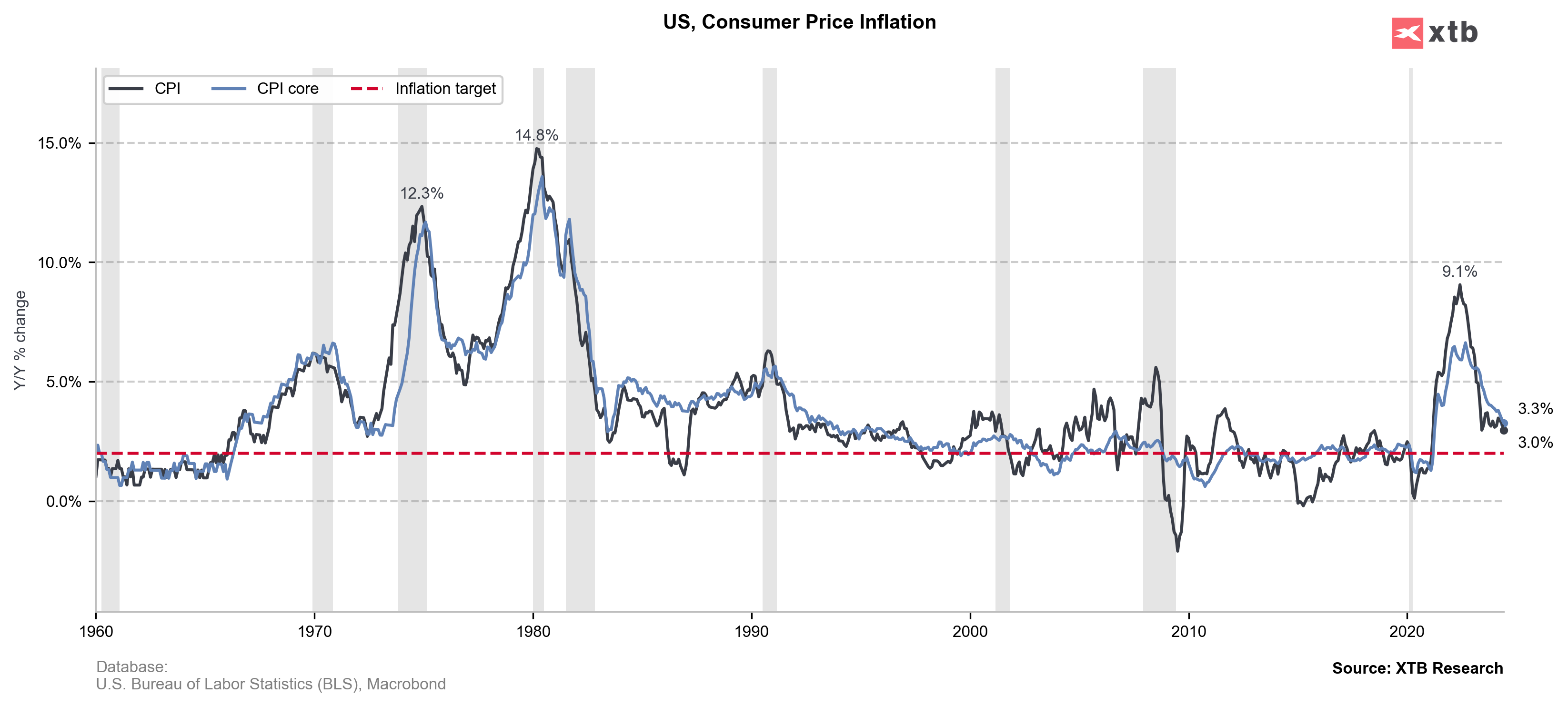

US CPI for June came in 3% YoY vs 3.1% exp. and 3.3% previously (-0.1% MoM vs 0.1% exp. and 0% previously)

US Core CPI for June came in 3.3% YoY vs 3.4% exp. and 3.4% previously (0.1% MoM vs 0.2% exp. and 0.2% previously)

- US June CPI food inflation came in 0.2%, also housing inflation was 0.2% higher, while rent was up 0.3% MoM

US jobless claims came in 222k vs 235k exp. and 238k previously (1.852M continued jobless claims vs 1,86M exp. and 1.858M previously)

After the data released, Fed fund futures traders bet more on September rate cuts in US economy. Wall Street indices are higher. Markets price in 85% chance of a September Fed rate cut after CPI (vs about 70% before).

Source: xStation5

Source: xStation5

Source: BLS, Macrobond, XTB Research

Source: BLS, Macrobond, XTB Research

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)