USA - inflation report for August:

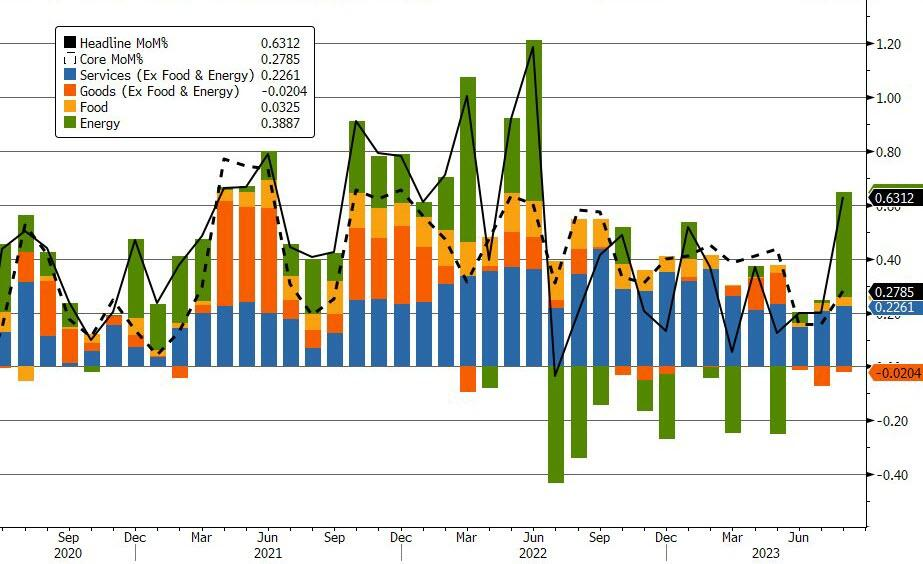

- CPI headline annual: Actual: 3.7% y/y. Expected 3.6% y/y; previously 3.2% y/y

- CPI headline monthly: Actual: 0.6% y/y. Expected 0.6% m/m; previously 0.2% m/m

- Core CPI annual: Actual: 4.3% y/y. Expected 4.3% y/y; previously 4.7% y/y

- Core CPI monthly: Actual: 0.3% y/y. Expected 0.2% m/m; previously 0.2% m/m

Shelter +0.3% versus +0.4% last month. Year on year 7.3% versus 7.7% last month

Services less rent and shelter +0.5% m/m vs +0.2% prior

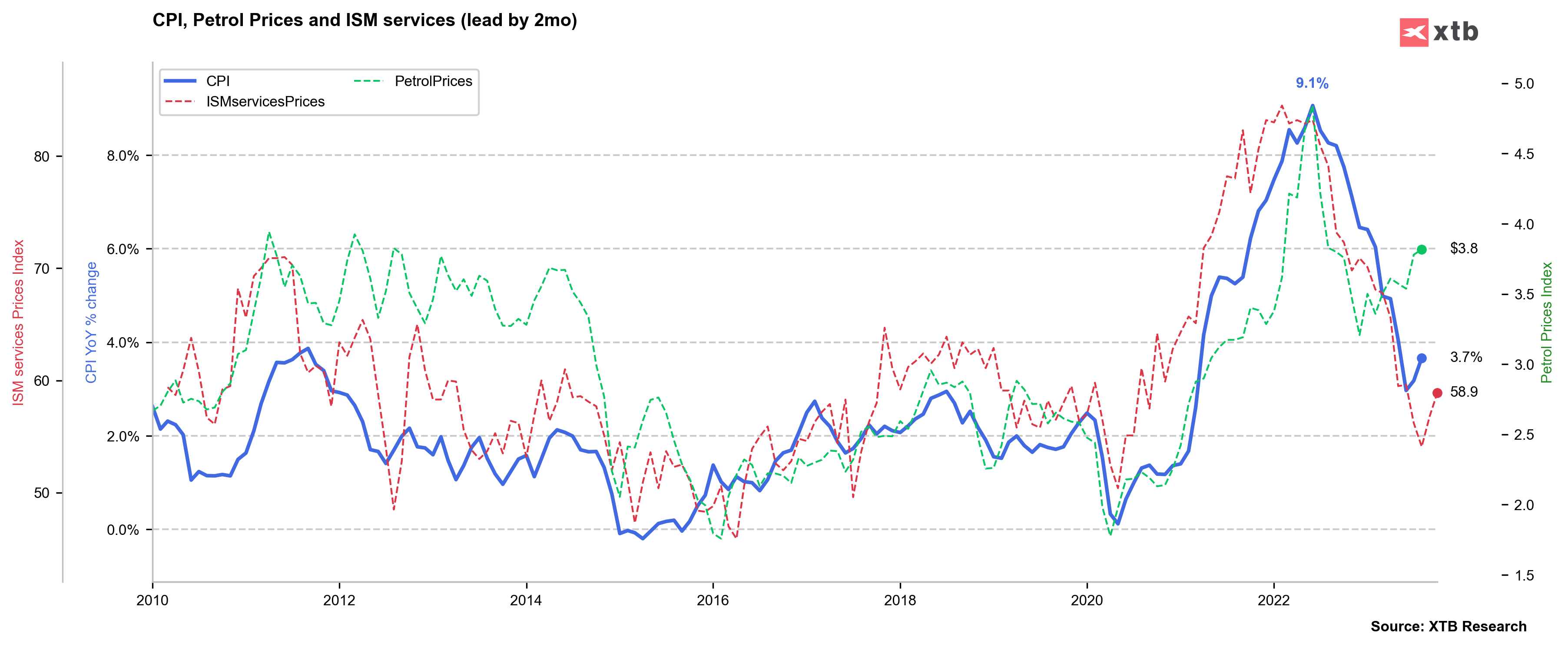

Gasoline contributed to more than 50% gain in the US CPI in August

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

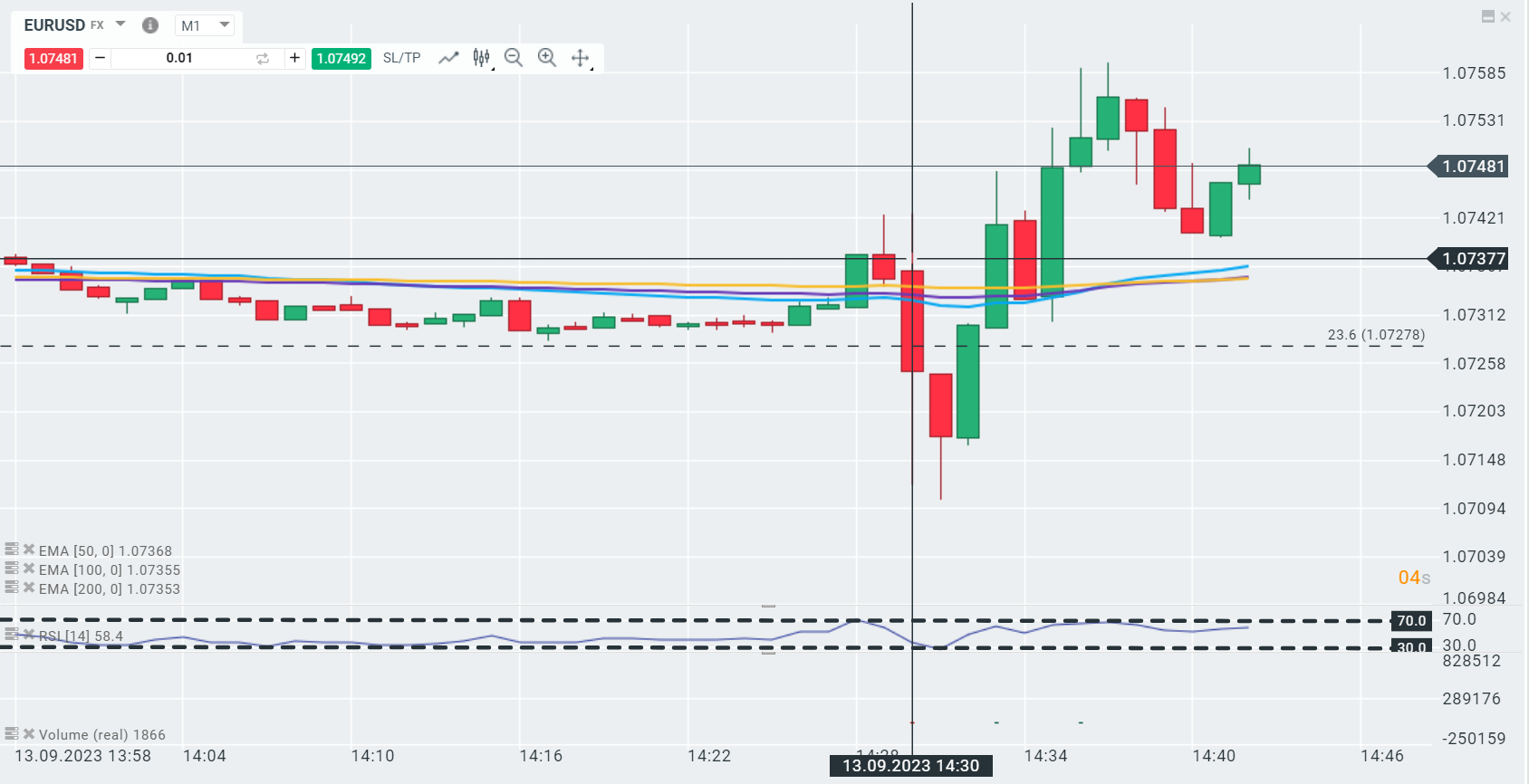

In general, initial moves in the dollar, stocks and yields have erased. That confirms the view that most participants had been positioned for a hot reading. The implied rate for November shows exactly the same number as before the latest CPI numbers hit (implying a roughly ~38% chance of a 25 bps hike).

ii

EURUSD erases early downward reaction to data. Source: xStation 5

EURUSD erases early downward reaction to data. Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)