- Inflation in US below expectations

- Inflation in US below expectations

14:30 - USA CPI (Consumer inflation) for September:

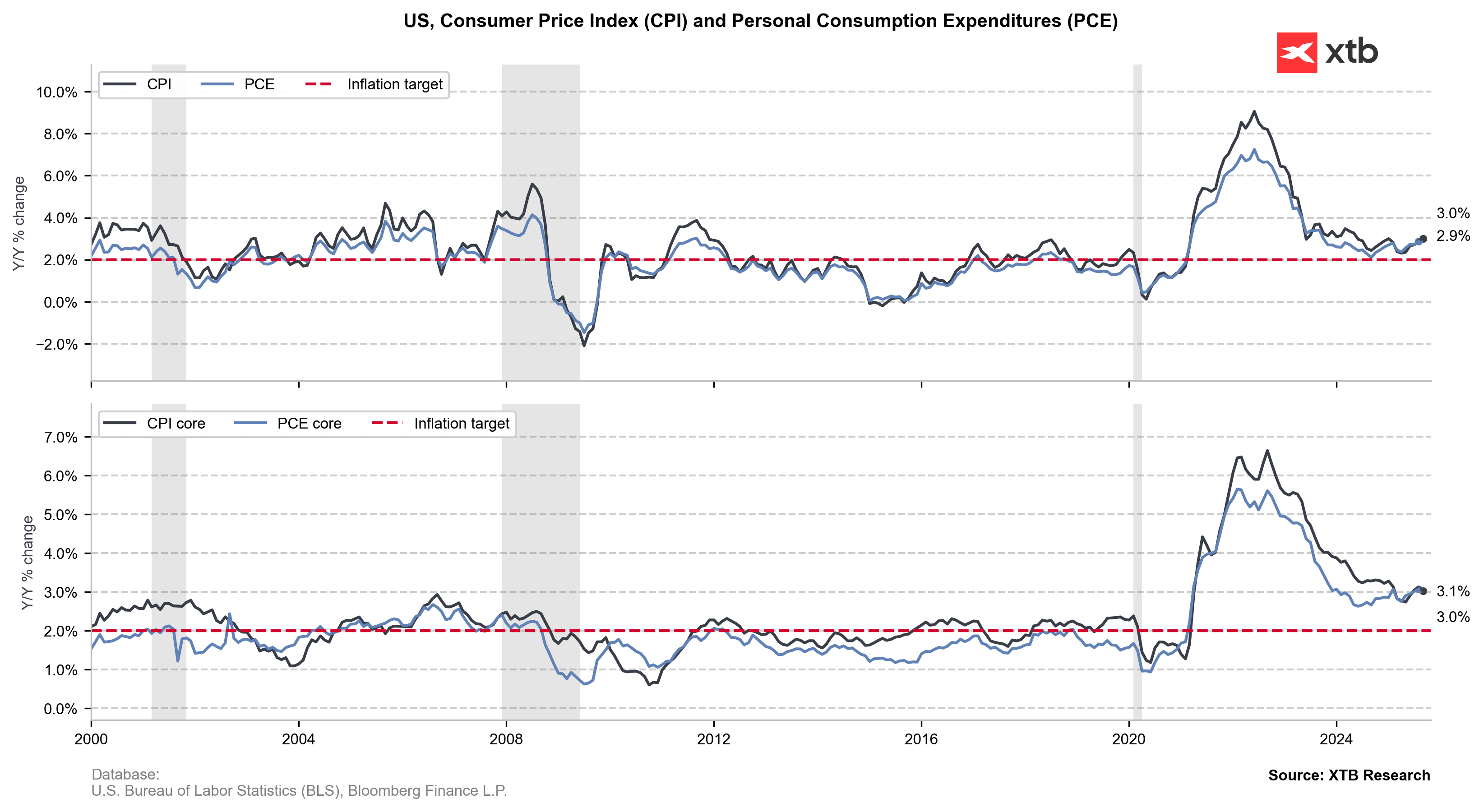

Core CPI YoY: 3% (Expected: 3.1%, Previous 3.1%)

Core CPI MoM: 0.2% (Expected: 0.3%, Previous: 0.3%)

CPI YoY: 3% (Expected: 3.1%, Previous 2.9%)

CPI Mom: 0.3% (Expected: 0.4%, Previous 0.4%)

The CPI reading from the USA presented lower than expected, signaling disinflation in the US economy. Both the annual and monthly indicators fell 0.1% percentage points below consensus. Structure of changes is ambiguous is as follows:

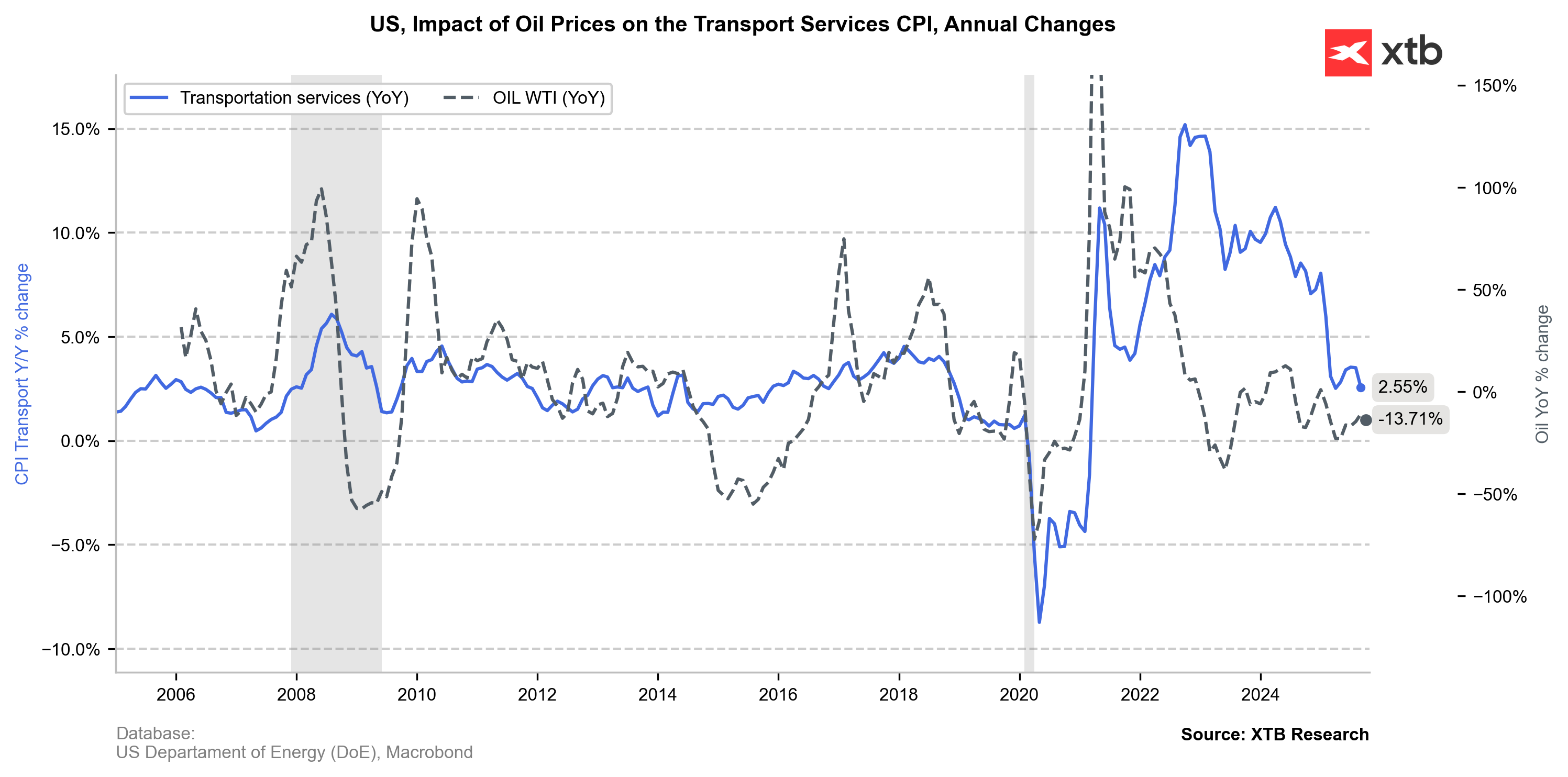

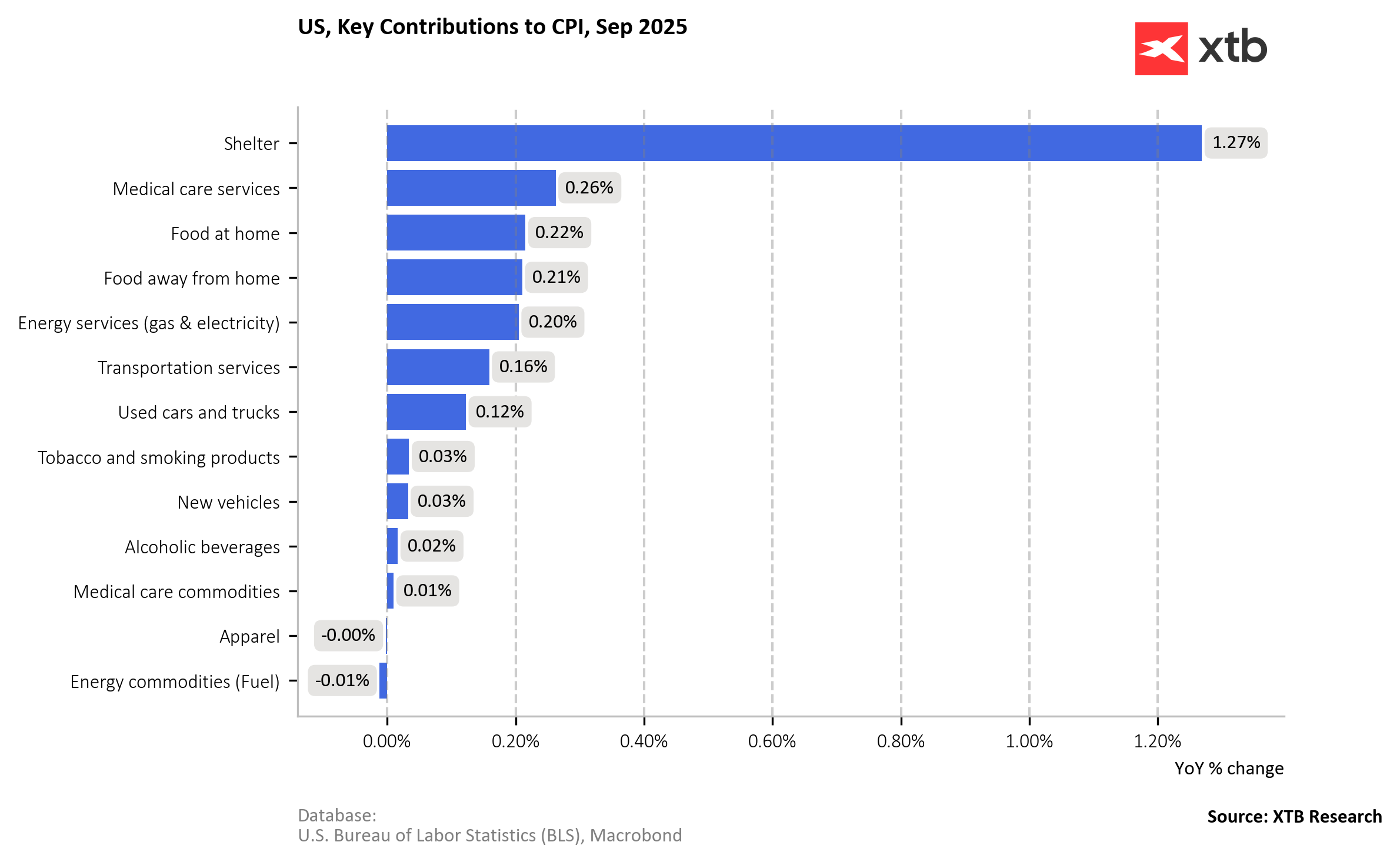

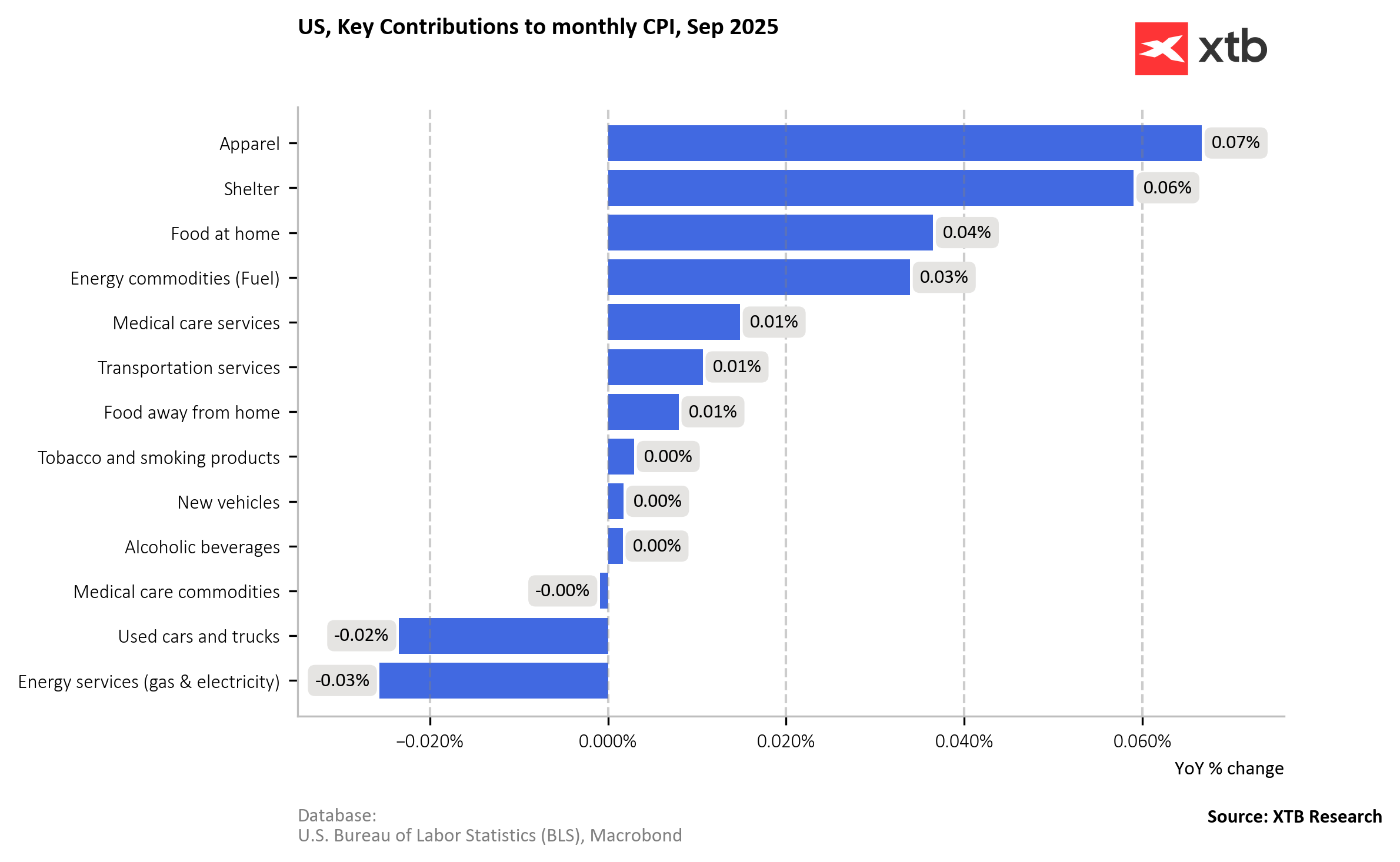

Despite the drop in oil prices, fuels contributed to September's dynamics. This is possibly due to factors such as refinery margins and seasonally higher prices at stations.

At the same time, the apparel category came out surprisingly high.

On the other hand, electricity decreased month-on-month and acted in a disinflationary manner. This is interesting in the context of ongoing debate in the US related to the electricity prices rising due to high usage by data centers.

Finally, housing, or "shelter" inflation, remains the largest and most persistent contributor to CPI, although the growth rate in this category is gradually slowing.

This mix suggests further flattening of price pressure in most goods, while inertia persists in housing related services. The power market, fuel and tariffs may still react with a delay, but for now, CPI shows relief subcomponent in this regard.

This has far-reaching implications for monetary policy. Lower than expected means increased expectations that FED will resume QE policy sooner than expected. Pricing in further rate cuts and repurchase of the debt by the Fed is crucial for the current market.

Even more so now due to "heightened concerns about shutdown" pressure on the economy.

Markets reacted swiftly, Euro appreciated to the dollar after the CPI reading by approximately 0.3%, although market quickly corrected substantial part of this gain.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report