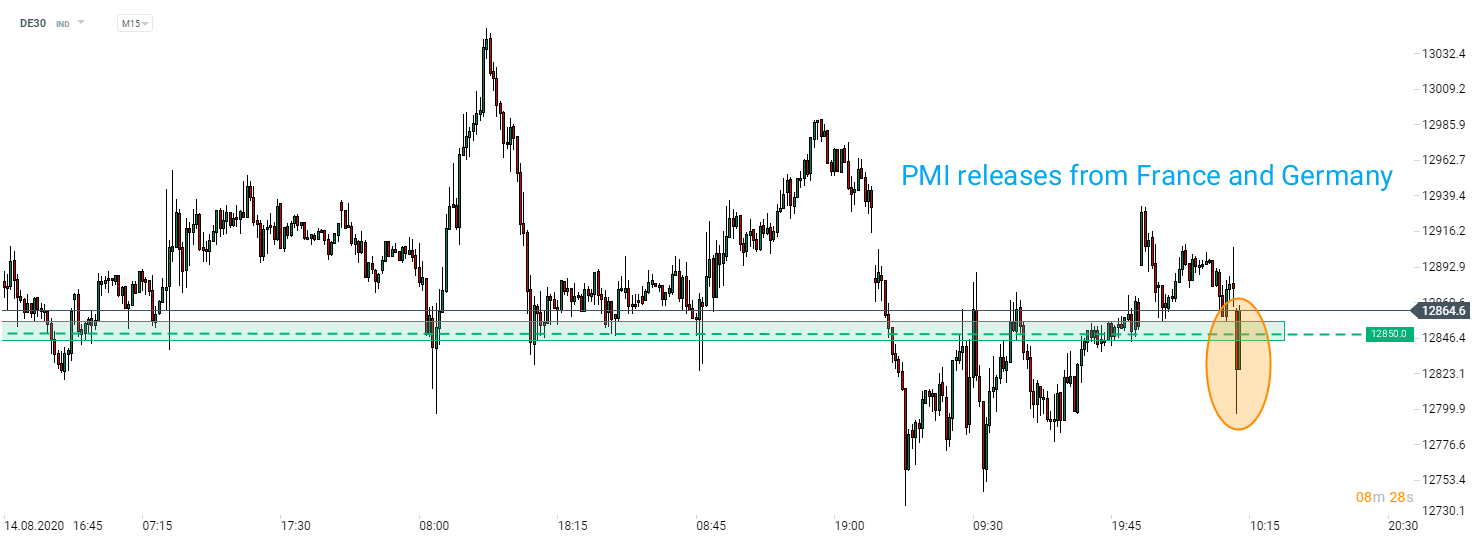

A set of preliminary PMI indices for August from France and Germany has been released this morning. Releases turned out to be mixed with French data being a major disappointment. Details of reports:

France

-

Manufacturing: 49 vs 53 expected

-

Services: 51.9 vs 56.3 expected

-

Composite: 51.7 vs 57 expected

Germany

-

Manufacturing: 53 vs 52.3 expected

-

Services: 50.8 vs 55.2 expected

-

Composite: 53.7 vs 55 expected

A drop back below 50 in case of the French manufacturing PMI is rising concerns over the continued impact of the coronavirus pandemic on the European economy. Recent rise in coronavirus cases could have also caused people to be more cautious and go out less, what seems to be reflected in misses in services. Stocks plunged in the aftermath of French PMI release but managed to recover a bulk of losses after the release of German data.

Traders should also keep in mind that PMI indices from the UK will be released at 9:30 am BST while PMIs from the US will be released at 2:45 pm BST).

DE30 seesawed around 12,850 pts price zone on the back of French and German PMI releases. Source: xStation5

DE30 seesawed around 12,850 pts price zone on the back of French and German PMI releases. Source: xStation5

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)