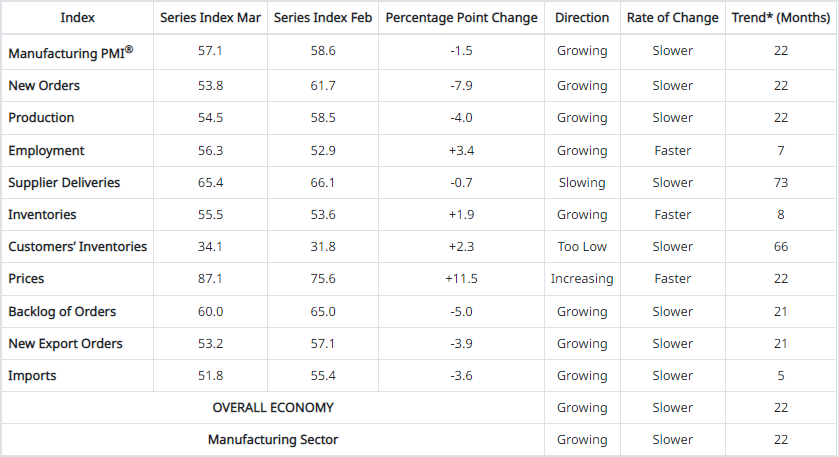

- The ISM Manufacturing PMI for the US fell to 57.1 in March from 58.6 in the previous month, well below analysts’ expectations of 59.0.

- The prices paid index rose to 87.1 from an anticipated 80 and an earlier reading of 75.6

- Comments posted on the ISM manufacturing report highlight strong demand and weakening supply chains.

Of course, today's reading remains very high in historical context, but it is the lowest reading since August 2020. This is a result of uncertainty surrounding the war, inflation and higher interest rates.

A very strong decline in new orders is a warning signal! A drop in the manufacturing sub-index, a powerful rise in the price sub-index, a rise in the employment sub-index. A mixed picture for the economy, although there is still expansion almost everywhere (except in customer inventories, although this factor points to still strong demand for products). Source: ISM

A very strong decline in new orders is a warning signal! A drop in the manufacturing sub-index, a powerful rise in the price sub-index, a rise in the employment sub-index. A mixed picture for the economy, although there is still expansion almost everywhere (except in customer inventories, although this factor points to still strong demand for products). Source: ISM

The EURUSD pair did not react significantly to today's ISM reading. Source: xStation 5

Economic Calendar: Quiet Tuesday Highlights Geopolitics and Weekly Oil Stocks (10.03.2026)

EURUSD gains 0.2% on unexpectedly bigger trade surplus in Germany 🇩🇪 📈

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)