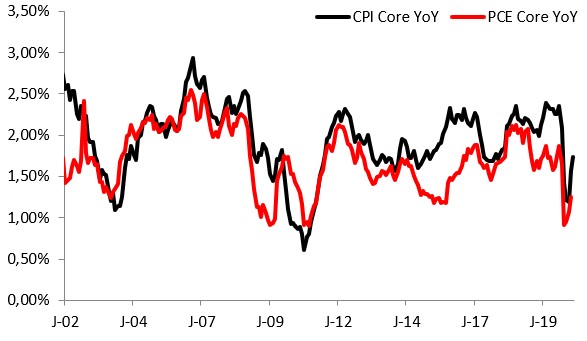

US CPI inflation report for August was released at 1:30 pm BST. Reading turned out to be a positive surprise with price growth accelerating more than expected. Headline CPI came in at 0.4% MoM against expected 0.3% increase while core gauge showed 0.4% advance (exp 0.2% MoM). On an year-over-year basis headline CPI improved from 1% to 1.3% while core reading moved from 1.6 to 1.7% YoY. However, a report lost some of its significance last month when Powell said that price stability is no longer a top priority of the Federal Reserve. EURUSD pulled back a bit following release but move was not major.

US CPI accelerated more than expected in August. Source: Macrobond, XTB

US CPI accelerated more than expected in August. Source: Macrobond, XTB

EURUSD deepened pullback following release of the US CPI data. Source: xStation5

EURUSD deepened pullback following release of the US CPI data. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS