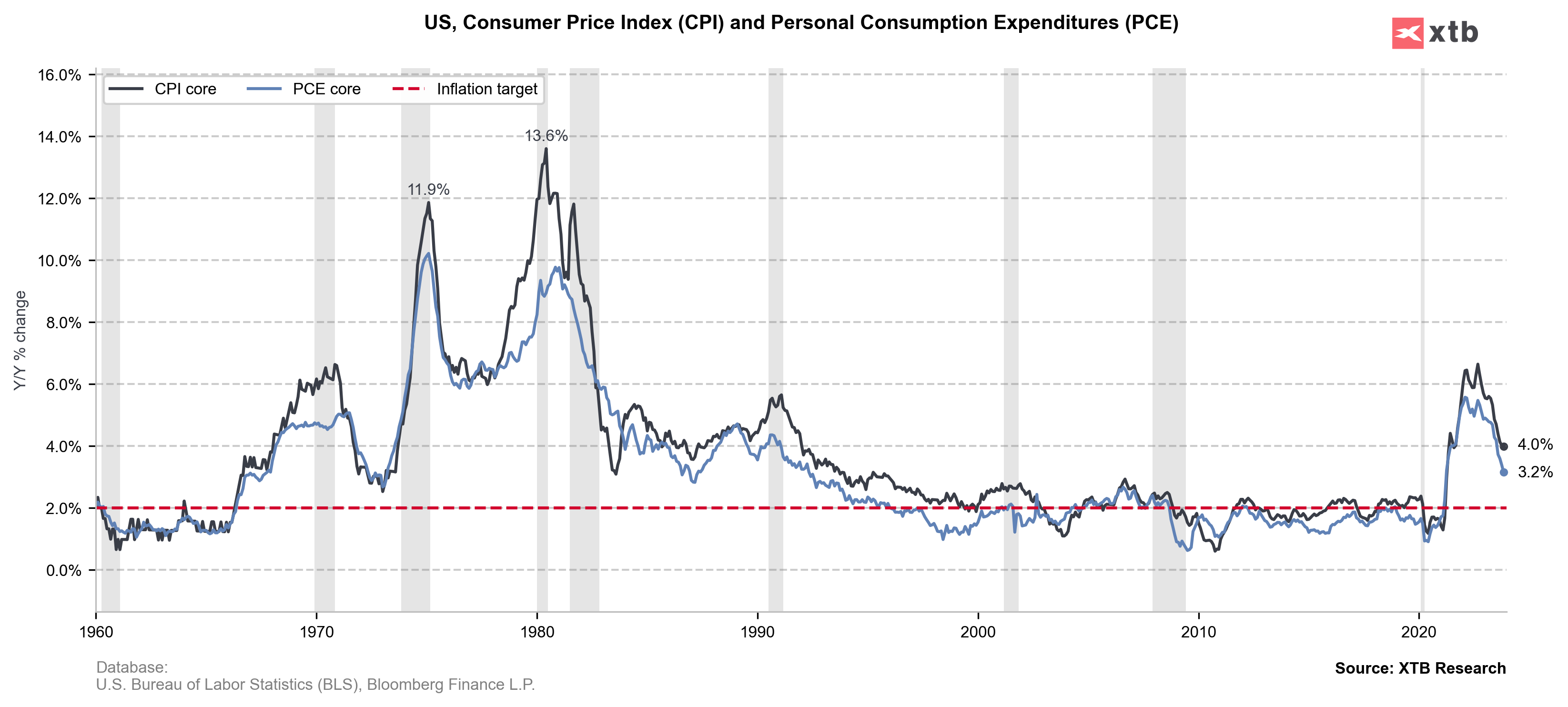

- PCE inflation. Currently: 2.6% y/y. Expected: 2.8% y/y. Previous: 3.0% y/y

- Core PCE inflation. Current: 3.2% y/y. Expected: 3.4% y/y. Previous: 3.5% y/y

- Personal income. Current: 0.4% m/m. Expected: 0.4% m/m. Previous: 0.2% m/m

- Personal spending. Current: 0.3% m/m. Expected: 0.3% m/m. Previous publication: 0.2% m/m

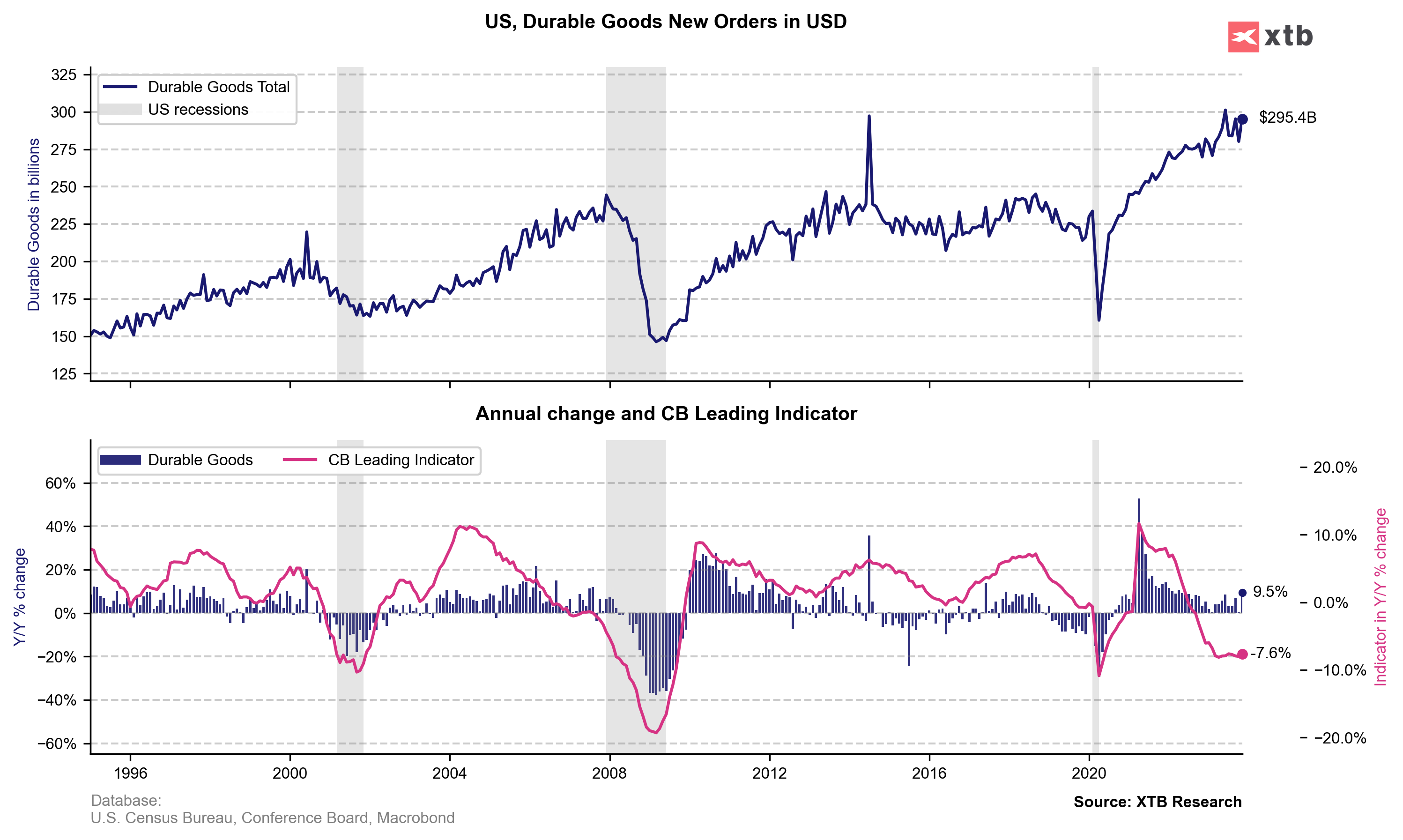

US, durable goods orders for November.

- Main. Currently: 5.4% m/m. Expectations: 2.3% m/m. Previous: -5.4% m/m

- Excluding transportation. Current: 0.5% m/m . Expectations: 0.2% m/m. Previous: 0.0% m/m

In response to the data, the dollar index strengthened dynamically. The move, however, was temporary, and after a few minutes USDIDX returned to the vicinity of pre-release levels.

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀