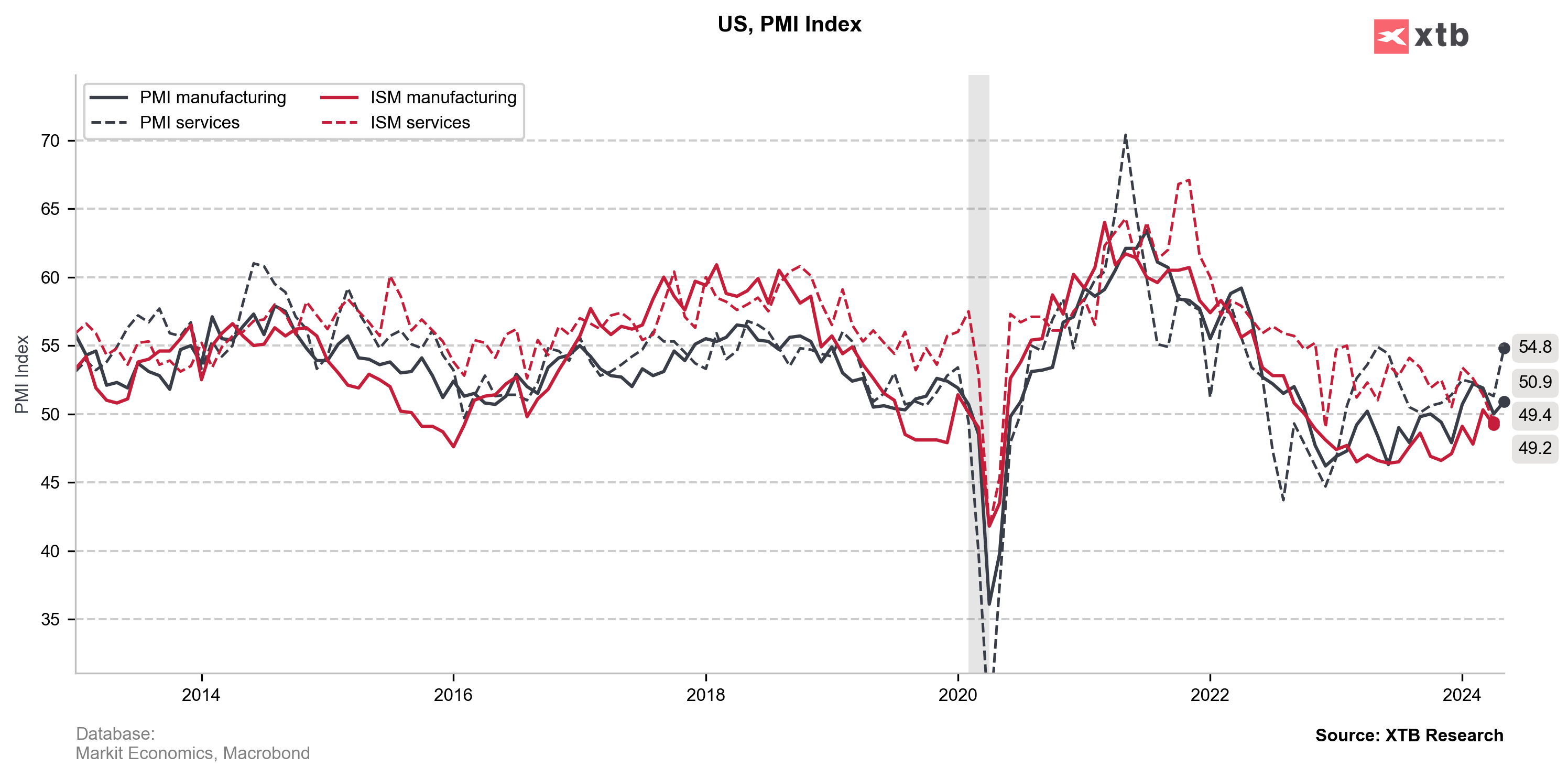

US S&P PMI Services came in 54.8 (the highest since May 2023) vs 51.2 exp. and 51.3 previously

- US S&P PMI Manufacturing PMI came in 50.9 vs 49.9 exp. and 50 previously

- US S&P Composite PMI came in 54.4 vs forecast 51.2 and 51.3 previously

At the same time regional Chicago National Activity Index came in much lower than expected with -0.23 vs 0.125 exp. and 0.15 previously

US dollar gains after the reading, stock market indices erasing some early gains, as investors 'jump in' Nvidia (NVDA.US) shares, selling other stocks. Higher than expected PMI signals that Federal Reserve has still some job that has to be done with 'higher for longer' policy as higher services inflation (justified by higher services PMI data) may be more persistent, than expected.

Source: Macrobondm Markit Economics, XTB Research

Source: Macrobondm Markit Economics, XTB Research

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS