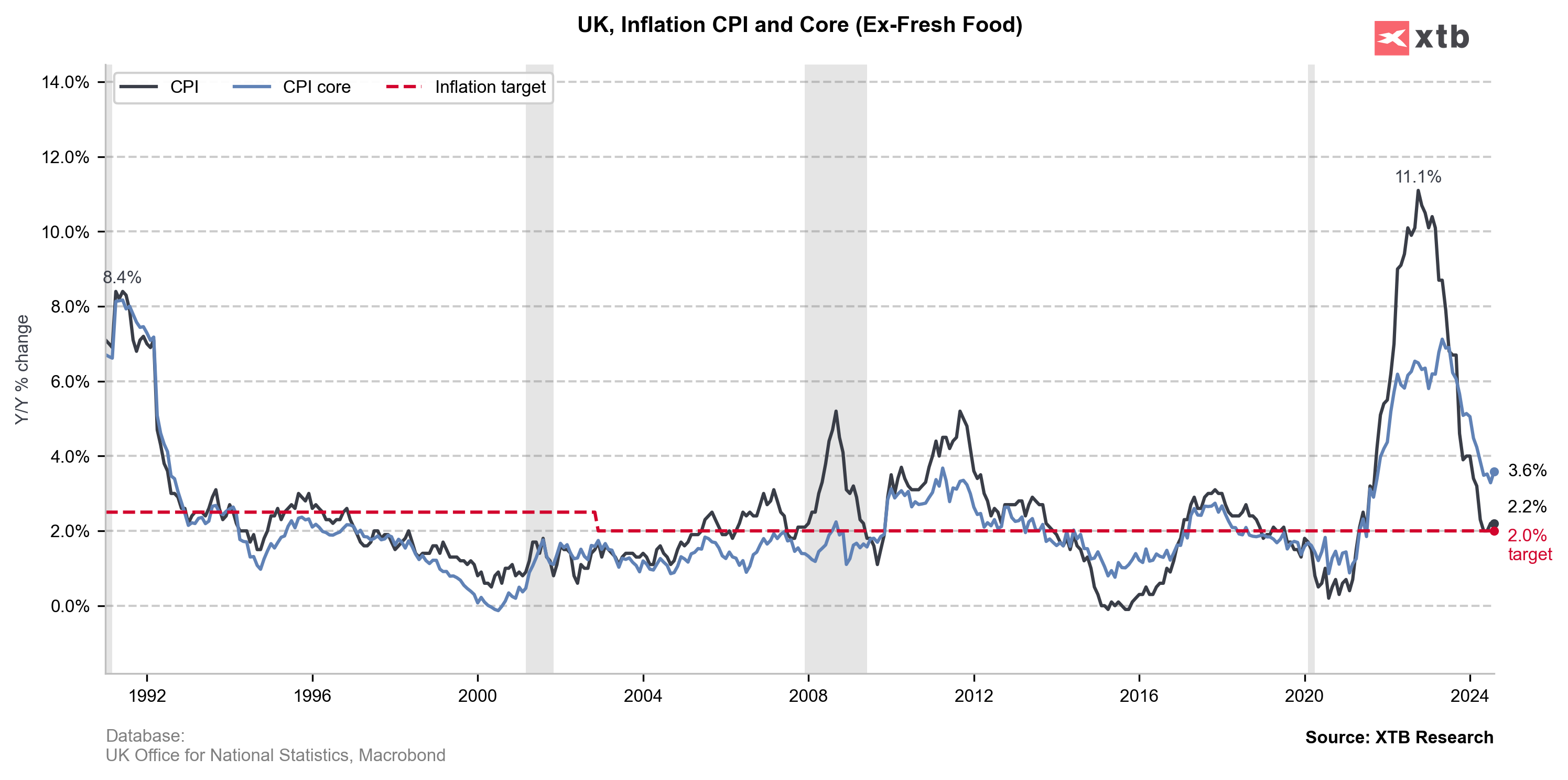

UK CPI in August came in 2.2% YoY vs 2.2% exp. and 2.2% previously (0.3% MoM vs 0.3% exp. and -0.2% previously)

UK Core CPI came in 3.6% YoY vs 3.6% exp. and 3.3% previously (0.4% MoM vs 0.1% previously)

UK PPI output prices came in lower than expected with 0.2% YoY vs 0.5% exp. and 0.8% previously (-0.3% MoM vs 0% exp. and 0% previously)

UK PPI input prices dropped -1.2% YoY vs -0.8% exp. and 0.4% previously (-0.5% MoM vs -0.3% exp. and -0.1% previously)

Source: xStation

Source: xStation

The lower than expected PPI data come one day ahead of the Bank of England meeting. Currently market is pricing 25% chance of rate cut and two cuts in this year. First meeting with implied softening of the monetary policy might come in November. This might partly explain strenght of British currency against US, where more than four cuts are expected by the market.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉